Catastrophe bond market set for record issuance in 2024, if pipeline completes

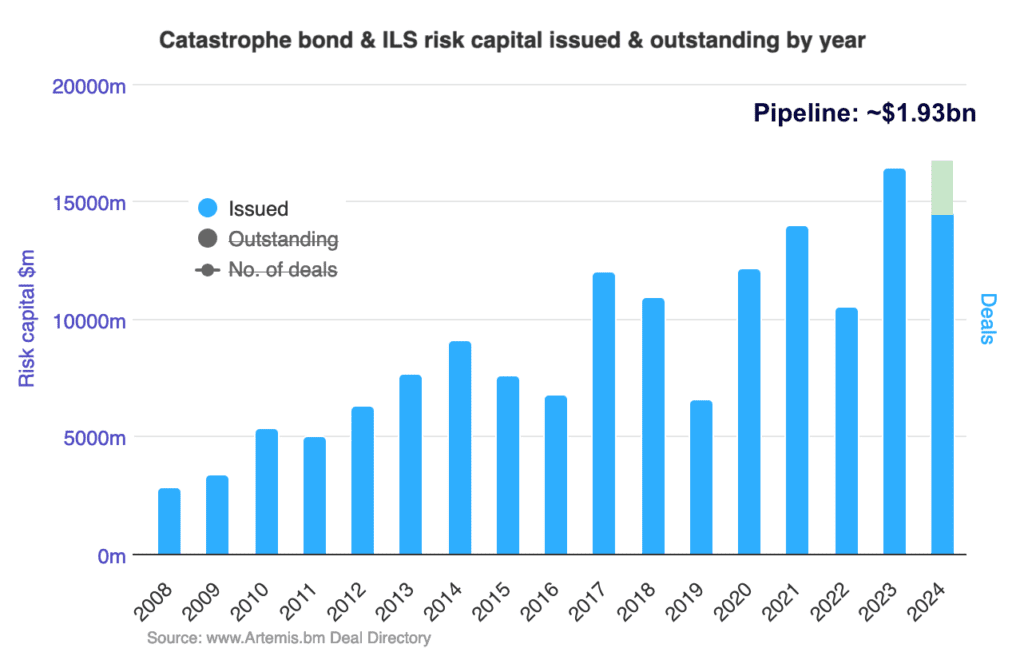

It’s official. If the current pipeline of new deals all complete before year-end, at their current targeted sizes or larger, then the catastrophe bond market will set a new record for primary issuance in 2024 of roughly $16.54 billion, according to Artemis’ Deal Directory data.

With three new catastrophe bond issuances having launched to investors in recent days, the pipeline of cat bonds currently scheduled to complete and settle this year has built-up to approximately $1.93 billion, Artemis’ Deal Directory shows.

With settled catastrophe bond issuance already at just over $14.6 billion, across 144A property cat bonds, 144A deals covering specialty and other lines of risk, plus private cat bond issues we’ve tracked, the market is now on course to beat the previous record set a year ago.

2023 saw a record almost $16.45 billion of new cat bonds issued across these three categories, which beat the previous record from 2021 when almost $14 billion of new cat bond deals came to market.

Now, adding the roughly $1.93 billion current pipeline of cat bonds scheduled to complete before year-end to the current total of $14.6 billion, would take the market to a new annual issuance record of almost $16.54 billion for full-year 2024.

The chart above shows where issuance will end the year if every catastrophe bond in the pipeline completed and settled at its current targeted size, for a total of $16.54 billion of risk capital to be issued in 2024.

Of course, this figure could change, either by growing larger as some of the cat bonds in the pipeline get upsized (which is entirely possible).

Also possible though, is that some perhaps don’t achieve their targets, or some could potentially be delayed and fall into the next year for settlement.

However, with roughly five weeks of the year left to run, there is still time for more new cat bonds to join the market pipeline and take the full-year catastrophe bond issuance for 2024 to an even more impressive record.

Looking at the categories of catastrophe bonds we track at Artemis in our main interactive chart on issuance and the size of the outstanding cat bond market, so 144A property cat bonds, 144A deals covering specialty and other lines of risk, plus private cat bond issues we’ve tracked, there is another notable catastrophe bond market record that now looks set to be achieved.

144A property catastrophe bond issuance will reach a new annual record high of just over $15.44 billion for 2024, if the pipeline completes at the currently targeted sizes this year.

You can analyse catastrophe bond issuance by year, as it currently stands, split out by these three categories in another of our interactive charts here.

Issuance of 144A catastrophe bonds covering other lines of business, such as specialty and cyber, will reach $675 million if the pipeline completes as planned, which is currently down on the prior year’s $832 million, but aligned with the 10-year average for this category of deals.

So far in 2024, including the pipeline, we’ve tracked 91 catastrophe bond issues, which is close to the record of 95 deals tracked last year.

In 2024 so far, we’ve tracked debut catastrophe bonds from 12 new first-time sponsors that have entered the market, which is slightly lower than the 13 first-time cat bond sponsors that came to market in 2023.

Finally, if the pipeline completes as currently planned, then the outstanding catastrophe bond market, by Artemis’ reckoning, would reach $48.32 billion, representing cat bond market growth of roughly $3.36 billion over the course of 2024.

2024 looks set to be another banner year for the catastrophe bond issuance market and despite a heavy maturity schedule, the investor community has responded to sponsors demand for reinsurance and retrocession, to close on a very impressive new record volume of cat bond deals.

The catastrophe bond maturity schedule (view our chart tracking this here) is particularly heavy in the first-half of 2025, with over $10 billion slated to mature in the first-half of next year.

Which means the cat bond market may struggle to achieve further growth through the first-half of 2025. But the maturity schedule is much lower for H2 next year, so it seems there is every chance of further catastrophe bond market growth across the full-year ahead.

So, it now looks likely we will see a second consecutive record year of catastrophe bond market issuance in 2024, which drives home the health of the cat bond market and the still-growing demand for capital markets coverage from sponsors.

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.

All of our catastrophe bond market charts and visualisations are up-to-date and include data on new cat bond transactions as they settle.