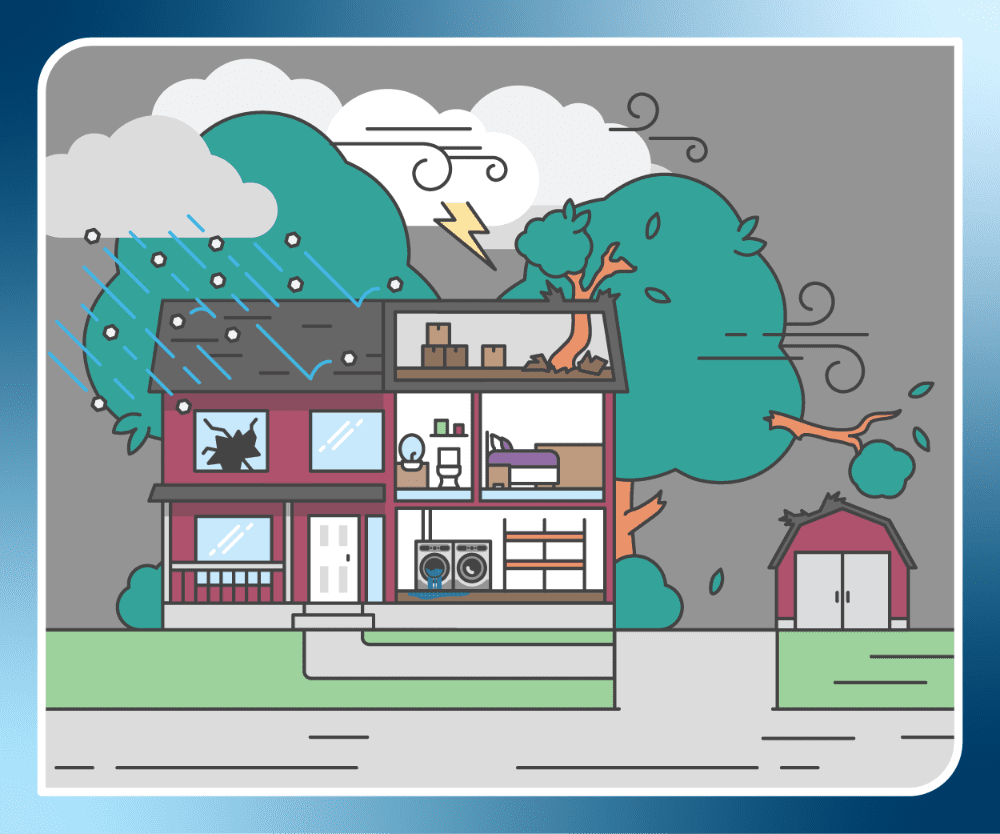

What Storm Damage Homeowners Insurance Covers vs. What it Doesn’t

The winds are picking up and those clouds aren’t looking friendly. This may be the time you start thinking about what your home insurance covers.

Be honest: is it the first time you’ve thought about it since buying your house? You’re not alone.

To help in these unnerving moments, let’s go over some of the common concerns homeowners have about what storm damage their home insurance may cover and what it may not.

Your homeowners insurance policy covers certain types of water damage.

Water damage can be devastating after a severe storm. So, it’s important to know what types of water damage your homeowners insurance policy may cover and the types it may not.

It partly comes down to how the water got inside your house.

Storm damage that is usually covered by homeowners insurance may include situations where the home is physically damaged by the storm, allowing rain water to enter. In some cases wind driven rain may be covered.

However, this often excludes losses caused by surface water. Surface water can include, but is not limited to flooding/flash flooding of creeks, rivers and lakes; or sources like waves, tides, and storm surges. In addition to the natural sources of surface water stated above, many homeowners policies also exclude unnatural or manmade surface water hazards.

Unfortunately, these types of damages can be quite costly. This is why it’s important to consider a separate flood insurance policy.

For Auto-Owners Homeowners Insurance policies, you may have the option to add our Inland Flood coverage* to an existing homeowners policy if your home is in a low-to-moderate flood zone rather than purchasing a separate flood insurance policy.

*This insurance product is not affiliated with the National Flood Insurance Program.

Storm-related interior water damage coverage may depend on if it’s new damage or if it’s been going on for a while.

Water damage that has accumulated over time may be excluded. Another great reason to inform your agent or insurance company promptly if you notice water damage after a recent storm.

But, if you notice water seeping through your ceiling after a storm, even if your roof is older, you may have coverage for recent interior damage.

However, sump pump, floor drains and other water backups may not be covered unless a specific endorsement covering these losses is purchased. Also, coverage for personal property is typically not as broad as coverage for the home itself; and may require that an actual opening be created by the storm.

Homeowners insurance typically covers storm damage to your roof.

Oftentimes the first thing we think about when the wind or hail is blowing is our roof. Homeowners insurance will typically cover storm damage to your roof.

Examples of roof damage that your home insurance may cover can include:

Wind damage

Hail damage

Damage from fallen objects, like tree limbs

However, non-storm damage to your roof, such as wear and tear, are often excluded by the policy

If somebody else’s property damages your house during a storm, your insurance will likely cover it.

During a severe storm, your neighbor’s tree falls on your house and damages your roof! Your insurance will likely cover those damages, although there may be limits on coverage for tree debris removal.

It may seem odd that your neighbor’s insurance doesn’t apply, but the general rule for insurance is that your property is your responsibility. This usually includes trees that fall onto your property.

But, things may change if your neighbor’s tree is dead or dying before the storm. In that situation, the owner of the tree may be responsible for your damages. However, you should still turn in a claim to your insurance agent or company.

Storm damage to other structures on your property will likely be covered by your homeowners insurance.

If you want higher limits for your additional structures on your property, you will want to make sure that’s listed in your policy. Pole barns, sheds and detached garages are all examples of structures you may want to make sure have proper limits within your home insurance policy.Storm damage can cause a variety of damages to your property. Be prepared and knowledgeable with the right homeowners insurance policy by contacting your local, independent Bolder Insurance advisor today.

This article provided by Auto-Owners Insurance, a Bolder Insurance partner.

* Products referenced may not be approved/available in all states. Limitations and conditions may apply. Premium will be based on benefits chosen and policy rates available at time of application.

Disclaimer: This article is not expert advice. The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Discounts may not be available in all states. Limitations and conditions may apply. Premiums will be based on benefits chosen. Please check with your local Independent Bolder Insurance Agent for details.