Aon poll: 15% of US insurers say ILS / third-party capital feature in their 2025 plans

A recent poll of insurers in the United States, undertaken by broker Aon’s Capital Advisory division, found that within those carriers’ capital management plans for 2025, insurance-linked securities (ILS) and third-party reinsurance capital solutions are a significant feature.

With the market having been challenging for a number of years, but insurers responding with a growth mindset against a backdrop of positive rate momentum, demands on capital are shifting, broking giant Aon says.

One interesting finding for our audience from the poll, is that the US insurance industry looks set to continue exploring the capital markets for reinsurance and risk transfer solutions, with 15% of respondents specifically indicating ILS solutions as within their 2025 capital management plans.

Growth plans are evident, as too is the fact that the majority of insurers see their catastrophe retentions as manageable, relative to surplus, although many still see them as meaningful compared to earnings.

But with a growth mindset, the US insurance industry needs a wide-range of capital solutions to support its premium plans, which is where reinsurance and risk transfer looks set to continue playing a significant role.

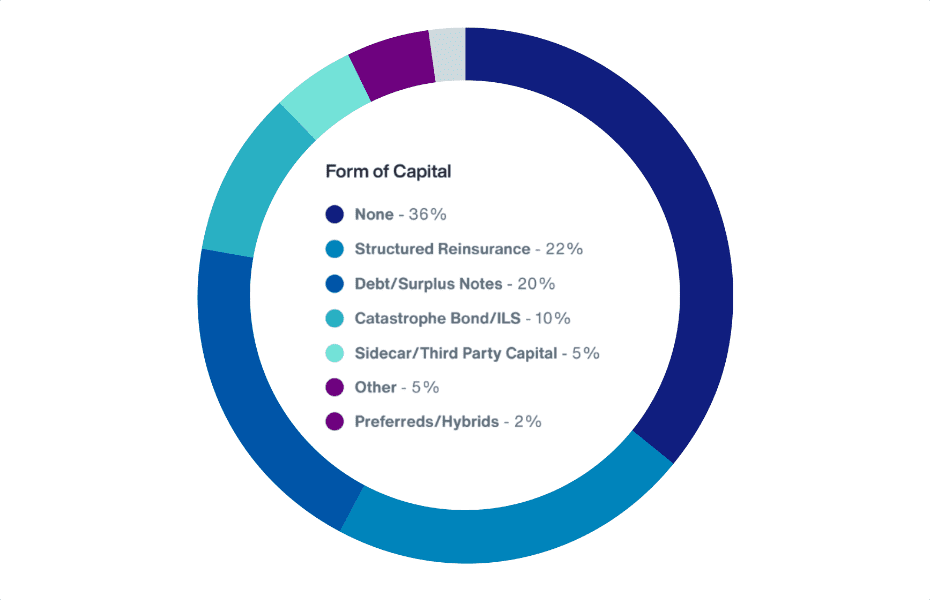

Asking poll respondents about the forms of capital they are including in their 2025 capital management plans, other than traditional reinsurance, retained earnings and equity, Aon found that 15% cite insurance-linked securities (ILS) and third-party capital backed reinsurance arrangements.

Some 10% of respondents answered catastrophe bonds or ILS, as a form of capital in their plans for 2025.

A further 5% answered sidecars or third-party capital.

When you consider that traditional reinsurance is excluded from the answers, but a proportion of that no doubt flows to collateralized reinsurance funds, this suggests a relatively high-level of interest in cat bonds, ILS and other third-party investor backed reinsurance arrangements.

Other structures that can be backed by institutional capital and investors also featured in the responses, with 20% indicating debt or surplus note issuance as in their plans, while 22% pointed to structured reinsurance, on which Aon says “structured quota shares might be a possible solution.”

With some investors and ILS fund specialists also focusing on the quota share reinsurance investment space, this could also indicate more reliance on the kind of capital that gets managed in the ILS market, or deployed by other adjacent entities and allocators.

By excluding traditional reinsurance from this question on forms of capital, Aon has helped to drive home the growing sophistication in how institutional and capital markets are accessed by the US insurance industry.

Which suggests continued positive momentum for 2025, within catastrophe bonds, ILS, sidecars and other third-party reinsurance capital arrangements.