Florida State Board considers specialty, casualty, cyber ILS opportunities

Having previously said it was researching how to expand its insurance-linked securities (ILS) allocations beyond natural catastrophe risk, at a recent meeting executives of the Florida State Board of Administration explained that specialty lines, as well as casualty and cyber risks could be in scope for the large ILS allocator.

The Florida State Board of Administration invests into insurance-linked securities (ILS) via a number of specialist ILS managers, making these allocations on behalf of the Florida Retirement System Pension Plan (FRS) portfolio, which it administers.

With some $201.7 billion in assets as of the end of 2024, the Florida Retirement System Pension Plan one of the largest institutional investors that allocates to the ILS sector.

To-date, these allocations have all been across natural catastrophe risks, with investments in funds or managed structures under the management of Aeolus Capital Management, Nephila Capital, Pillar Capital Management and RenaissanceRe Capital Partners. In addition the State Board also allocates to life settlement investments with manager Miravast.

The Florida state pension nat cat ILS allocation reached $1.56 billion at September 30th 2024, as we reported in February. Including the life settlement allocation we estimated that was at least a $1.74 billion total insurance-linked investment at around that time.

We now understand that, as of December 31st 2024, the ILS investments were valued at approximately $1.791 billion, being somewhere north of 0.85% of total fund assets at the time (the target allocation size remains 1%, so there is further room to grow).

We also reported in that article that an additional $70 million commitment was being made to the RenaissanceRe managed Tintoretto ILS structure during the fourth-quarter of the year, which would potentially lift the total ILS allocation of the Florida retirement system pension fund even higher. In addition, earnings from its investments will also have helped boost the value of the ILS investment by the end of last year, we suspect.

As we’ve also reported, in our coverage of the Florida State Board and FRS pension ILS strategy, options to invest into other lines of reinsurance business have been researched in recent months.

Initially, this was an exploration of opportunities in the Lloyd’s market, we understood.

But now, commentary during a recent meeting of the Florida State Board executive suggests the allocator is open to expanding into a broad range of insurance-linked opportunities, if they proved to be suitable for its strategy.

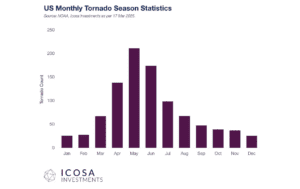

During the recent meeting, Subhasis Das, Senior Portfolio Manager at the State Board of Administration of Florida, said that rates in reinsurance remained attractive, while the attendees heard in a presentation that the market remains hard but that rate increases had begun to slow or decline in some areas.

They also heard that the impacts of the California wildfires had affected funds, which likely includes some of the strategies the State Board is invested in.

Overall the ILS market remains attractive to the investor, but there is an ambition to source returns from a wider range of insurance-related risk categories, it seems.

On the state of the property cat market, Das said, “The current market is, while the best market may have been January 1 of 2023, it’s sort of in that same area. So we view the market as still being very attractive in terms of the premium rates you can earn on these contracts.”

Das explained on the ambition to diversify within reinsurance during the recent meeting, “Over time, we are looking at adding more specialty exposure possibly through Lloyds of London in the shape of marine, maybe some casualty, cyber, all of other types of insurance risk.”

Which suggests the Florida State Board is getting an appreciation for the role insurance risk linked investments can play within its portfolio as a strategic diversifier and sees an opportunity to expand that further, while also diversifying within the space.

That aligns with some other large investors in the space, who have expanded their mandates beyond catastrophe risks in recent years.

Not every investor follows this approach, with many preferring to stay focused on nat cat. But it can make a lot of sense for larger investors to look more broadly, given ILS allocations are typically small components of their assets but can add a particularly diversifying return stream over time.

View details of major pension fund and sovereign wealth investors in ILS and reinsurance in our directory.