10 Ways You Can Protect Your Family from Identity Theft

With the heightened awareness of identity theft and cyberattacks, it makes sense to protect our families at home. But how do we do that?

We talked with the experts from our IT security team to give you 10 ways to protect your family from identity theft, both online and offline.

Use multifactor authentication

Label the inside of children’s belongings, not the outside

Monitor children’s technology usage

Wait to share your vacation photos on social media

Configure your smart home technology

Keep your Wi-Fi password safe

Take care of your devices

Keep purses and wallets out of sight

Store and discard documents securely

Educate your family about phishing, vhishing and smishing

1. Use multifactor authentication

When available, utilize multifactor authorization. Multifactor authentication adds another step after you enter your password, which usually prompts you to enter a code that the website or app sends to you via text or email.

Multi-factor authentication is a quick way to ensure nobody is trying to use your login information. If a bad actor obtains your password, it mitigates the risk and may alert you of the fraudulent activity.

As for the passwords themselves, make sure you create different ones for each login. Never use a default password. They are easy to hack!

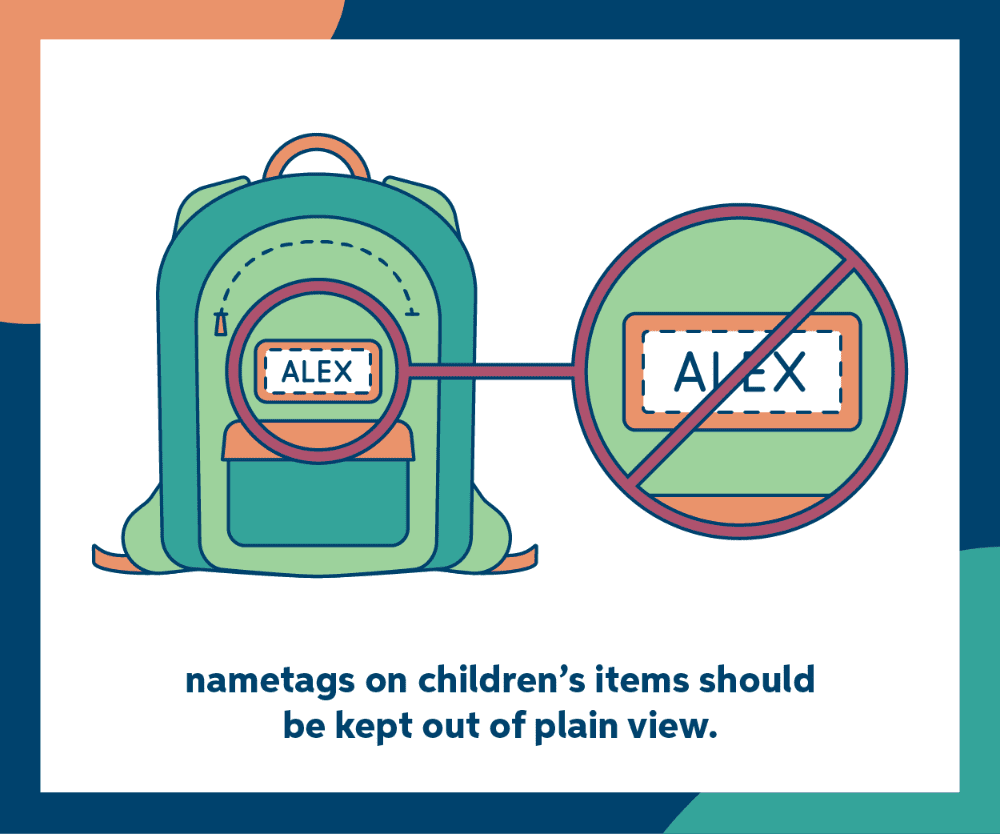

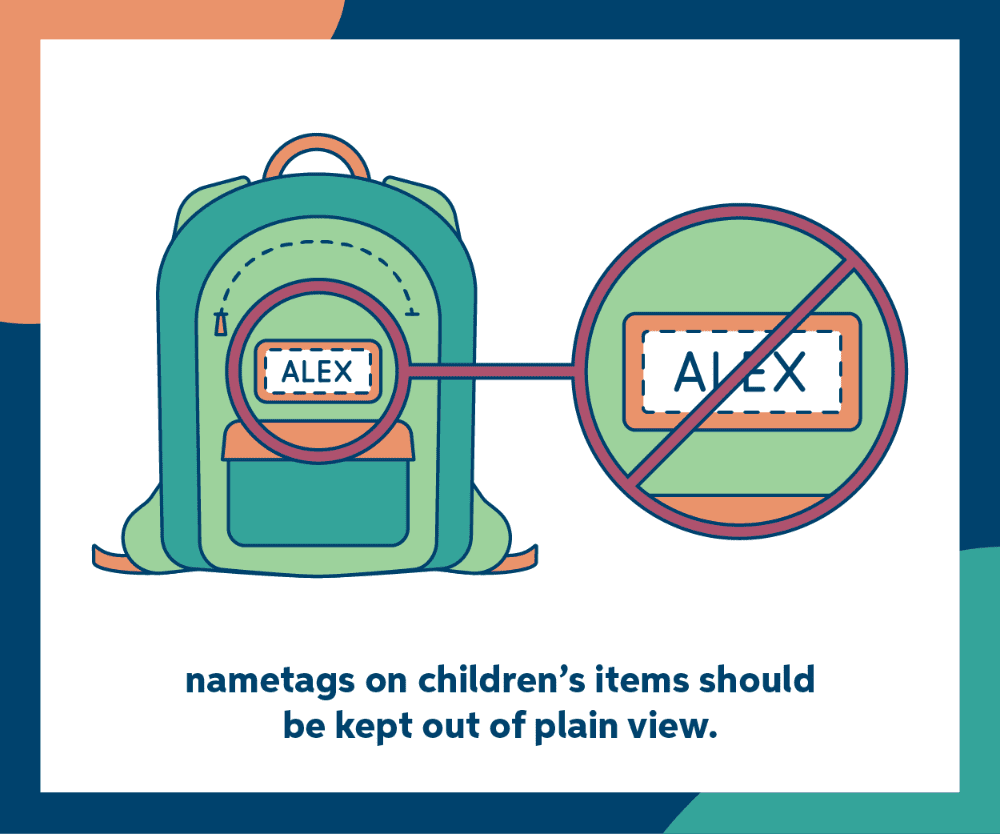

2. Label the inside of your children’s belongings, not the outside

Personalizing the outside of your child’s backpack with their name may seem cute, but can make it easier for predators to call your child by name. When a predator can address your child by name, they may be able to convince your child to trust them. Label their backpack on the inside instead.

3. Monitor children’s technology usage

There are so many ways you can keep your kids safe online. The important thing is to find a system that works for your family and stick to it!

Some ideas to consider include:

Only allow kids to use computers and other devices in a main living space of your home

Establish a central, designated charging area to keep up with supervision

Find an app to install on your child’s devices to alert you when unknown numbers try to reach them, or if a stranger sends them a direct message on a social media platform

Communicate your rules and the reasons behind them clearly and often

Research if your phone’s service provider offers training for parents on apps/techniques to keep your kids safe

4. Wait to share your vacation photos on social media

It’s easy to target your home when you announce it will be empty. Think twice before you post your upcoming travel plans on social media. When you are on vacation, it may be tempting to post updates, but that can also make it obvious that your house is vacant. Enjoy your trip and save the posts for later.

5. Configure your smart home technology

When you get a new device that connects to the internet, take time to configure it and set up the security settings. Don’t assume the default settings provide enough security.

Things like baby monitors and surveillance cameras that connect to Wi-Fi can be hacked. Even appliances, like refrigerators, can be hacked.

Why would it matter if somebody hacked your refrigerator?

Those prying eyes may be able to deduce that you aren’t home when they see you haven’t opened your refrigerator in a few days. This may be enough of an incentive for them to break into your home.

6. Keep your Wi-Fi password safe

It may be a fun trend, but don’t frame your Wi-Fi password on the wall. It’s best to only share the password with visitors in person. For continued security, change your password seasonally. One way to help yourself remember is to change it during an existing routine. For example, change your Wi-Fi password every time you change your smoke detector batteries. You could even leave yourself a note on the pack of batteries to change the password.

Also, if you frequently have people over that use your Wi-Fi, consider setting up a guest network for them.

7. Take care of your devices

What does it mean to take care of your devices? Updating! Keep your device’s operating systems and anti-virus protection up to date. Turn on notifications for updates so you will be reminded when you need to update your devices. Try to install it soon after you get an update notification.

8. Keep purses and wallets out of sight

Rather than keeping purses and wallets by the front door or in your car, tuck them away in a closet. A visible purse or wallet is home to a lot of personal information and can be an incentive to thieves.

9. Store and discard documents securely

You’ve probably heard this about old tax documents, but it’s also important to apply this to some of the mail you discard. Things like credit card applications that pre-qualify you for a line of credit are especially important to shred because somebody could take out a line of credit in your name. Store the mail that you keep for bills or taxes in a secure place, such as a locked box.

10. Educate your family about phishing, vhishing and smishing

Yes, those are real words and very real threats. Take time to talk through some best practices to avoid falling for one of the many ways bad actors try to gain information and access.

A good place to start is to encourage your family to be cautious of urgent-sounding communications and avoid disclosing personal information without an adult cross-checking the source.

For example, your child gets an email from what appears to be their school system. The email is asking them to click a link to pay and register for an upcoming field trip ASAP. Since there’s urgency and they’re asking for personal information, it’s certainly worth the time to cross-check this by either contacting their teacher or checking the school’s website (without clicking the link).

What should I do if my identity is stolen?

If you, unfortunately, have your identity stolen, there are some steps to take to start recovering.

Gather documentation and information regarding the suspected identity theft. You can start with basic information, like when it happened, where, and what exactly was stolen (amounts, items, etc.).

If there is a crime involved, contact law enforcement. Start with your local police department to file a report. They may ask for documentation, so have that ready. From there you can also utilize the Federal Trade Commission’s steps and resources to help the recovery process.

Check your homeowners insurance policy for identity theft coverage. Many home insurance policies, including ours, cover the expenses from identity theft. Contact your insurance agent or company to see if you can submit a claim.

Keep in mind, our Identity Theft Expense coverage is for restoring your financial identity; it does not cover loss from the theft itself. The “expenses” that may be considered for coverage are:

Preparation and notarization of documents

Loan reapplication fees

Lost earnings as a result of time off from work

Reasonable attorney fees

Bond premiums

Assignment of a personal advocate through a third-party vendor to assist in restoring the insured’s identity

Overall, keep communication about these issues open with your family. There are so many ways a cyberattack and identity theft can play out. If something doesn’t feel right, question it!

Additional Resources:

https://www.cisa.gov/uscert/ncas/tips/ST15-002

https://www.cisa.gov/uscert/ncas/tips/ST05-002

https://www.cisa.gov/uscert/ncas/tips

*Products referenced may not be approved/available in all states. Limitations and conditions may apply. Premium will be based on benefits chosen and policy rates available at time of application.

Disclaimer: This article is not expert advice. The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Discounts may not be available in all states. Limitations and conditions may apply. Premiums will be based on benefits chosen. Please check with your local Independent , Bolder Insurance Agent for details.”

This article provided by Auto-Owners Insurance, a Bolder Insurance partner.