Lancashire has ‘plenty’ of aggregate reinsurance limit left despite erosion from LA wildfires: CUO

Bermuda-based Lancashire Holdings Limited has reported that losses from the devastating Los Angeles wildfires have eroded “a good portion” of the annual deductible of the organisation’s aggregate reinsurance cover, but the company has plenty of limit available for the rest of the year, according to Chief Underwriting Officer (CUO) Paul Gregory.

In January, Lancashire announced estimated, aggregate net ultimate losses from the California wildfires to be between $145 million and $165 million.

Moreover, at the key January 1st, 2025, reinsurance renewals, Lancashire secured annual aggregate worldwide coverage for its property treaty and direct and facultative books.

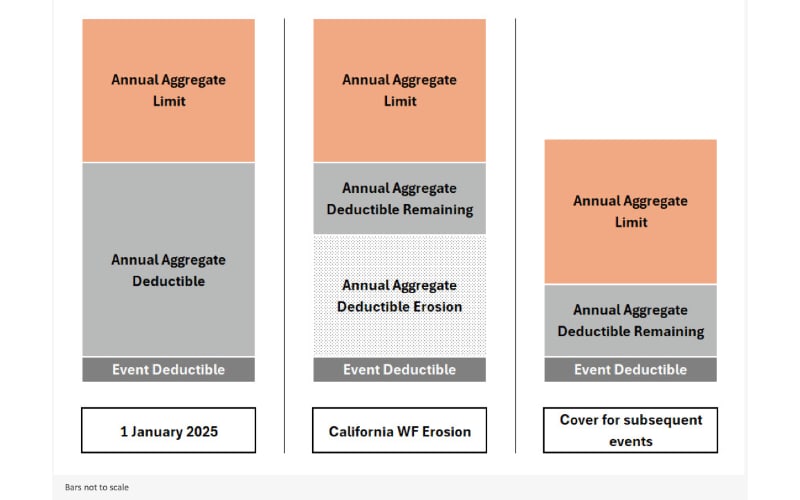

Earlier today, during its full year 2024 earnings call, Lancashire explained that each qualifying event is subject to an occurrence layer with a per event deductible and limit, and as-if recoveries from that layer erode the annual aggregate deductible.

“Our California wildfire loss estimate erodes a good portion of the annual aggregate deductible, reducing it for subsequent events,” Lancashire explained.

Once the aggregate deductible has been fully eroded, additional losses are recovered from the annual aggregate reinsurance limit secured at the 1/1 renewals.

It’s important to note that this aggregate reinsurance structure provides coverage for Lancashire’s property insurance classes and property catastrophe treaty reinsurance, while other classes are not covered under the agreement.

During its full year 2024 earnings call, Lancashire confirmed that, at the renewal, the aggregate structure was extended to fully include all natural catastrophe perils.

As you can see from the image below provided by Lancashire, the Los Angeles wildfire losses have eroded more than 50% of the organisation’s annual aggregate deductible.

During the call, Gregory was questioned on the structure of the 2025 aggregate reinsurance cover, and confirmed that the structure is similar to last year.

Gregory explained: “We were able to get benefit of, obviously, some softening of rate. So, we took that benefit. We were also able to expand coverage for certain products, which was helpful.

“In terms of the limit, obviously, the wildfires erode an element of the limit in our reinsurance programme, but we have plenty of limit remaining available for the rest of the year.”

Furthermore, Lancashire didn’t reveal how close the annual aggregate limit is to attaching or how high the limit extends, but Gregory did provide some additional context.

“For illustrative purposes only, if we had an exact repeat of our 2024 natural catastrophe loss events, in addition to the Q1 wildfire loss, we would anticipate recoveries from the aggregate cover. We would also not be exhausting the full limit available,” commented Gregory.