Artemis’ measure of catastrophe bond market size surpasses $50bn for the first time

For the first time since we’ve been tracking the catastrophe bond marketplace, Artemis’ measure for the size of the market, based on our estimate of catastrophe bond risk capital outstanding, has surpassed the $50 billion mark, as 2025 issuance continues to outpace the heavy maturity schedule.

As of Thursday 27th February 2025, our figure for risk capital outstanding across 144A catastrophe bonds and the private cat bonds we have tracked reached an all-time high of almost $50.98 billion.

That’s up by almost $1.5 billion since only the end of 2024, despite there having been roughly $2.5 billion of maturities already this year. As new cat bond issuance recorded by Artemis has now reached $4 billion in 2025 already, so has far outpaced this.

In fact, the outstanding catastrophe bond market is now almost 7% larger than it was at the end of the third-quarter of 2024, having grown by by more than $3.2 billion in size, reflecting the particularly strong issuance seen over just the last few months.

It’s important to note that our figure for cat bond market risk capital outstanding will differ to others you might see, as we include every 144A cat bond (property cat, specialty and other lines, but not including any mortgage ILS) as well as a number of private cat bond, or cat bond lite deals we’ve sourced details on. We also don’t always know about early redemptions, or partial repayments, so again the figure from broker-dealers and ILS managers will likely differ.

But, differences aside this new record high is particularly notable, as it’s the largest Artemis’ figure for the outstanding catastrophe bond market has been in our more than twenty-eight years of tracking the sector for our cat bond data set and the first time it has reached the $50 billion milestone thanks to the settlement of some larger cat bond deals in the past week.

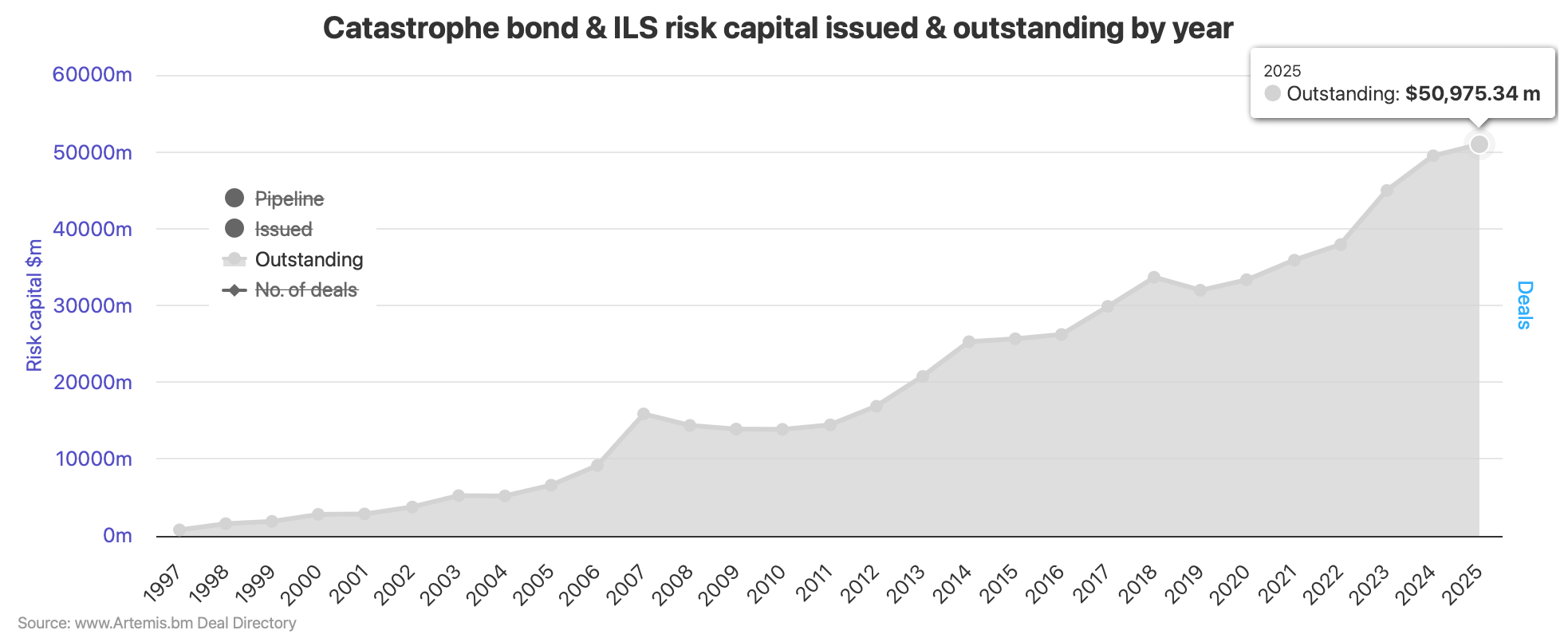

You can analyse the growth of the catastrophe bond market over time using our interactive chart:

The outstanding catastrophe bond market, by our measure, is now 13% larger than at the end of 2023 and 34% larger than it stood at the end of 2022.

Impressively, the cat bond market has now almost doubled in size since 2015, so in less than a decade.

At the rate of issuance we are currently seeing, the first-quarter of 2025 is almost certain to set new records and there is every chance we see the cat bond market double over a ten year period by later this year.

There are significant maturities to come though and the cat bond market will need to stay on a record-setting pace to continue to grow over the coming months.

There are a further almost $1.9 billion of catastrophe bonds set to mature before the end of the first-quarter and then another almost $5.9 billion wall of cat bond maturities coming in Q2 2025. Analyse the cat bond maturity schedule using this chart.

In fact, with additional maturities to come out of the market later today, the cat bond market size will shrink somewhat although remain above the $50 billion milestone for now.

Going forwards, it seems there is every chance the market continues to expand, given what we’ve witnessed in 2025 so far and the fact those maturities are going to bring significant levels of cash back to cat bond fund managers and investors, which will be available to be invested into new issuances and likely keep deal execution attractive for cat bond sponsors.

As demand for reinsurance and retrocession in insurance-linked securities (ILS) form continues to be high, there is currently no reason to think the market cannot continue to grow over the remainder of this year, with more records potentially set.

As a reminder, you can track catastrophe bond issuance and the pipeline of deals due to settle in this chart.

You can track settled cat bond issuance by month and quarter in this chart (use the key of months at the bottom to include and exclude any for your analysis).

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

All of our catastrophe bond market charts and visualisations are up-to-date and include data on new cat bond transactions as they settle.