Top 9 Insurance Agent Software Tools You Should Be Using

This post is part of a series sponsored by Darkhorse Insurance.

Imagine juggling multiple clients and endless paperwork. You face constant pressure to meet deadlines while providing excellent service. This overwhelming scenario is all too familiar for independent insurance agents. Fortunately, the right insurance agent software can transform chaos into streamlined efficiency.

They free up your time to focus on what matters most: building relationships and growing your business. Here are nine tools to help you tackle common challenges and elevate your agency’s performance.

What Is an Insurance Agent Software?

Insurance agency software is a specialized tool designed to streamline your daily operations. It helps you manage client information, policies, and communications in one central location. The software functions by integrating various capabilities into a single platform.

You can manage client details, monitor leads, and much more, all in a single platform. It automates routine tasks, such as sending reminders for renewals and generating quotes, helping you maintain organization and efficiency. Centralized information allows for quick access to important data so you can respond promptly to client inquiries.

Benefits of Insurance Agent Tools

Using insurance agent software offers several key benefits that can significantly enhance your agency’s operations:

Increased Efficiency: Automation of routine tasks, such as data entry and reminders, saves you valuable time. This allows you to focus on client interactions and closing deals.

Improved Client Management: By centralizing client data, you can effortlessly monitor interactions, preferences, and policy information. This leads to better-personalized service and stronger client relationships.

Faster Quoting and Policy Management: Streamlined quoting tools enable you to generate quotes quickly from multiple carriers. This responsiveness can increase your chances of winning business.

Enhanced Compliance and Risk Management: Many software solutions include compliance tracking features. This ensures that you stay updated with industry regulations, reducing the risk of costly penalties.

Robust Reporting and Analytics: Access to detailed reports helps you understand your agency’s performance. You can recognize trends, assess productivity, and make data-driven decisions for future development.

Better Communication: Integrated communication tools facilitate seamless interaction with clients and team members. This promotes stronger collaboration and ensures everyone stays in sync.

Scalability: As your agency grows, this tool can easily adapt to your changing needs. You can add features and functionalities that support your expanding operations.

Best Software for Insurance Agents

Here are our curated top nine essential tools that can help you as an independent insurance agent.

Agency Management System: Epic by Applied Systems

Epic by Applied Systems is an all-in-one agency management system that enhances workflow and improves productivity. This management platform features automated workflows and customizable dashboards so you can streamline operations. Also, its mobile app allows you to manage your agency on the go. Applied Epic Accounting is also available, which integrates accounting management and other back-office operations.

Customer Relationship Management: AgencyZoom

AgencyZoom is software for insurance agents that enhances client relationship management. It centralizes interactions, policy renewals, and follow-ups, streamlining the process for insurance professionals. The CRM software offers automation tools that help agents handle renewals, policy changes, and claims management.

Additionally, this insurance software integrates email marketing and lead management, enabling personalized communications and efficient tracking. With built-in analytics, agents can track customer engagement and optimize their sales and service strategies, ensuring improved client retention and satisfaction.

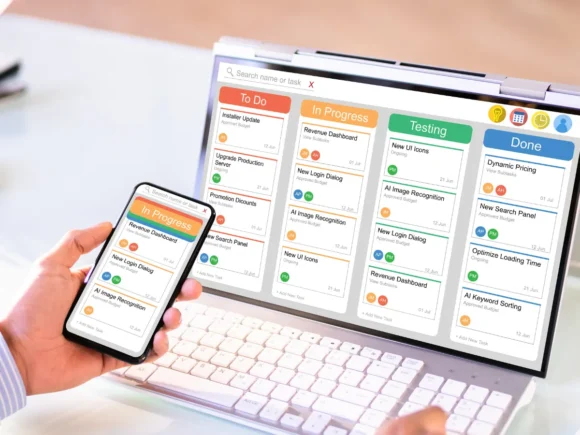

Project Management Tool: ClickUp

ClickUp is a flexible project management tool created to help insurance agents maintain organization. This platform enables you to oversee tasks, establish deadlines, and collaborate effortlessly with team members. With its customizable workflows, you can adapt ClickUp to meet the unique requirements of your agency.

Marketing Automation: Google Ads

Google Ads is a powerful tool for agents looking to expand their reach and attract new clients. By creating targeted ad campaigns, you can showcase your services to potential clients actively searching for insurance solutions. This platform, utilized in the insurance industry, enables you to define specific criteria to ensure your ads target the appropriate audience.

With various ad formats, including search ads and display ads, you can create compelling messages that resonate with potential clients. Google Ads provides detailed analytics to help you track campaign performance and make smart adjustments.

Email Marketing: Mailchimp

Mailchimp is a versatile email marketing tool for effective campaigns. This email marketing tool enables you to easily create, send, and monitor emails. Mailchimp offers customizable templates and segmentation options. You can design newsletters and promotional campaigns tailored to your audience. Analytics enable you to assess engagement levels and modify your strategies as needed.

Claims Management: IVANS

IVANS Download helps streamline claims management by facilitating the transfer of claims data from carriers directly into your agency management system. This software guarantees that essential claims information is automatically updated and readily available in your system. By minimizing manual data entry, it enhances both accuracy and efficiency. With real-time updates, your agency can respond more quickly and maintain transparency throughout the claims process.

Accounting Software: QuickBooks

QuickBooks is a popular accounting software that helps manage finances easily. It automates invoicing and tracks expenses effectively. Creating financial reports offers essential insights into your agency’s overall health. QuickBooks simplifies tax preparation by maintaining accurate records. Its user-friendly interface is easy to navigate, and integration capabilities with other platforms enhance its functionality.

Compliance Management: AgentSync

AgentSync is a compliance management platform tailored for insurance agencies. It helps automate agent licensing, appointment processes, and ensure regulatory compliance. With real-time updates, agents can stay informed of changing regulations and streamline renewals. The platform integrates with existing CRM systems, reducing manual work and improving efficiency. AgentSync’s reporting and audit features provide transparency and help agencies avoid penalties.

Collaboration Tools: Slack

Slack is a collaboration tool that enhances communication among team members. It provides real-time messaging and file-sharing capabilities. Teams can collaborate effortlessly, regardless of whether they’re in the office or working remotely. Channels organize conversations around specific topics for clarity. Improved communication leads to increased productivity and better client service. Slack keeps everyone aligned and informed.

Darkhorse: Your All-in-One Insurance Agency Platform

Darkhorse is an all-in-one insurance agency platform designed specifically for independent agents like you. It combines essential tools into a single, user-friendly interface, eliminating the need to juggle multiple tools. With Darkhorse, you can seamlessly strengthen client relationships, automate workflows, manage leads and more.

Darkhorse also offers advanced reporting features, helping you gain insights into your agency’s performance. Partnering with Darkhorse means you can focus more on serving your clients rather than getting bogged down in administrative tasks.

Enhance Your Workflow with the Best Insurance Agency Software

Utilizing insurance agent tools is essential for success. The right software can improve your efficiency and client service. Use technology to grow and transform your agency. For a seamless experience, consider learning more about Darkhorse, an all-in-one system that simplifies your workflow and allows you to focus on what truly matters—building lasting client relationships.

Topics

Agencies