Stone Ridge marks mutual cat bond / ILS funds the most on LA wildfires

Stone Ridge Asset Management, the New York based alternative risk premia focused investment manager, appears to have taken the strongest action in terms of marking down its mutual catastrophe bond and insurance-linked securities (ILS) funds on potential exposure to the California wildfires, while most other strategies in the market have barely moved.

The biggest moves came on January 10th and 13th, as the net asset values of Stone Ridge’s two 1940’s act mutual investment funds that allocate to reinsurance instruments were marked somewhat lower.

The investment manager has made much bigger cuts in the NAVs of its two funds than has been seen for the most comparable mutual ILS fund strategies we have seen data for.

But, this has been seen before, especially with the US hurricane activity in 2022 and 2024, when Stone Ridge has made prudent earlier cuts to ILS fund NAVs right after catastrophic events, as it sought to account for uncertainty and potential losses, but with a good deal of those mark-downs recovered over the following weeks.

First, the Stone Ridge Reinsurance Risk Premium Interval Fund, which likely has the most exposure to the wildfire events, given its broad ILS and reinsurance focus on making investments into private reinsurance quota shares, sidecars, collateralized reinsurance arrangements and other ILS instruments, including some catastrophe bonds.

The Stone Ridge Reinsurance Risk Premium Interval Fund was marked down on both Friday January 10th and Monday January 13th, leaving it 3.20% down on the previous NAV mark.

Yesterday, it was marked slightly higher likely as premium accrual will continue and as the investment manager feels, based on the information available, it has marked sufficiently to absorb any loss within that effective NAV reserve.

Next, the Stone Ridge High Yield Reinsurance Risk Premium Fund, which is not an interval structure and invests largely in catastrophe bonds.

This strategy saw its NAV marked down 0.56% on January 10th, since when it has been marked flat each day following.

As greater clarity emerges over the eventual insurance and reinsurance market loss from the Los Angeles area wildfires, it will be interesting to see whether these early marks are sufficient, or even if there is some bounce-back (although that may be hard to see, with premium/risk interest spread accrual continuing).

Quota share investments are likely to take a share of losses, given their proportional nature and with the Interval ILS fund managed by Stone Ridge allocating to numerous of these, some attrition is to be anticipated for such a significant catastrophe loss event.

Next, we looked at the Amundi US managed Pioneer ILS and cat bond funds.

The Pioneer ILS Interval Fund, which invests across the range of reinsurance-linked investments, including quota shares and collateralized reinsurance, has not yet moved down at all on the back of the wildfires, but did rise at a slower pace than recent weeks, being up only 0.22% from Jan 7th to Jan 13th.

It’s likely the manager feels losses from the wildfires may still be too uncertain to make any significant moves at this stage, while also suggesting any wildfire losses may be absorbed within expected loss budgets for the strategy, while again premium accrual continues and may outpace that over time.

It’s important to note, any early moves made are based on managers own estimates, plus what estimates are available in the market at that time.

Meanwhile, the Pioneer CAT Bond Fund, Amundi US’ dedicated cat bond mutual fund strategy, has also not had any negative movement in its NAV, but was flat since Jan 7th to the 13th.

Two other mutual ILS strategies, the Ambassador Cat Bond Fund (largely cat bond focused) and the City National Rochdale Select Strategies fund (which is largely ILS and index-trigger cat bond focused), both rose slightly between those dates, albeit again at a slower pace than prior weeks, it seems.

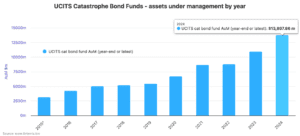

In addition, we’ve looked at certain UCITS catastrophe bond funds that mark more regularly and found some very minor declines as of Friday pricing, but this results in largely just a relatively flatter period for most cat bond funds we’ve seen, seemingly with any loss estimates made falling within accrued risk interest spread earned for recent days.

This aligns with forecasts that the catastrophe bond market will not face any immediately realised losses due to the wildfires, given the reduced exposure to that peril and fact exposure is largely constrained to aggregate cat bonds, or privately placed smaller deals.

It’s worth noting that, aside from the wildfires, there have been other cat bonds marked, or needing to be marked, in recent days. Not least the two tranches of FloodSmart Re cat bonds that provide the NFIP with flood reinsurance, that we discussed in this article yesterday.

We should also point out that none of the mark-downs seen are overly significant, while it’s not surprising to see the Stone Ridge Interval structured ILS and reinsurance fund marked the most, given its very broad exposure to re/insurance sector private deals and quota shares, plus that managers tendency to mark for potential losses early and sufficiently to absorb exposure based on its view of a catastrophe event at the time.

Also read:

– Euler ILS Partners puts wildfire industry loss at $15bn-$17bn, highlights BI / ALE uncertainty.

– Wildfire losses may cause re/insurance pricing to firm as payback sought: Berenberg.

– BMS says LA wildfire insured losses likely to exceed $25bn. KBW analyses up to $40bn.

– Autonomous raises its LA wildfire loss estimate to $25bn, $18bn from Palisades fire.

– California wildfires: Subrogation topic raised, as utilities come into focus.

– ICEYE satellite analysis: Over 10,900 buildings likely destroyed in Palisades and Eaton fires.

– Catastrophe bond price movements due to LA wildfire exposure.

– Evercore ISI: LA wildfire insured loss $20bn-$25bn. Could be one event under reinsurance.

– LA wildfire losses to “notably exceed” $10bn, could approach $20bn: Gallagher Re.

– Mercury says LA wildfire losses to exceed reinsurance retention.

– LA fires: “Considerable attachment erosion” likely for some aggregate cat bonds – Steiger, Icosa.

– LA wildfires: Over 10k structures destroyed. Insured losses up to ~$20bn, economic $150bn.

– LA wildfire losses unlikely to significantly affect cat bond market: Twelve Capital.

– LA wildfires unlikely to cause meaningful catastrophe bond impact: Plenum Investments.

– JP Morgan analysts double LA wildfire insurance loss estimate to ~$20bn.

– LA wildfires: Analysts put insured losses in $6bn – $13bn range. Economic loss said $52bn+.

– LA wildfires bring aggregate cat bond attachment erosion into focus: Icosa Investments.