The Top Insurance Carriers in Canada | Brokers on Carriers

Jump to winners | Jump to methodology

Winning brokers’ trust

Canada’s top insurance carriers have strengthened their relationships with brokers by focusing on what matters most: competitive rates, exceptional service, and strong underwriting expertise.

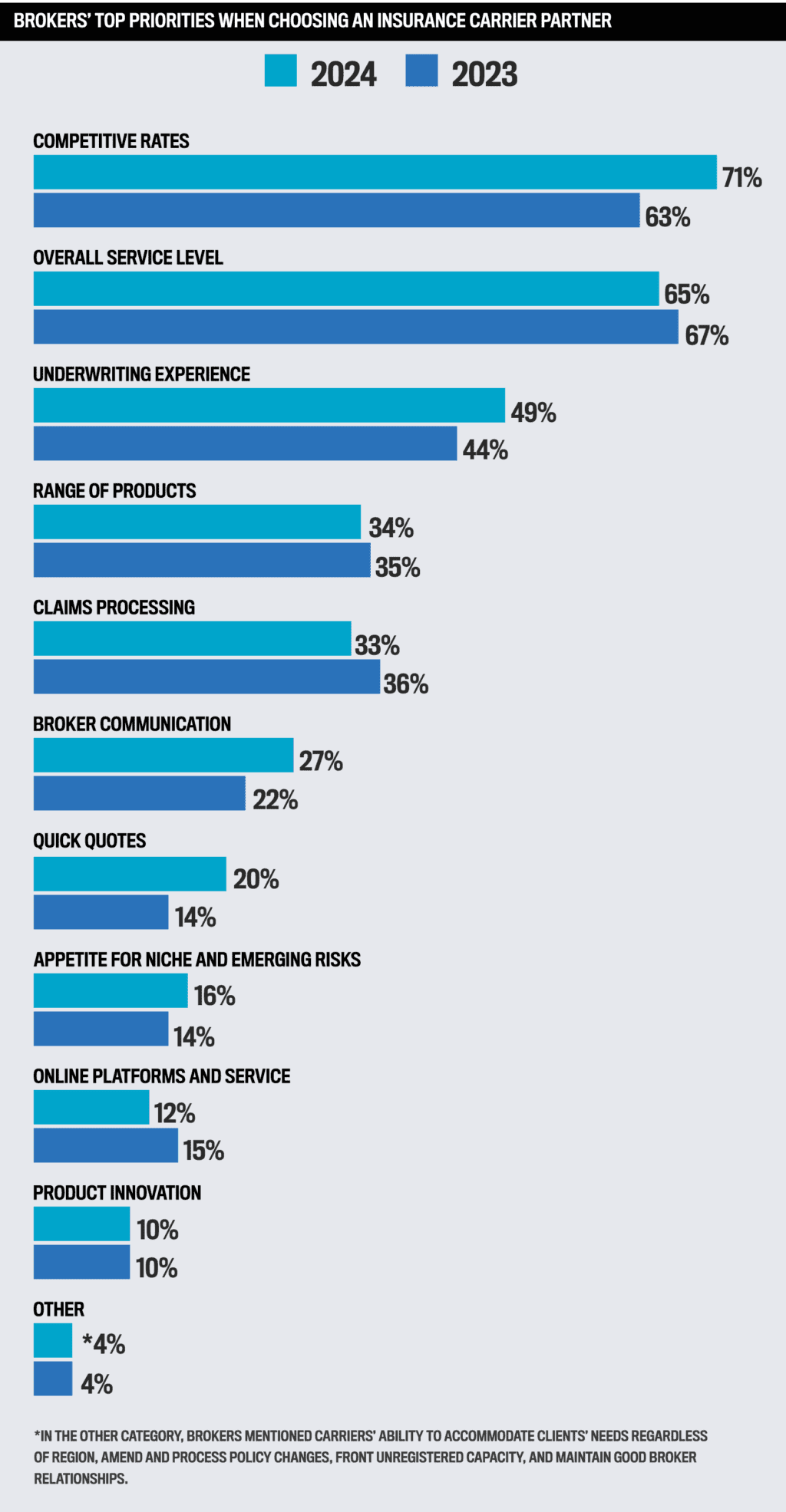

In Insurance Business Canada’s Brokers on Carriers 2024 survey, brokers across the country shared their priorities when choosing an insurance carrier partner. The results reveal a shift toward pricing, communication, and efficiency.

Among the key findings in 2024 vs. 2023 are the following:

71 percent ranked competitive rates as the most important factor, up from 63 percent.

49 percent emphasized underwriting expertise, compared to 44 percent.

65 percent prioritized service, down slightly from 67 percent, reflecting its continued top-quality status.

27 percent highlighted broker communication, up from 22 percent.

These broker priorities reflect similar industry-wide Canadian trends identified in KPMG’s Nine Key Trends Shaping the Future of Insurance 2024 report, which underscores the importance of the top insurance carriers’ adaptability, innovation, and service in a challenging market:

US$1 billion: the estimated protection gap in natural catastrophes, resulting from one of Canada’s worst years on record for climate-related disasters in 2023

2.1 percent: the forecasted annual growth in global insurance premiums for 2023 and 2024, following a 0.2 percent decline in 2022. Modest growth is expected as insurers navigate challenges such as inflation, political uncertainty, and emerging technology risks

40 percent: estimated potential increase in productivity and reduction in operational costs for the insurance sector driven by AI

71 percent: proportion of organizations planning to implement their first generative AI solution within the next two years

21 percent: expected boost in profitability for insurers leveraging AI technology

81 percent of financial executives believe embedded insurance will shift from a “nice-to-have” to a “must-have” in the industry, according to a 2023 survey conducted by IBC winning carrier Chubb Insurance

US$33.3 billion: projected value of the global cyber insurance market by 2027, up from US$11.9b in 2022

Recent Insurance Bureau of Canada research also highlights how the P&C insurance industry supports the country’s economy:

$38 billion: the industry’s contribution to Canada’s nominal GDP

297,000: estimated number of jobs created by the P&C insurance industry

60 percent: percentage of women employed in the industry in 2021, compared to the national average of 48 percent

$12 billion: annual amount P&C insurers contribute in federal and provincial taxes and levies

$39 billion: value of federal, provincial, municipal, public authority, and school bonds held by the P&C insurance industry in 2022, supporting Canada’s economy

For the ninth consecutive year, IBC recognized 5-Star Carriers that garnered an 80 percent or greater score from their broker partners in the past 12 months across time-tested metrics, including overall service level, product range and innovation, claims processing, appetite for niche and emerging risks, and quick quotes.

While broker respondents provided an in-depth view of their priorities and assessments of carriers’ performance, IBC also contacted several of its Top Insurance Brokers 2024 for their perspectives on what makes the best carriers stand out.

One of the leading brokers highlighted strong communication and accessibility as fundamental qualities of top-performing carriers, singling out 5-Star award winner Wawanesa Insurance for excelling in these areas.

“The best carriers I’ve worked with this year have distinguished themselves through a commitment to relationship-building by showing up in person, whether it’s for quoting or general support, and being readily available on the phone when needed,” says Michael Rocchetti, commercial insurance director at St. Andrews Insurance in Woodbridge, ON.

“These efforts over the past few years have been highly effective in strengthening their partnerships with brokers.”

Another IBC top broker, Karim Zein, vice president and account executive at HUB International in Ottawa, ON, who specializes in the construction, real estate, and hospitality industries, remarks that the best carriers are scheduling broker visits and being proactive with calls and meetings.

“There have been many instances when the carrier visits our office to say hello, and we end up collaborating on new or existing risks,” he says. “Carriers’ appetites are constantly changing, so one key element to standing out is updating their broker partners.”

And according to Jason Di Vincenzo of Bradford, ON-based Tupling Insurance Brokers, the leading insurance carriers stand out for their proactive approach to addressing claims management issues.

“We’ve been going through a difficult time over the last couple of years, with claim service levels dropping dramatically,” he says. “The top carriers have started their own body shops to reduce fraudulent and over-inflated auto claims.”

Di Vincenzo points out that the top carriers have also been judicious in assigning premium increases to specific high-theft vehicles, ensuring fairness between targeted and non-targeted vehicles.

Price sensitivity still dominates brokers’ challenges year after year

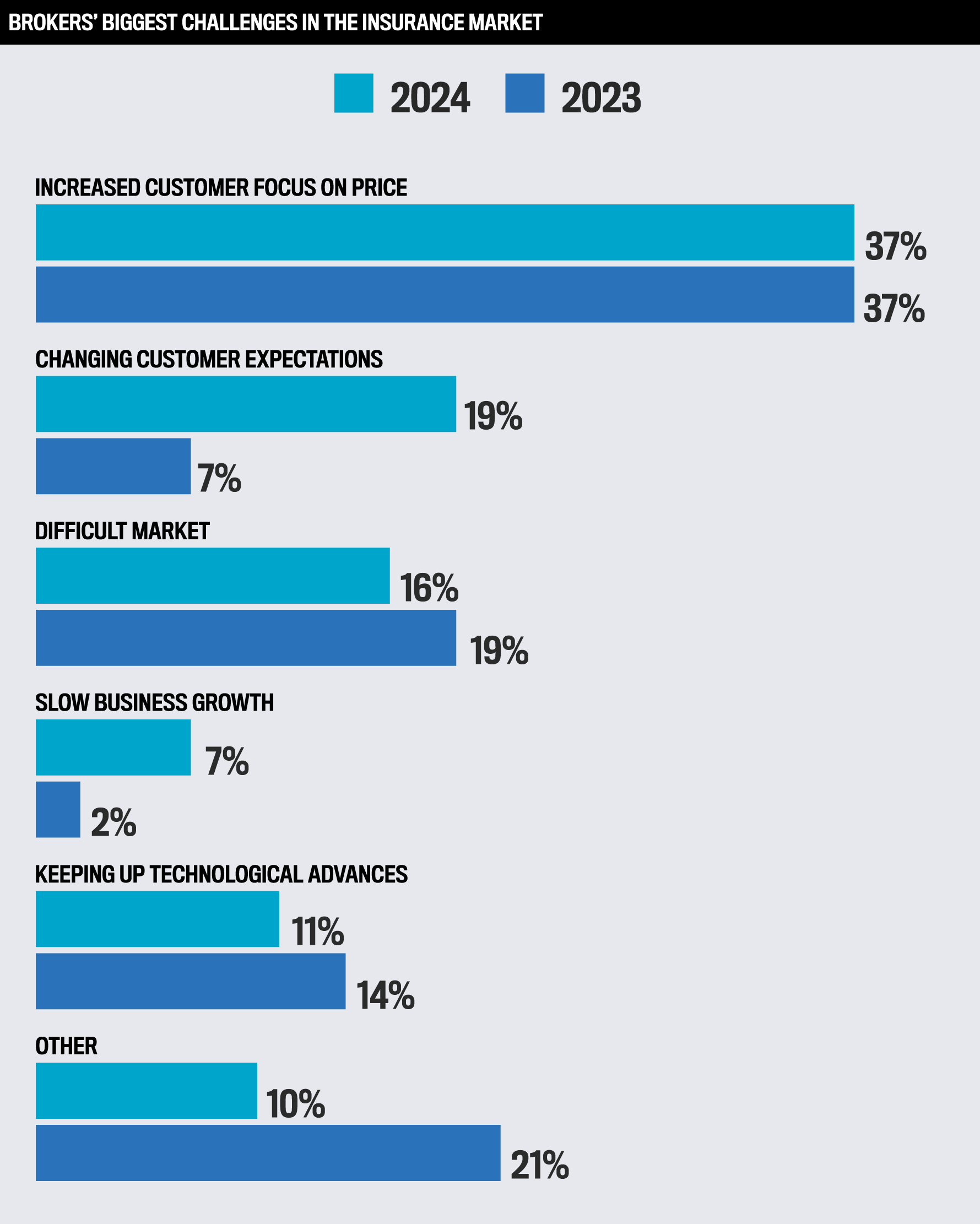

IBC’s 2024 data reveals a sharp 12 percent rise in broker concerns about changing customer expectations and a 5 percent increase in slow business growth as challenges.

Over one-third of brokers cited customers’ continued focus on pricing for the second year, a challenge that hits home for Tupling Insurance’s Di Vincenzo.

He says, “Inflation has made it difficult for people to pay premium increases. Our carriers have tried their best to combat rising costs with good risk management. We need to try to stay affordable in unaffordable times.”

Meanwhile, concerns about difficult markets and technological advances have eased slightly.

The category of “other” challenges has become less prominent this year. However, broker comments to IBC point to concerns about market volatility, process inefficiencies, and staffing, all arguably systemic issues that impact brokers’ business and client service:

“Insurers becoming too aggressive too quickly, resulting in a correction across critical and growing coverage sectors (cyber and property)”

“Making sure an e-app is done properly. Each carrier is different”

“Staff challenges”

“Slow turnaround time on quotes/communication”

St. Andrews Insurance’s Rocchetti feels one of his biggest challenges has been navigating price increases in the market, and the top insurance carriers have stepped up to assist.

“The ability to shop for competitive rates, negotiate pricing, and receive quick turnaround times from carriers has been essential in helping me address this issue and find the best solutions for my clients,” he says.

For HUB International’s Zein, capacity issues on hard-to-place risks were major issues in the hard market, along with high insurance costs.

He says, “The best carriers were able to become creative on certain risks and were also able to offer competitive pricing for best in class.”

Technology and easy-to-use systems continue to play a significant role in broker satisfaction.

Zein notes an outstanding online platform consists of the following: “User-friendly, efficient, and compatible with broker management systems.”

Rocchetti adds that a high-performing online platform should do the following:

prioritize detailed and precise questions during the quoting process

allow the selection of multiple operations for businesses with diverse needs

offer quick communication with underwriters or support staff when questions arise

“These features ensure brokers can work efficiently while providing the best possible service to their clients,” he says.

Top insurance carriers set new standards in claims processing

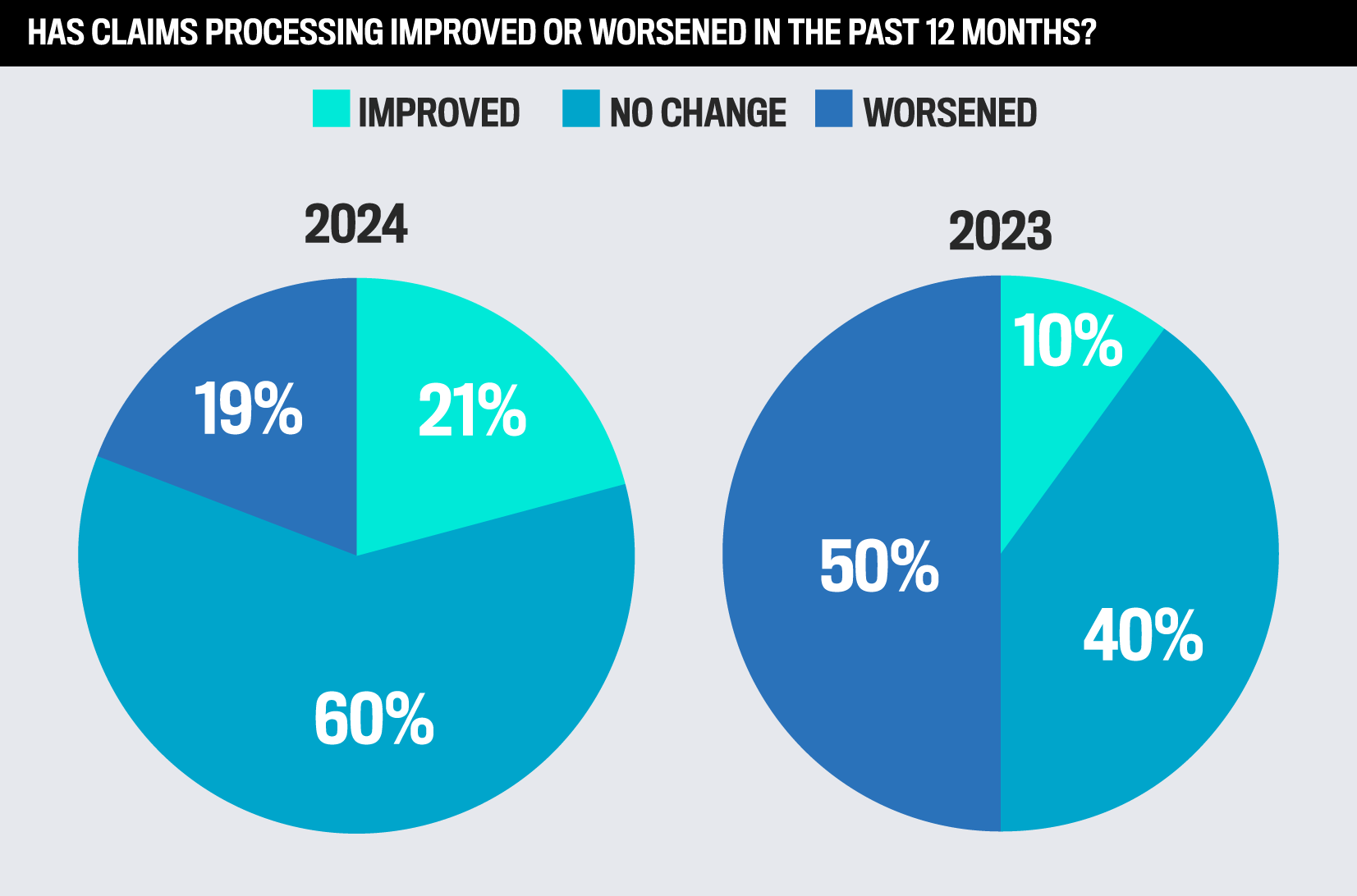

IBC’s data suggests a notable shift in brokers’ views on insurance carriers’ claims processing times between 2023 and 2024, reflecting:

improved broker confidence

stabilization and consistency

room for further improvement

The percentage of brokers who saw improvements in carriers’ claims processing more than doubled from 2023 to 2024, reflecting a 110 percent increase. This boost in positive feedback demonstrates the progress 5-Star carriers have made in claims management, which brokers note is key to earning and maintaining their trust.

Brokers reporting no change in claims processing also rose in 2024, suggesting that this crucial aspect has stabilized for most respondents.

Fewer brokers now believe claims processing times have worsened, indicating that leading insurers have addressed some past issues. While this upward trend is encouraging, nearly one-fifth of brokers see room for improvement.

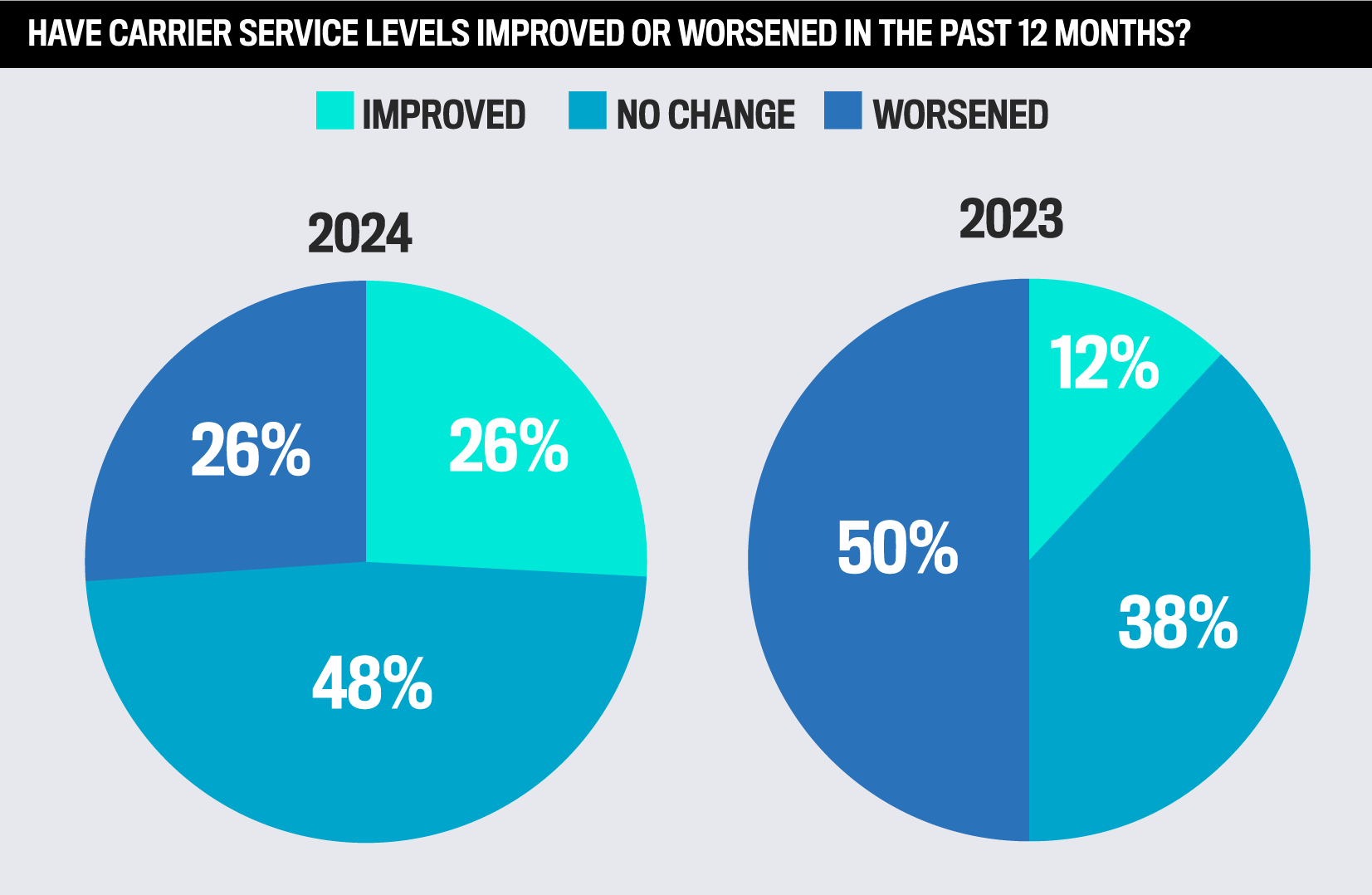

Service gains drive broker satisfaction with top carriers

The percentage of brokers who noted carriers’ improved service levels more than doubled this year, indicating the top insurance companies have strengthened their overall service levels compared to the year prior.

Brokers’ perceptions of worsening service also fell sharply, highlighting that fewer respondents are dissatisfied with their carriers’ performance. A greater proportion of brokers also feel service levels have stabilized, which could suggest consistency in carriers’ offerings and service delivery.

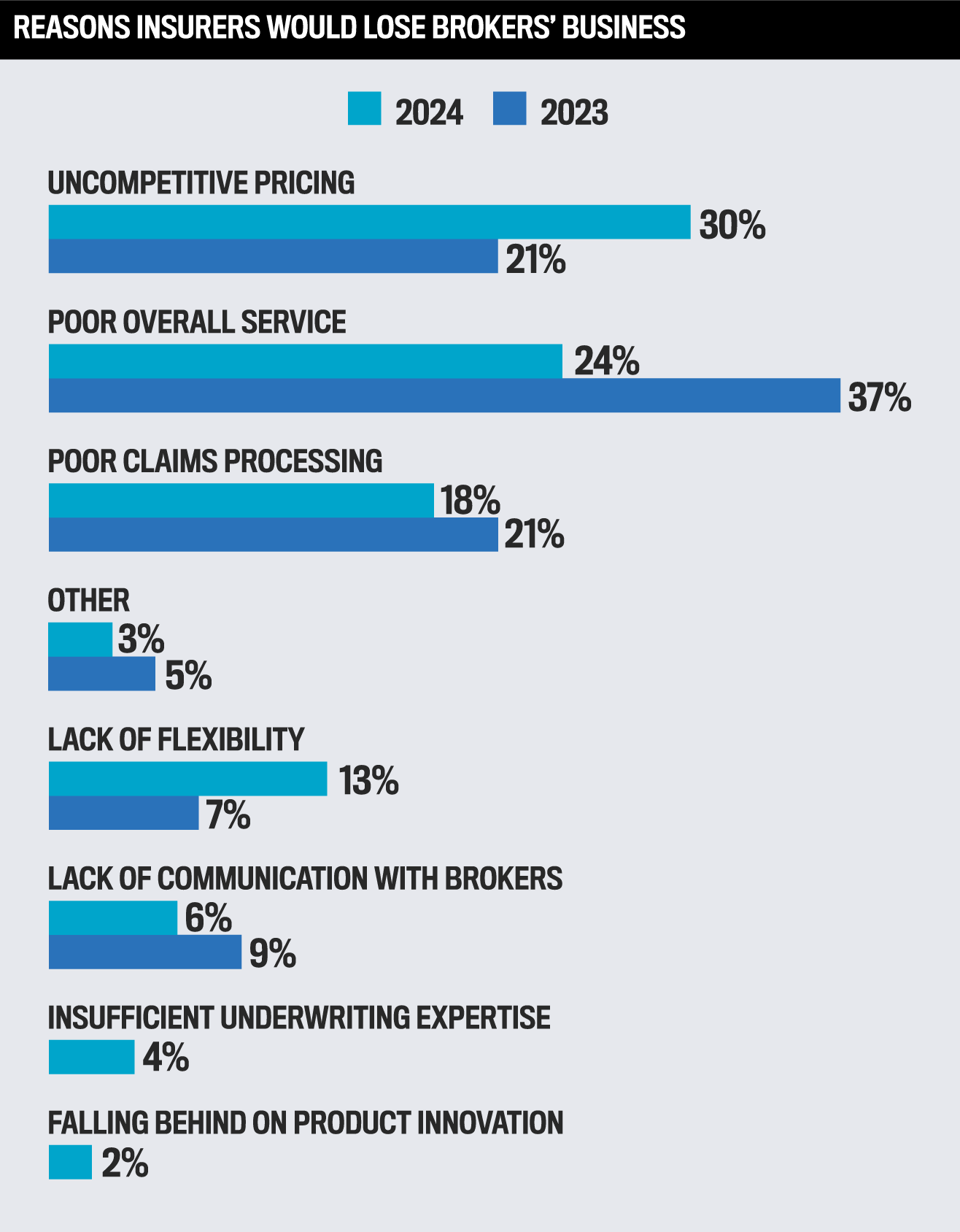

What drives brokers away?

It’s clear from IBC’s survey that the top insurance carriers have enhanced service and communication in 2024 compared to last year. Still, brokers are emphasizing competitive pricing and flexibility as reasons to jump to a competitor.

In fact, uncompetitive pricing was the top reason insurers might lose brokers’ business this year. Claims management remains a persistent issue for brokers, underscoring the need for continued focus. Overall, brokers reward top insurance carriers that balance competitive offerings with adaptability and exceptional service.

How the top insurance carriers can earn more broker business

Brokers continue to value competitive pricing, exemplary service, improved communication, and innovative products tailored to client needs.

Top broker Rocchetti mentions that the industry’s stability discount has been a standout product innovation.

“By offering clients lower rates for maintaining good credit, it not only provides incentives but also fosters loyalty among policyholders,” he says. “This has been an impactful addition to the marketplace.”

Broker respondents didn’t hesitate to share their frustrations and suggestions for how they’d like to see their primary insurance carrier improve across various areas, which follows the listing of the top-performing winners across the categories evaluated by brokers below.

Appetite for niche and emerging risks

Top 3 carriers:

1st place: Chubb

2nd place: Northbridge Insurance

3rd place: Intact Insurance

“Expand offerings for coverage to new/niche/more complex industry types”

“Tailor policies to clients’ needs; they tend to primarily sell their panel policies, which are not always tailored to specific clients’ needs”

“To have more flexibility in E&O for engineers”

Broker communication

Top 3 carriers:

1st place: Northbridge Insurance

2nd place: Wawanesa Insurance

3rd place: Economical Insurance

“Answer emails and pick up the phone”

“Better communication with brokers due to large staff turnover”

“Avoid duplication of effort: too many people are copied on communications; indicate the lead person handling the file in the initial correspondence”

Claims processing

Top 3 carriers:

1st place: Chubb

2nd place: Northbridge Insurance

3rd place: Wawanesa Insurance

“Hire and train better adjusters”

“Provide better claims service”

“We have to place more importance on claims – that is our product”

Competitive rates

Top 3 carriers:

1st place: Northbridge Insurance

2nd place: Chubb

3rd place: Wawanesa Insurance

Online platforms and services

Top 3 carriers:

1st place: Wawanesa Insurance

2nd place: Economical Insurance

3rd place: Intact Insurance

“E-app is glitchy, which is frustrating when it’s a really big client”

“Improve online platforms and systems”

“Underwriting updates could be better; the online system for apps is hard to follow”

Overall service level

Top 3 carriers:

1st place: Chubb

2nd place: Northbridge Insurance

3rd place: Wawanesa Insurance

“More training; I’m getting the wrong information and have to call several times. Slow processing”

“Regular communication of products; describe the niche products”

“Be clear on expectations and work with brokers better”

Product innovation

Top 3 carriers:

1st place: Chubb

2nd place: Intact Insurance, Aviva Canada, and Sun Life Canada (tie)

3rd place: Economical Insurance

Quick quotes

Top 3 carriers:

1st place: Wawanesa Insurance

2nd place: Northbridge Insurance

3rd place: Economical Insurance

“Hire more people, specifically underwriters. Everyone has their ups and downs, but this is chronic”

“Quicker underwriting decisions”

“Taking a long-term approach for various commercial lines and stop leaving some while overpricing others”

Range of products

Top 3 carriers:

1st place: Chubb

2nd place: Northbridge Insurance, Wawanesa Insurance, Intact Insurance, Economical Insurance, and Sun Life Canada (tie)

3rd place: Aviva Canada

Underwriting expertise

Top 3 carriers:

1st place: Chubb

2nd place: Wawanesa Insurance

3rd place: Economical Insurance

Winning broker loyalty one proactive step at a time

As evidenced by the decline in brokers planning to change carrier partners in 2024, IBC’s 5-Star winners have succeeded in delivering what brokers want most, fostering greater loyalty.

While more brokers this year say they are unlikely or very unlikely to look for new carrier partners, the high uncertainty levels in over a quarter of respondents indicate that to retain their broker networks, carriers must remain proactive in demonstrating value.

One example of how the top carriers go above and beyond for brokers and their clients is by promoting innovative products such as telematics, notes Tupling Insurance’s Di Vincenzo. This technology leverages the customer’s real-time data to offer tailored policies and premiums.

“Trying to explain to a client why their rates went up 20 percent or 30 percent isn’t always easy,” he says. “But carriers have assisted with this by rewarding drivers for good driving behaviour.”

Carriers’ use of technology in product innovation has positively impacted Di Vincenzo’s auto insurance clients in other ways. He notes digital services such as paying premiums online and downloading and storing liability slips in clients’ mobile wallets have made managing their insurance more convenient, especially in a world where most people rely on their smartphones.

Appetite for niche and emerging risks

Chubb

Economical Insurance

Northbridge Insurance

Broker communication

Economical Insurance

Northbridge Insurance

Wawanesa Insurance

Claims processing

Chubb

Economical Insurance

Northbridge Insurance

Wawanesa Insurance

Competitive rates

Chubb

Economical Insurance

Northbridge Insurance

Online platforms and services

Overall service level

Chubb

Economical Insurance

Intact Insurance

Northbridge Insurance

Wawanesa Insurance

Product innovation

Aviva Canada

Chubb

Intact Insurance

Sun Life Canada

Quick quotes

Economical Insurance

Northbridge Insurance

Wawanesa Insurance

Range of products

Chubb

Economical Insurance

Intact Insurance

Northbridge Insurance

Sun Life Canada

Wawanesa Insurance

Underwriting expertise

Chubb

Economical Insurance

Intact Insurance

Northbridge Insurance

Wawanesa Insurance