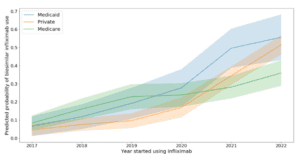

UCITS cat bond fund returns average 12.57% after November 2024

Catastrophe bond funds in the UCITS format tracked by the Plenum CAT Bond UCITS Fund Indices averaged a 1% return for November, taking their year-to-date return to an average of 12.57%.

It’s indicative of the continued strong returns being enjoyed by catastrophe bond investors in 2024, with this already set to be the second-best return for this Index since its inception.

In fact, the 12.57% return for 2024 up to and including November 29th, is now double the average return achieved by UCITS cat bond funds in 2013, the next best year of performance.

The rolling 30-day return will be higher than the 1% average return for the 29 days of November. Looking back to the nearest Index pricing date before that of October 25th, the average return of UCITS catastrophe bond funds for that just over one month period was actually a very impressive 1.63%.

With one month still to go until the full-year figures are available for the Plenum CAT Bond UCITS Fund Indices, the total for 2024 may see an average UCITS cat bond fund performance of approaching 13.5%, it now seems.

The rolling twelve-month return, on average, for this UCITS cat bond fund index has now reached 13.25%.

Lower-risk cat bond funds tracked by the Index are now averaging 12.31% year-to-date and 12.90% for the last 12-months.

For the higher-risk group of cat bond funds this Index tracks, the YTD average has reached 12.73% and the 12-month rolling return is sitting at 13.49%.

As we reported earlier, the catastrophe bond market yield dipped to 10.31% at the end of November, on seasonality and due to tightening.

With the hurricane season now over, it is expected the yield widens again, reflecting the attractive opportunities available in catastrophe bond investments at this time.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using our new chart.