Private ILS funds outpace cat bond funds in 13.10% ILS Advisers Index 2024 return

Private ILS funds outpaced pure catastrophe bond funds in the full-year performance of the Eurekahedge ILS Advisers Index, while the average return across all of the insurance-linked securities (ILS) fund strategies tracked was 13.10% for 2024.

2024 was the second year running where the two categories of ILS investment funds were evenly paced through the first-half.

But, second quarter premium accrual on the private ILS fund side, so those ILS fund strategies that allocate capital to collateralised reinsurance and retrocession opportunities, lifted that segment to deliver the strongest average returns of last year again.

Overall, annual performance was down for the ILS Advisers Index in 2024, year-on-year, while in addition both of the ILS fund groupings also failed to beat the 2023 returns they had delivered.

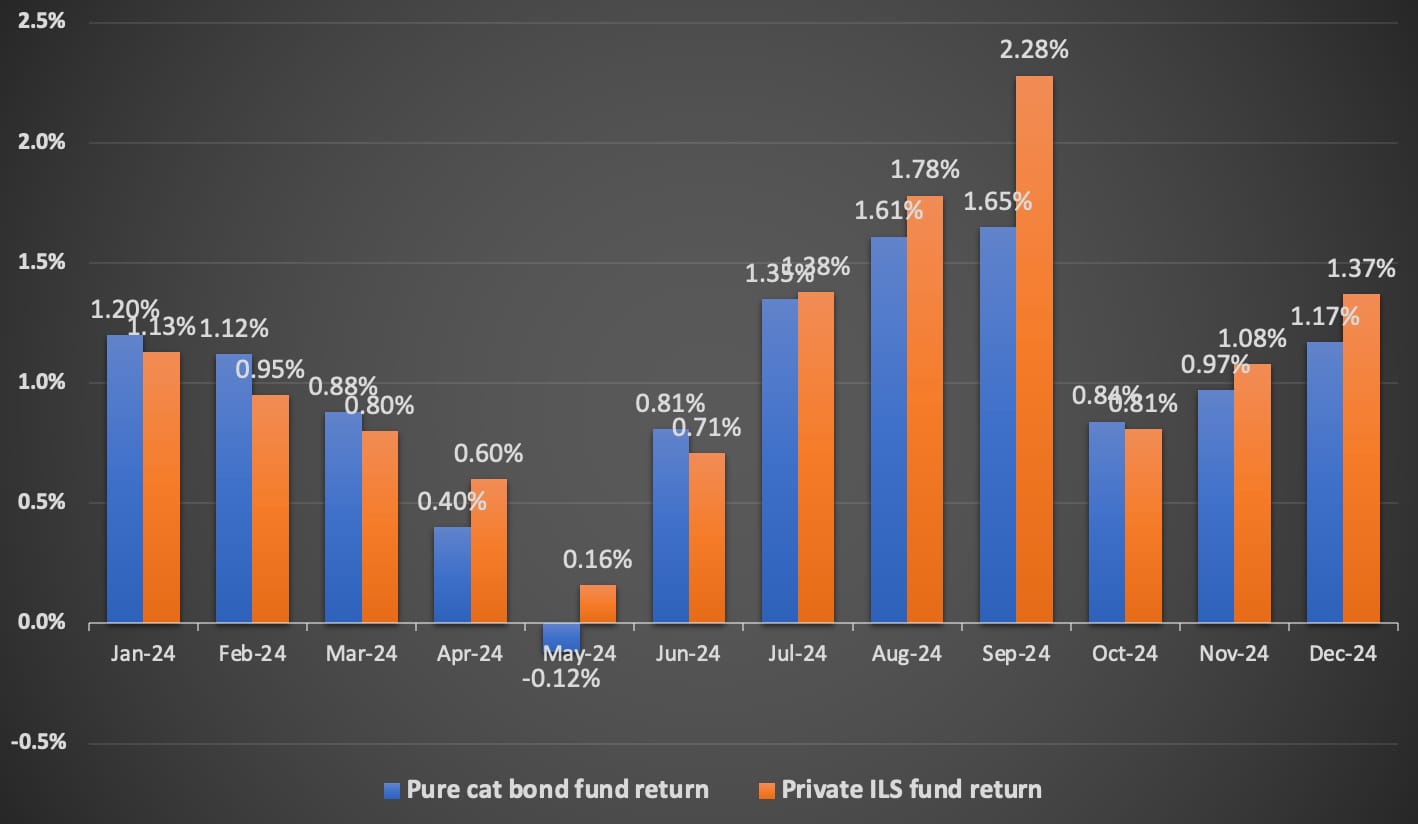

The average ILS fund was up by 1.29% for December 2024, capping the year with a strong final month’s performance, ILS Advisers explained.

Across the ILS Advisers Index, the average ILS fund performance for full-year 2024 was 13.10%.

That’s slightly down on the 13.89% performance recorded in 2023.

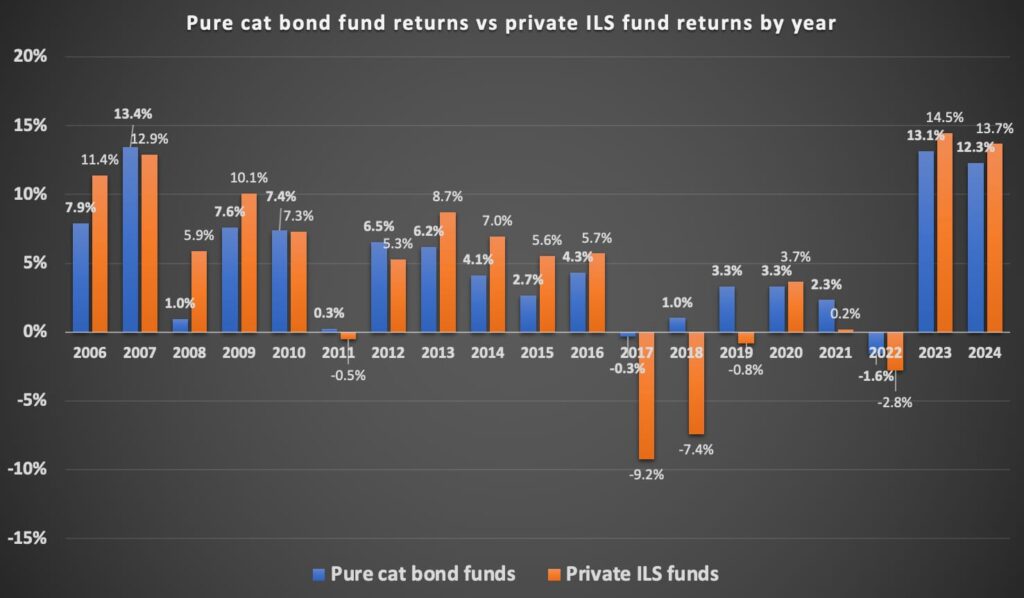

Pure catastrophe bond funds averaged 12.3% according to ILS Advisers data, while the group of private ILS funds that also allocate to other reinsurance instruments delivered an average return of 13.7% in 2024.

Both figures were slightly down on the 13.1% return for cat bond funds and 14.5% return for private ILS funds of 2023, but each were the third-highest performance since this Index was first calculated back for 2006.

You can see the performance by category of ILS fund in the chart below over the history of the ILS Advisers Index.

The strong performance of both catastrophe bond funds and private ILS funds is once again clear with these averages well into the double-digits and the chart above shows how historically high ILS fund returns have been for now two years in a row.

ILS Advisers commented, “Despite the substantial natural catastrophe activity and insured losses in 2024, the Insurance-Linked Securities market demonstrated resilience. ILS contracts typically feature annual resets that adjust attachment levels to reflect current replacement values, ensuring a consistent risk level. Additionally, ILS contracts have recently benefitted from improved terms. While ILS insurance spreads have moderated from their peak levels two years ago, they remain historically elevated, offering attractive opportunities for investors.”

For the final month of the year, December 2024, pure cat bond funds as a group delivered an average +1.17% gain for the month, while funds incorporating private ILS strategies achieved a return of +1.37%, ILS Advisers data shows.

Every ILS fund tracked by the ILS Advisers Index delivered a positive return in December 2024.

Once again, catastrophe bond funds began the year strongly and tracked private ILS funds closely until the mid-year, after which the seasonal premium accrual helped the reinsurance and retro focused investment strategies extend their lead, as the chart below shows.

With the reinsurance market having softened somewhat and catastrophe bond pricing having tightened towards the end of 2024, it remains to be seen whether these levels of return can be sustained, as averages across the market.

However, it is important to remember that within the averages there is great diversity across ILS fund strategies, return targets and risk appetites, meaning there is typically a wide-range of performance in the market and while there are strategies that only seek up to a low double-digit return, there are higher-octane ILS fund strategies that look for something closer to 30% returns.

Reflecting the diversity available in the ILS fund marketplace, while all ILS funds were positive for full-year 2024, the range of returns in those tracked by ILS Advisers was from 7.96% to 20.11% (across funds that are comparable).

Which further demonstrates that there is an increasingly broad range of ILS fund options available for investors to choose from, which means even in a time of slight softening some will continue to deliver double-digit and higher returns.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 26 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.