HDFC Life Premium Payment

Insurance premium payment was a big task in itself in the early days. One had to visit the insurance office or branch of that particular bank to pay the amount.

Moreover, premiums were also paid at the insurance office. But with the advancement of technologies, we have different modes of premium payment at present.

Let us make a study of modes of premium payments on the HDFC Life insurance policy.

HDFC Life Premium Payment Online

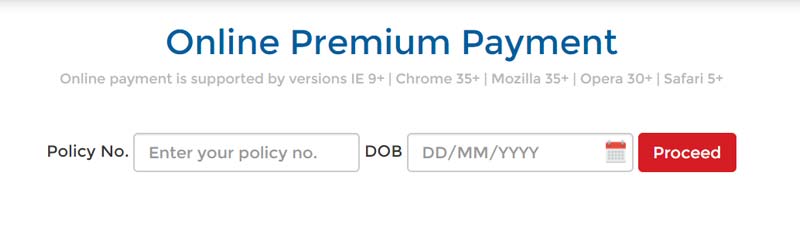

Quick Pay Payment

HDFC has launched a Quick Pay payment facility to serve its customers effortless premium payment mode. The quick pay is very easy for the policyholders who manage their account online. The steps following can guide you to Quick Pay:

Go to the customer service tab on the site of HDFC life and click on the customer care tab.On newly appeared customer service page you will find pay premium tab. Click on the same.Fill in all the required details like the name, policy no, etc and proceed to the next step. After cross verifying all the premium details displayed on the page you can proceed and do the payment.

After cross verifying all the premium details displayed on the page you can proceed and do the payment.

HDFC Life Premium Payment Through NEFT

HDFC life insurance premium payment can also be done through NEFT.You can take the service after you have added the HDFC Life Insurance as the beneficiary into your HDFC bank account.One thing is to be kept in mind that during the payment, it is that you opt on the same policy number you want to pay for.Premiums can not be paid for lapsed policies.Never initiate a premium payment without cross-checking and confirming the previous due premium amount.Once the premium is paid, a receipt is generated which is sent to the policyholders registered contact number, emailed or sent to the registered address shared with the insurance company.You can check your premium payment receipt by login to your account.

Standing Instruction Mandate For HDFC Account Holders

The HDFC bank account holders have the benefit of auto-debit through standing instructions issuance.The premium amount will be automatically deducted from the HDFC account of the policyholder before the payment date.Download the SI mandate from the HDFC site in case you want to use this facility.

National Automated Clearing House (NACH)

Under these premiums can be paid from any bank account depending on the choice of the policyholders.A canceled cheque of the respective bank is needed to be submitted to the HDFC branch and the policyholder also needs to show auto-debit mandate to initiate payment through the bank of his/her own choice.The MICR code mentioned on the cheque helps in fund transfer. It is generated automatically by HDFC bank branch.

Credit Card Payment

In case you withhold HDFC credit card then you need to relax as the payment can be done easily.An automatic deduction for premium payment is done from the credit card balance.Submit the details of the credit card and a photocopy of the front side of the credit card for the further payment process at any of the HDFC Bank branches.

HDFC Life Premium Payment Through Mobile Wallet

Payment through wallets has become nowadays common among android/ios mobile users. HDFC Life premium payment can be done through wallets.Wallets like Paytm is providing the premium payment option to their users for HDFC Life Premium Payment.

Payment through EBPP (Electronic Bill Presentment & Payment)

Payment through the bank account of your choice is another option of premium paymentRegistration can be done on the bank site for the premium payment.After you do the premium payment an e-receipt is generated against the payment done by the account holder.The premium can be paid for only those policies in force.

HDFC Life Premium Payment Offline

Under certain circumstances, the policyholders might not be able to do the premium payment online. In this case, we have got several other options to do the HDFC Life premium payment. Here are the other modes of payments mentioned for your convenience.

Payment At HDFC Bank/HDFC Life office

You can pay your premiums at the HDFC bank branches or HDFC life offices through cheques and demand drafts (DD).The demand draft or cheque should be in the name of “HDFC Life Policy No. xxxxxx”. In case the policy number is missing your DD or cheque is of no use.DD and cheque payment mode can also be used for renewal premium payment.Transaction beyond INR 50,000 through DD or cheque requires PAN details to be mentioned at the back of the cheque or DD.

Payment At Axis Bank Branches

Several other banks are accepting the HDFC Life premiums and among those are Axis Bank branches.All that is to be done is to generate a DD or cheque in the name of HDFC Life Policy No.xxxx and do insert policy number.After the payment is done, you will receive a payment receipt from the bank branch you have paid the premium at.

Through IVR

An automated voice can also assist you on call to do the premium payment.All you need to do is call on 1860 267 9999. The call can be answered only between 10:00 am to 7:00 pm.Follow the instructions provided on the call regarding the payment.The payment can also be initiated through, VISA credit card, MasterCard, etc.The payment can be done sitting at home.

Drop Boxes

Dropboxes are the best options for policyholders who do not have time to stand in a queue.A DD or a cheque generated in the name of the insurance company along with your policy number can be dropped into the dropbox of the banks.The DDs/cheques automatically get processes by the bank officials.Transaction above INR 50,000 needs PAN card details.

CSC (Common Services Centres)

The insured can reach out to any of the common services centers as many of the centers have started accepting premiums. You just need to cross verify and confirm whether the particular CSC accepts the premium amount for the particular insurer.

Payment Sent Through Courier or Post

Courier and post facilities are the best option, in case you are stuck in some problem, or you are not in your hometown for some reason.Signed documents along with DD or a cheque can be sent to the insurance company through the post.ID proof and address proof are must in case of transfer more than INR1,00,000 subjected to terms and conditions of the bank.Show your PAN card details in case of payment above INR 50,000.

Cheque Pickup by HDFC Representative

The HDFC Life insurance provides an additional facility to the policyholders who are not in a condition of visiting any of the branches to pay the premium neither they have the online payment services.Such policyholders can sign a cheque in the name of HDFC Life Policy No. xxxxx and the same cheque will be picked up by an HDFC representative.The facilities have proved to be a great help to the policyholders who are not in a position to reach out to the HDFC Life Office or branches.

Payment through M swipe

The insured can visit any of the HDFC life insurance offices and pay the premium through the debit card.It is acceptable on working days.Axis Bank and ICICI bank account holders can have the benefits of EMIs.Under M swipe American Express/Master/Mastro/Visa/Rupay debit and credit cards are accepted.

Other Payment Option For Specific States

The apps mentioned below have been made basically according to certain states.

Maha Online Payment Gateway: HDFC Life Insurance policyholders belonging to Maharashtra have an opportunity to use this payment window.MP Online Payment Gateway: Only the HDFC Life Insurance policyholders belonging to Madhya Pradesh can do the payments through this payment window.AP Online Payment Gateway: The HDFC Life Insurance policyholders belonging to Andhra Pradesh are eligible to pay through the AP online payment gateway.

How To Download HDFC Life Premium Payment Receipt Online?

The premium payment receipt is very important for the policyholder who has paid the premiums.

The receipt is the confirmation of the fact that the amount paid by you has been received by the insurance company.It is the whole and sole proof of payment in case of any scam happens with the policyholder.It can be helpful in the application of tax saving.

So, it is safe to be updated with a premium payment receipt. Let us see how you can get your premium payment receipt online.

Steps To Download HDFC Life Premium Payment Receipt Online

It is very simple and easy to check whether your payment has been processed or not. For the same you need to follow the following guidelines:

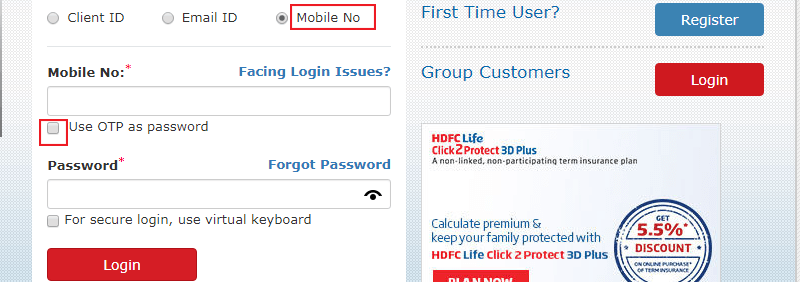

Open the official site of HDFC Life Insurance.Move on to the tab “My Account” mentioned at the top of the screen.  Open “My Account” and login according to your data availability like client id, phone number, email id, and password.

Open “My Account” and login according to your data availability like client id, phone number, email id, and password. The click will redirect you to a new page. You can find a tab “E-Statement” at the top of the page on the right-hand side.When you click on the “E-Statement” option then several pop-ups will appear below that and among which you can find “Payment Receipt”.Open “Payment Receipt”.

The click will redirect you to a new page. You can find a tab “E-Statement” at the top of the page on the right-hand side.When you click on the “E-Statement” option then several pop-ups will appear below that and among which you can find “Payment Receipt”.Open “Payment Receipt”. Select the policy number for which you want to see the payment receipt.Select a date for which you want to see the receipt.

Select the policy number for which you want to see the payment receipt.Select a date for which you want to see the receipt. After filling in all the details click on “View Premium Details” and get the HDFC Life premium payment receipt.

After filling in all the details click on “View Premium Details” and get the HDFC Life premium payment receipt.

Premiums are to be paid on time to keep the policy running. The late premium payments can harm the dependent families. The family may not get after death benefit in case the claim gets rejected. In case the premiums are missed then the policy lapses and lapsed policy is of no use. So, keep paying the premiums on time. The mode of payment is to selected by you from the list of modes mentioned in the article.

Last Updated : November, 2019

Naval Goel is the CEO & founder of PolicyX.com. Naval has an expertise in the insurance sector and has professional experience of more than a decade in the Industry and has worked in companies like AIG, New York doing valuation of insurance subsidiaries. He is also an Associate Member of the Indian Institute of Insurance, Pune. He has been authorized by IRDAI to act as a Principal Officer of PolicyX.com Insurance Web Aggregator.