How Retirement Age and Social Security Claiming Age Are Related

Frequency of Retiring and Claiming Social Security at the Same Age

Source: EBRI 2024 RCS, Author’s Calculations

About 75% of people claim Social Security retirement benefits at their retirement age (among those retiring between the ages of 62 and 70), although the frequency is highest for younger retirees. For example, about 90% of individuals who retired at 62 claimed Social Security at 62, while about 40% of people who retired at 70 claimed at 70.

While only 50% of respondents who claimed benefits at 62 retired at that age, a significant portion of retirees claim Social Security benefits at 62 but retire earlier. For example, 92% of people who claimed Social Security benefits at 62 retired at or before 62. In other words, retirees who claim at 62 overwhelmingly retire at relatively younger ages.

The following chart includes additional information about the distribution of retirement ages and is provided for three claiming ages: 62, 66 (the approximate average full retirement age) and 70.

Retirement Ages for Certain Social Security Claiming Ages

Source: EBRI 2024 RCS, Author’s Calculations

Source: EBRI 2024 RCS, Author’s Calculations

Among those who claimed benefits at age 66, 53% reported retiring at age 66 (when considering retirement ages from 50 to 80 inclusive, although the chart includes only ages 55 to 70). In contrast, 31% of people who claim at 66 retired before 66, while 16% retired later. Claiming Social Security retirement benefits at 70 seems to be the least related to respondent retirement age.

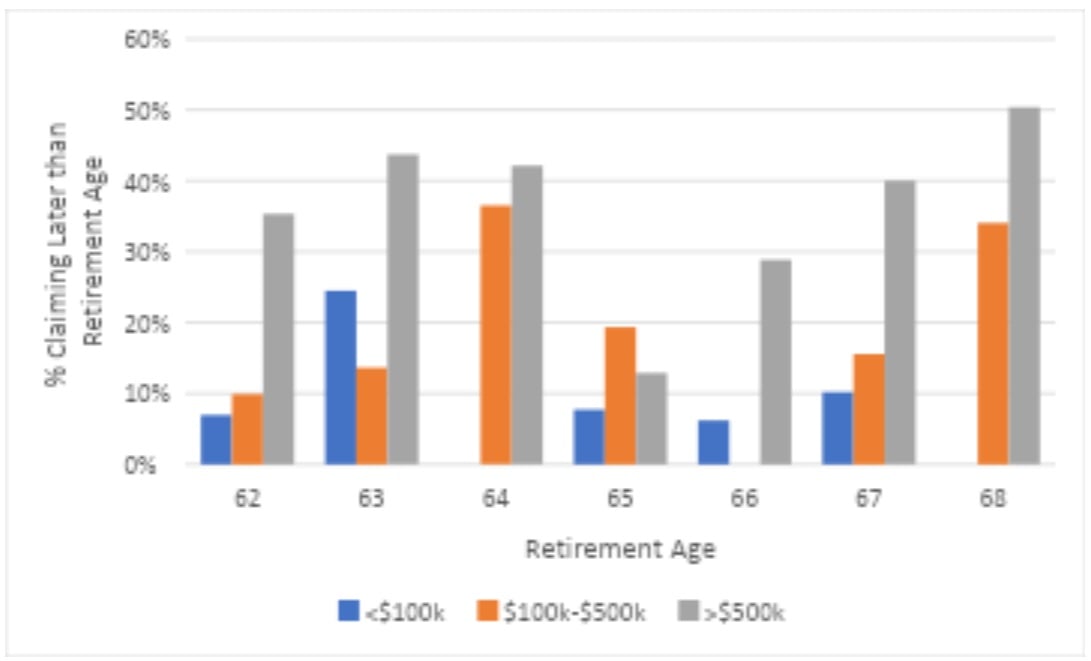

The decision to delay claiming benefits beyond retirement age is expected to relate to household financial assets. Therefore, the following chart explores the percentage of retirees who claim Social Security retirement benefits later than their retirement age for three levels of total household financial assets: those with less than $100,000, those with between $100,000 and $500,000, and those with $500,000 or more.

Retirees Who Claimed After Retirement Age by Total Financial Assets

Source: EBRI 2024 RCS, Author’s Calculations

Source: EBRI 2024 RCS, Author’s Calculations

While retirees with higher levels of financial assets are more likely to delay claiming Social Security benefits beyond their retirement age, the individual data is somewhat inconsistent. Only 8% of respondents with less than $100,000 in total financial assets claimed after their retirement age, compared to 18% for those with $100,000 to $500,000 in financial assets, and 36% of those with more than $500,000 in assets. This is consistent with expectations, whereby households with higher levels of financial assets are more likely to delay claiming since they have the means to decide when to claim benefits.

David Blanchett is managing director, portfolio manager and head of Retirement Research for PGIM DC Solutions, a global investment management business of Prudential Financial.