Property & Casualty Market Update

Save as PDF

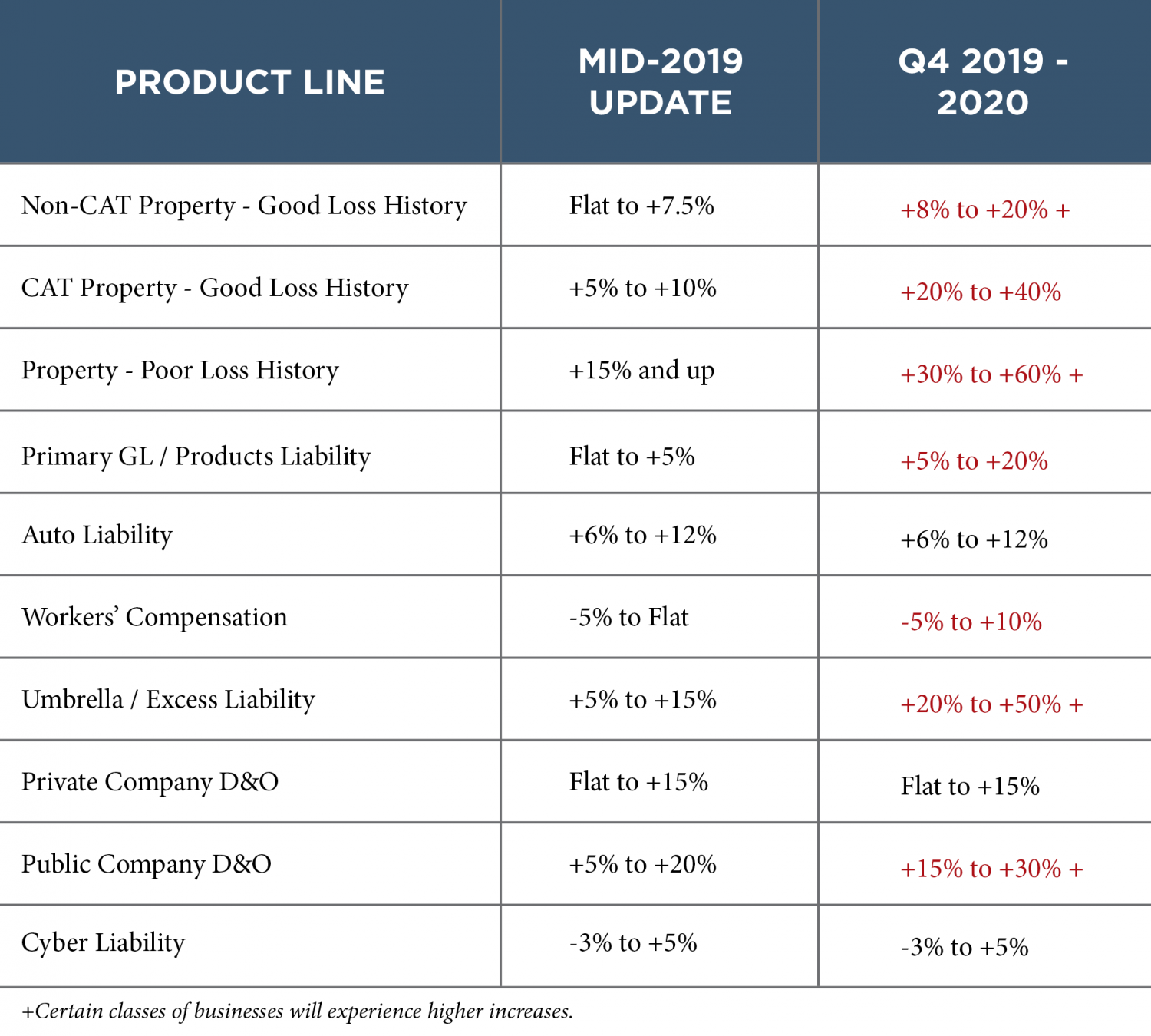

As we begin a new decade, we are navigating an increasingly unpredictable insurance market and many businesses are facing significant pricing increases upon renewal. Our 2019-2020 Property & Casualty Market Outlook, which was released in June 2019, provided our reaction to market trends and some pricing expectations. With Q3 and Q4 now behind us, we thought it would be beneficial to share an update with new insights and observations to better prepare our clients for current pricing pressures and provide guidance for managing the net impact.

What have we learned & what has changed?

Catastrophe (CAT) Losses:

Following back-to-back years of nearly record CAT losses, we had a bit of a reprieve in 2019; however, that didn’t stop rate spikes beginning in Q3 in anticipation of the hurricane season. While we didn’t see the same levels of hurricane and flood losses; the property market wasn’t immune to wildfires, heavy winds and hail losses. Therefore, our initial property predictions proved to be a bit too optimistic when it came to CAT exposed, frame and heavy manufacturing risks.

General & Products Liability:

Underwriters are relying on predictive modeling to evaluate loss characteristics and actuaries are hard at work evaluating necessary increases to casualty reserves. Claim costs for Products Liability are increasing due to heavy litigation, judgements and recalls. At this time, it is unclear how reinsurers will respond to the current climate, but we do know that reserves are at an all-time high. Couple this with the “social inflation” buzzword, and we’re likely to see widespread attempts to increase rates across the board, with a specific focus on accounts with heavy product exposure. This doesn’t just mean trouble for General Liability premiums; be prepared to see development into the excess layers putting even greater strain on the Umbrella/Excess market.

Umbrella/Excess Liability:

The Excess market proved to be one of the most challenging markets in Q3 and Q4. Reduced capacity, higher attachments and rate-upon-rate complicated the placement of this coverage. With continued auto losses and the aforementioned casualty reserves, we should expect to see further development into higher layers and increased pricing well into 2020.

The chart below provides updates to the pricing predictions in our 2019-2020 Property & Casualty Market Outlook: