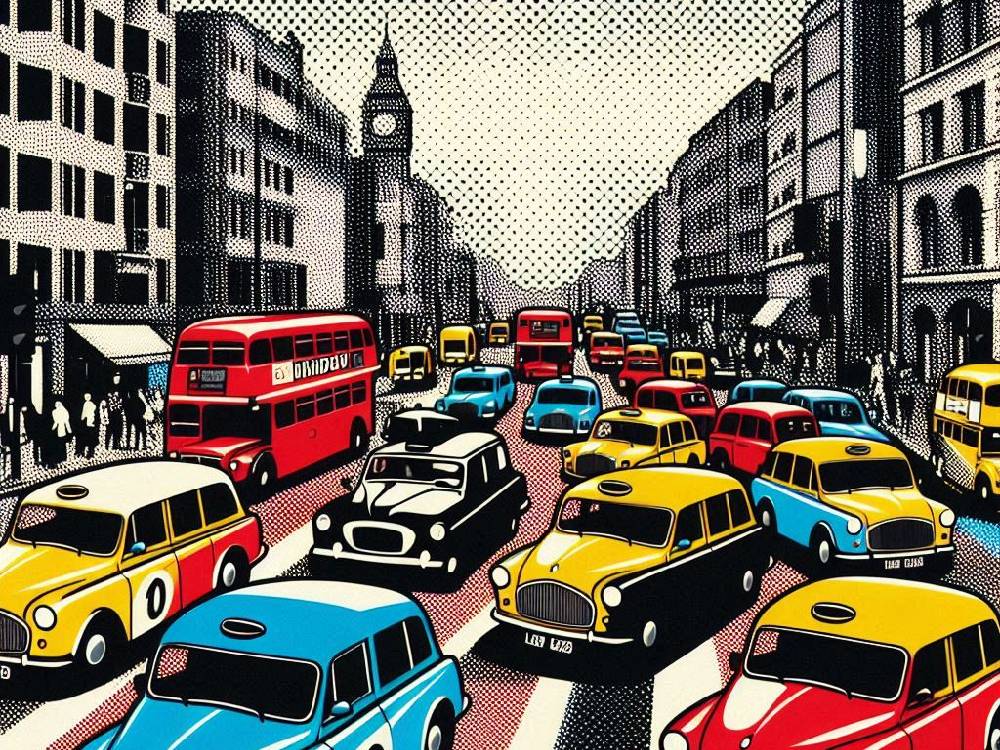

Car Insurance Costs Fall, But London Drivers Still Pay The Most

Introduction

London drivers still pay the most.

Car insurance prices are finally falling across the UK—but not for everyone.

While the national average has dropped from £885 to £769, drivers in London are still paying over £1,100 per year.

Why?

High crime rates, traffic congestion, and postcode-based pricing keep London premiums sky-high.

But there’s more to the story.

Let’s dive in.

Why Are Car Insurance Prices Falling?

After a sharp rise in 2023, many UK drivers are now seeing lower premiums.

But what’s behind the decline?

1. Insurers Are Adjusting Their Pricing Models

Last year’s price hikes were unsustainable. Insurers increased premiums due to inflation, rising claims, and supply chain issues.

Now, as supply chains stabilise and insurers reassess their risk calculations, prices are correcting.

2. Fewer Claims, Lower Risk

Safer cars, wider use of telematics policies, and improved driver behaviour have led to fewer insurance claims.

Fewer claims = lower risk for insurers = cheaper policies for drivers.

3. More Competition Among Insurers

As more insurance providers fight for customers, they’re offering better deals.

Comparison sites are also driving down prices, with motorists switching to cheaper policies more frequently.

4. Government & Industry Regulations

New industry rules have forced insurers to price renewals fairly, preventing excessive premium hikes for existing customers.

Why Is Insurance For London Drivers Still The Most Expensive?

If car insurance costs are dropping, why are Londoners still paying the most?

1. High Crime Rates Drive Up Costs For London Drivers

London has some of the UK’s highest rates of car theft, vandalism, and fraud.

Insurers factor in postcode-based crime rates when calculating premiums.

High-risk areas = higher premiums.

2. More Accidents in Congested Areas For London Drivers

London’s roads are packed with stop-start traffic, increasing the risk of accidents, whiplash claims, and minor collisions.

Insurers see London as a higher-risk region, leading to costlier premiums.

3. Expensive Repairs for London Drivers in the Capital

Labour costs in London are significantly higher than in other regions.

If you need repairs after an accident, garages charge more, pushing claim costs up—which in turn raises premiums.

4. Postcode-Based Pricing Models For London Drivers

Even within London, insurance prices vary by postcode.

Drivers in areas like East London (with higher crime rates) pay far more than those in more affluent, low-crime neighbourhoods.

How Do Other UK Regions Compare?

London isn’t the only expensive place for car insurance.

Most Expensive Regions (After London)

West Midlands (£800+) – Birmingham has high accident and crime rates.

Yorkshire & North West (£780+) – Urban areas like Manchester and Leeds push up costs.

Cheapest Regions for Car Insurance

South West England (£566 avg) – Fewer claims, low crime, and less traffic congestion keep costs low.

Scotland & Wales – Generally cheaper due to lower population density and fewer high-risk postcodes.

Predictions for 2025: Will Prices Continue to Fall?

Lower premiums are a welcome relief, but will they last?

1. Repair Costs Are Still Rising

Although insurance prices are falling now, repair costs continue to climb.

For instance, inflation is making parts and labour more expensive.

As a result, insurers may have to increase premiums again to cover these growing expenses.

2. More Climate-Related Damage Could Push Costs Back Up

At the same time, extreme weather events—such as flooding, storms, and snowfall—are becoming more frequent.

Because of this, insurers are paying out more claims for flood-damaged and written-off vehicles.

If these weather trends worsen in 2025, premiums could start rising again in affected regions.

3. Insurers Are Closely Watching Driving Trends

Meanwhile, as more people continue working from home, driving patterns are shifting.

If fewer people commute daily, accident rates may decrease further, keeping insurance costs low.

On the other hand, if traffic levels return to pre-pandemic levels, insurers could adjust pricing accordingly.

4. Regional Price Gaps Will Remain For London Drivers

Even if prices drop nationally, regions with higher risks—such as London, Birmingham, and Manchester—will still face above-average premiums.

For this reason, motorists in these areas shouldn’t expect major reductions anytime soon.

Bottom line?

Although UK drivers are benefiting from lower insurance prices now, several factors—including rising repair costs, extreme weather, and shifting driving patterns—could cause prices to fluctuate in 2025.

How to Keep Your Car Insurance Costs Low

Even if insurance prices go up again, there are several ways to keep your costs as low as possible.

1. Always Compare Quotes Before Renewing

Many insurers increase renewal prices without offering customers better deals.

Instead of automatically accepting your renewal quote, compare prices to find a cheaper alternative.

👉 Compare car insurance options

2. Update Your Policy Details Regularly

Believe it or not, minor details—such as your job title, annual mileage, and overnight parking location—can affect your premiums significantly.

By keeping your policy information up to date, you can ensure you’re not overpaying.

3. Consider a Telematics (Black Box) Policy

If you’re a careful driver, a black box policy could help you save even more.

Since these policies track your driving habits, insurers reward you with lower premiums if you drive safely.

👉 Telematics car insurance explained

4. Avoid Modifications That Increase Premiums

Adding custom alloys, tinted windows, or spoilers might make your car look great, but these modifications can drive up insurance costs.

In some cases, they can even invalidate your policy if not declared properly.

👉 Should you declare car modifications?

5. Pay Annually Instead of Monthly

If you can afford it, paying your insurance in one lump sum is far cheaper than spreading payments out monthly.

This is because monthly payments include interest charges, which add up over time.

6. Build Your No-Claims Discount (NCD)

Another way to significantly reduce your premiums is by building your no-claims discount.

The longer you go without making a claim, the bigger your discount will be.

Additionally, some policies allow you to protect your NCD for a small extra fee, which may be worth considering.

Conclusion

Right now, many drivers across the UK are finally seeing some relief, as insurance premiums continue to fall.

However, for London Drivers, prices remain frustratingly high.

So, what does the future hold?

Although current trends suggest further declines, rising repair costs, climate-related claims, and changes in driving habits could cause prices to increase again in 2025.

That’s why taking control of your insurance costs is more important than ever.

If you want to keep your premiums low, remember to:

Compare quotes before renewing

Keep your policy details up to date

Consider a black box policy

Avoid unnecessary modifications

Build your no-claims discount

By following these strategies, you can maximise your savings, no matter where you live.