Munich Re secures Eden Re II reinsurance sidecar at $150m again for 2025

Having begun its Eden Re II Ltd. collateralized reinsurance sidecar placements with the largest Class A tranche of notes since 2019, global reinsurer Munich Re has now added the usual Class B issuance, but this tranche has been placed at just $85.5 million, which is the smallest size for that layer since right back in 2015.

Which has resulted in the Eden Re II reinsurance sidecar placement of listed notes being at the same size as the prior year, securing Munich Re $150 million of collateralized quota share retrocessional reinsurance from the capital markets.

Artemis reported on December 30th that Munich Re had started its 2025 Eden Re II Ltd. collateralized reinsurance sidecar placements of listed notes with $64.5 million of Series 2025-1 Class A notes.

That was the largest Class A notes issuance from one of Munich Re’s Eden Re sidecars since back in 2019.

It implied that the total 2025 Eden Re sidecar placement could have ended up larger than the prior year. But now the expected Class B tranche of notes have also been placed and it has only taken the overall issuance to the same size as for 2024, at $150 million in size.

So, for 2025, Munich Re has finalised the sidecar issuance with an $85.5 million tranche of Eden Re II Ltd. Series 2025-1 Class B notes.

These $85.5 million of Class B participating notes were issued by Eden Re II Ltd. acting on behalf of a 2025-1 segregated account.

Maturity is due for the notes, which have been privately placed with qualified investors, on March 19th 2030, the same date as the previously reported Class A tranche, and they have also been admitted for listing on the Bermuda Stock Exchange (BSX) as insurance linked securities.

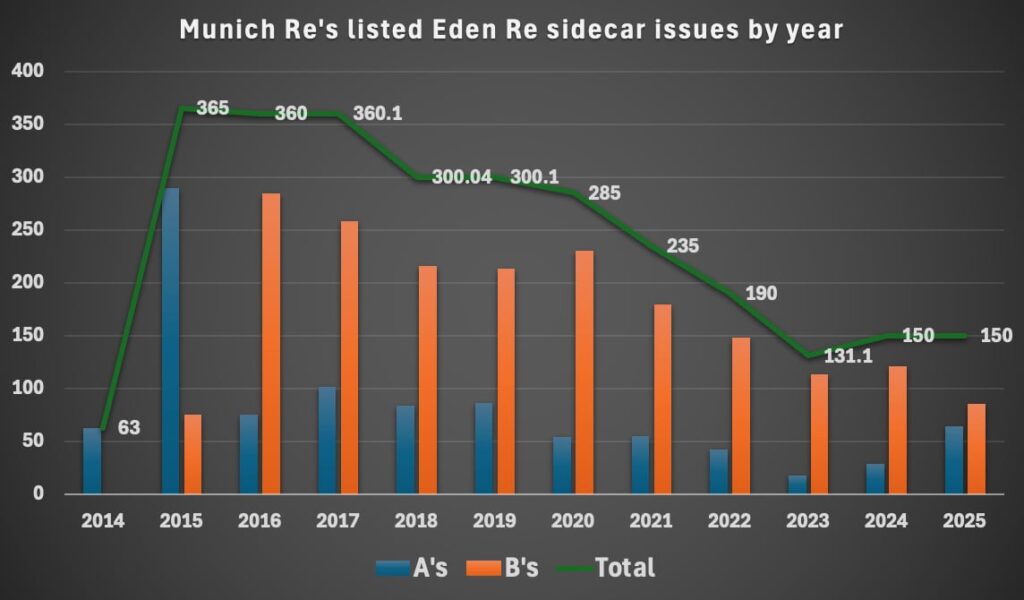

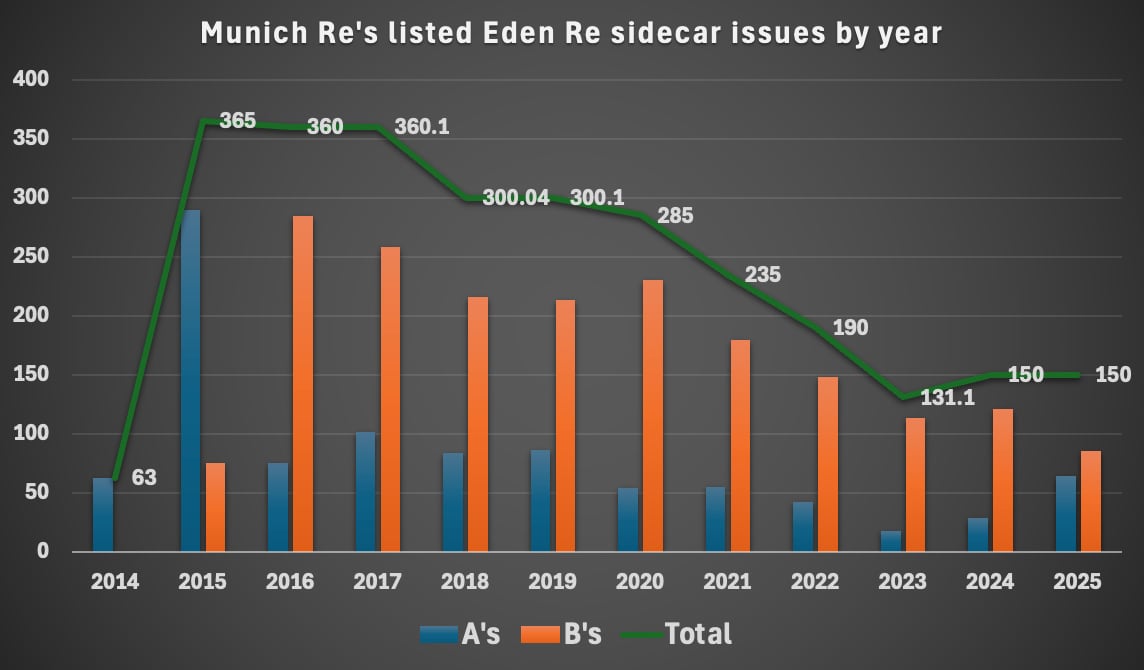

Munich Re has issued two tranches of sidecar notes under an Eden Re vehicle each year since 2015, while just a single tranche were issued in 2014, which was the first year an Eden Re reinsurance sidecar was used by the company.

The sidecar issuances have fluctuated in size over time, from their largest combined issuance in 2015 at $365 million, to $131.1 million in 2013 which was the smallest year when two tranches of notes were issued by an Eden Re sidecar, or to their smallest of $63 million in the first single tranche year issuance of 2014.

The fact the Class B notes have shrunk to their smallest since 2015 likely does not imply less investor interest, given sidecar investments have been resurging of late with more structures and larger issues for some sidecar sponsors.

It is likely to imply that Munich Re does not feel the need to secure more than the total $150 million of retrocessional sidecar reinsurance again, as the company looks to retain a greater share of the economics from its catastrophe reinsurance underwriting again in 2025.

You can see the history of the sizes of the Munich Re sponsored Eden Re sidecar issuances in the chart below:

Details of each of the Eden Re reinsurance sidecar issuances can be found in our directory of sidecar transactions.

The shrinking in size of the Eden Re reinsurance sidecars began after the heavy year of catastrophe loss activity in 2017, but then accelerated when property catastrophe reinsurance pricing was hardening.

However, it’s important to note that Munich Re has other quota share partnership sidecar structures in-use, reflecting its continued appetite to tap the capital markets for retrocession and risk sharing partnerships.

In fact, as we reported earlier in December, Munich Re’s collateralised reinsurance sidecar structures grew to $650 million in 2024, as the company elevated its use of retrocession, aligned with its growth in natural catastrophe exposure from its underwriting.

It’s also worth highlighting the reinsurers partnership with Dutch pension investor PGGM, allocating for the PFZW pension, as the target allocation range for the Leo Re sidecar structure had been increased last year.

Which means Munich Re may not have reduced its use of reinsurance sidecars and capital markets backed retrocession for 2025. It simply may be that the company feels its Eden Re II is optimal at $150 million for another year, as it looks to continue optimising and maximising profits from its catastrophe business.

Also read: Munich Re starts Eden Re II 2025 sidecar with $64.5m Class A notes, largest since 2019.

View details of many reinsurance sidecar investments and transactions in our list of collateralized reinsurance sidecars transactions.