The Best Insurance Brokers in Canada

Jump to winners | Jump to methodology

Service-driven client advocates

The best insurance brokers have the skills to make themselves irreplaceable to their clients. This finding came to light in Insurance Business Canada’s 2024 data, which shows that nearly all clients surveyed rely on their brokers’ expertise to guide them through the complex insurance world.

Clients value their broker’s know-how and advice when choosing an insurance company. An impressive 95 percent of respondents said they rely entirely on their broker or work closely with them to make coverage option decisions. These results demonstrate top insurance brokers’ importance as trusted advisors, helping clients make informed choices suited to their unique needs.

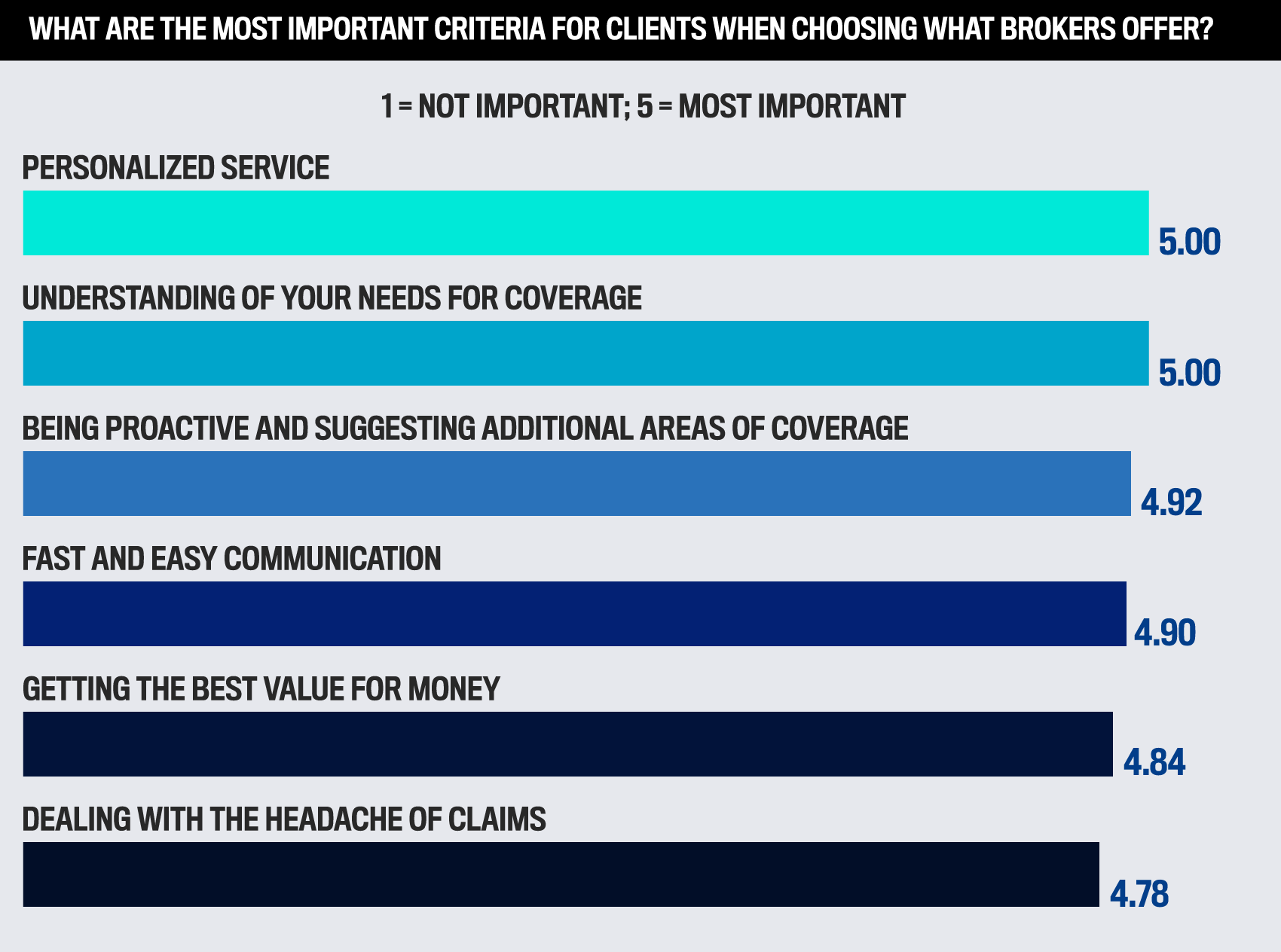

Respondents also emphasize the importance of personalized service and a broker’s keen understanding of their coverage needs, showing how top brokers go above and beyond with their proactive approach to service to ensure clients are adequately protected against all eventualities.

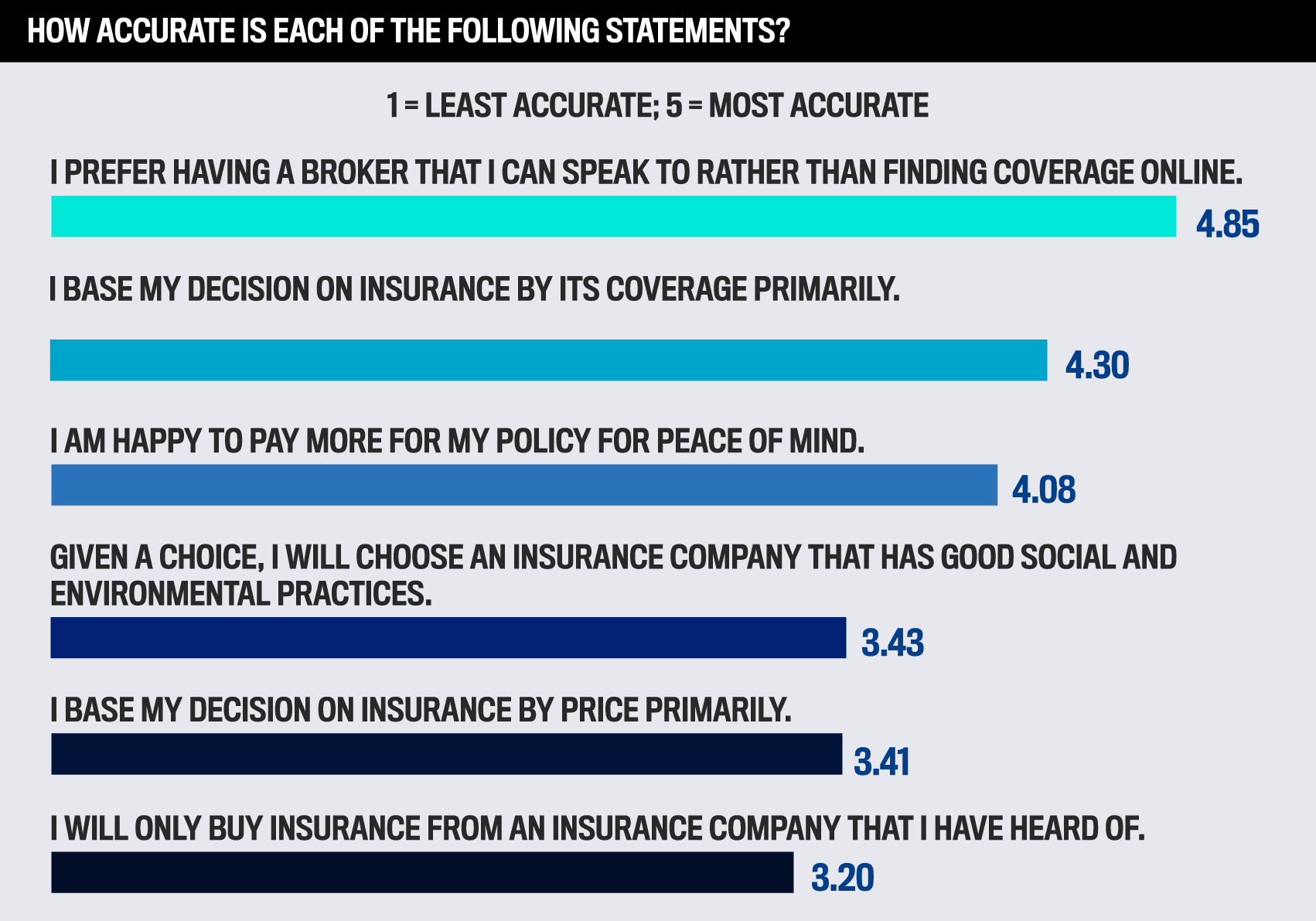

IBC’s data further suggests that clients overwhelmingly prefer working with a broker over finding coverage online, valuing human interaction and expert guidance. While coverage is a major factor in decision-making, many clients said they would pay more for their policy for peace of mind.

This is underlined by Nancy Fullarton, territory manager at Huestis Insurance Group.

She says, “Providing superior client service continues to equate to being able to respond efficiently and clearly to the needs of clients. As such, the most important skill we witness by every top-performing broker is an above-average communication ability.

“Having the ability to quickly adapt to clients and their preferred method of interaction is key to long-term success.”

That view is shared by Impact Recruitment director, insurance, Stefan Rolfe, who says, “The most essential quality a broker must have is trustworthiness; without it, everything else is irrelevant.”

He also emphasizes that a well-connected broker who is actively involved in the local community and clubs can usually have an advantage over others. This is because they understand that, much like recruitment, success as an insurance broker is driven by personal connections.

Respondents in IBC’s survey care less about social and environmental practices, price, and brand recognition; what matters to them is having good coverage and talking to their broker in person. This emphasizes brokers’ importance in providing personalized, trustworthy advice and building strong client relationships.

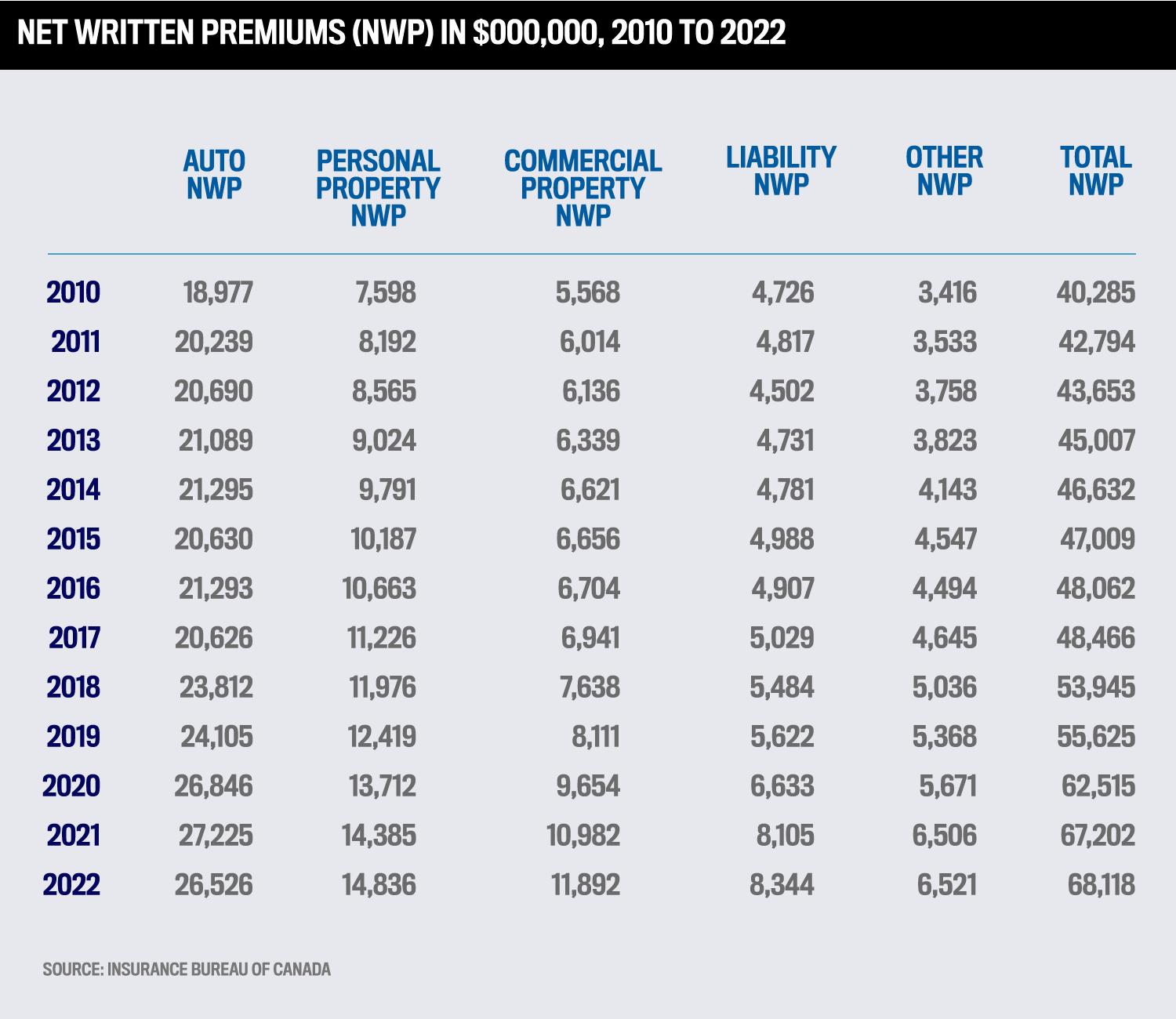

The top-performing brokers have the opportunity to win more business as net written premiums (NWP) has risen nationally in all categories. The total NWP in 2022 showed growth of 56 percent compared to the total 10 years previous.

In its second annual search for the Top Insurance Brokers who act in their clients’ interests, IBC conducted a rigorous marketing and survey process, leveraging its connections to thousands of readers nationwide, who were asked to nominate their brokers and rate them on six key criteria, including personalized service and understanding of coverage needs.

The most voted-for brokers that received an average score of eight or higher were named Top Insurance Brokers, recognized for their exceptional client service and not on revenue.

IBC proudly spotlights 23 remarkable insurance brokers for their passion, dedication, and commitment. Three of the best share a peek behind their service philosophy.

Why clients chose the best insurance brokers

Treating clients like a cherished friend forms the foundation of delivering exceptional service for this top insurance broker. That mindset, backed by his dedicated account executive, Francesca Petrusa, and brokerage staff, has resulted in some clients inviting Di Vincenzo to their family functions, such as weddings and baptisms.

“We really drive that and focus a significant amount of our time on customer service,” he says. “We don’t overpromise, and we still go out to clients’ homes to break down everything bit by bit and build a personal rapport.”

Di Vincenzo emphasizes communication and transparency, ensuring clients receive wraparound support from the initial contact to a claim by:

patiently assisting clients through the decision-making process, providing reassurance and support

advocating during the claims process to ensure fair treatment and prompt resolutions

negotiating with carriers to get the best rates and terms

“I strive to build personal relationships with my clients, helping when something does happen, and I go right to the end with them, making sure I see that smile on their face”

Jason Di VincenzoTupling Insurance Brokers

He received glowing client comments for delivering top-tier service:

“Service is exceptional. Jason always responds quickly and gives advice suited to my specific needs and circumstances. Personalized, human interaction is key with insurance.”

“Jason has shown exceptional service. When I got quotes, he went above and beyond the scope of being a broker. He explained coverages that I had that I didn’t even know about. He came over and spent a lot of time reviewing each coverage for my home and auto insurance. He truly exceeded my expectations.”

“I try to be the same broker that I would want my broker to be,” Di Vincenzo says.

Di Vincenzo has further proven his value to clients by taking extraordinary measures to help them in times of need, which has driven substantial referrals. He has attended several car accident scenes when clients have called in a panic.

On one such occasion at 10 p.m., he travelled 40 minutes from home to assist a client involved in a collision. After reassuring the client, who wasn’t physically injured, Di Vincenzo arranged for the tow truck to take the vehicle to a body shop, acted as a liaison between his client, the police, and the other driver, and promptly set up a rental car.

“When I get a call like that, I tell them I’m on my way,” he says. “They’re scared and confused; maybe it’s their first claim. I tell them not to worry. That’s what I want as a client, so why wouldn’t I project that onto my clients?”

The top broker also ensures that he carves out education time and stays updated on the fast-moving changes hitting the industry. He attends seminars and industry events, reads carrier and partner bulletins, and ensures he’s aware of the latest developments in better protecting clients from such things as water damage.

Di Vincenzo says, “Going out there and talking to peers is a great way to understand what’s happening, what the challenges are, and trying to figure out solutions.”

Ensuring client satisfaction by going above and beyond has driven the vice president and account executive onto IBC’s best insurance brokers in Canada list.

Zein prioritizes building and maintaining client relationships by being accessible after hours and on weekends. He makes it a purpose to visit clients in person often to establish a personal connection beyond their insurance needs.

“The relationships are one of my favorite parts of this business. There are so many great people out there with different stories,” he says. “For me, it’s about finding alternate ways to help them outside of insurance; my ear is always to the ground. If I come across any useful information that my clients can benefit from, I will reach out to them to relay the message.”

Survey respondents highlighted the superior quality of his service:

“Karim is fantastic. He is proactive, responsive, extremely knowledgeable, and comprehensive, regardless of whether he is insuring me for a large builders’ risk policy or a simple auto insurance policy.”

“He takes care of my needs from A to Z. As a service business owner and multi-unit residential developer, Karim has always been phenomenal at being on the ball regarding quotes, renewals, and claims.”

Adding that value to his mainly real estate and construction clients is one reason why Zein is an indispensable and trusted advisor.

He has honed various strategies and approaches to make clients feel appreciated and well cared for, including:

education first and foremost, simplifying complex insurance language for better understanding and decision-making

forward-thinking mindset to ensure clients are adequately covered in years to come

honesty and transparency in actions and advice

“I’m a sucker for a good story. When I meet new clients, my first objective is to hear their journey. I’ve always had an entrepreneurial spirit; listening to their challenges and successes motivates my growth”

Karim ZeinHUB International

“When your client base is continuously growing, at times, it can be challenging to maintain a certain level of service,” says Zein. “I have this motto for myself and my team: Act like you’re going to lose the client. This has pushed our personal bar to be better.”

Reflecting on how he goes that extra mile, Zein notes out-of-the-box thinking drives positive outcomes in challenging situations. In his specialization area working with developers, for example, deadlines are a constant battle. He tackles this by establishing a rapport with business partners who can turn things around quickly for him, and offer a great, comprehensive product.

“Building your professional network with insurance carriers, underwriters, and having that bond in a relationship where they trust you is important,” he adds.

To stay ahead of emerging trends, Zein emphasizes open communication with insurance carriers about current changes and their future forecasts. His insatiable curiosity finds him educating himself by speaking to various professionals within and outside of insurance.

He says, “It’s about being there and talking to people. Information is power.”

The director of commercial insurance and producer has come full circle after starting as a customer service representative.

He treats his employees and clients with high-level care and attention, as he does when managing day-to-day operations.

“Especially on the insurance side, I put myself in the customer’s shoes,” says Rocchetti. “When there’s an issue or price increase, I am proactive and call the client ahead of time so there are no surprises. People appreciate that.”

In IBC’s survey, his clients attested to his unmatched service excellence:

“Michael goes beyond my needs to meet all my questions. He is patient and always takes the time to explain small details.”

“Strong customer service skills and straightforward; responds to emails in a timely fashion.”

Differentiating Rocchetti’s service approach is his responsiveness, which clients frequently note as exceptional.

“It’s not rocket science; it’s about picking up the phone and making sure you’re there for clients, which has driven my success and that of the business,” he says. “That’s where the value is, and I think that gives us an edge in this competitive business.”

While acknowledging that his job is relatively simple when things are going well, Rocchetti prides himself on buckling down and delivering for his clients when they need him the most.

The top insurance broker ensures clients are supported throughout the process by:

proactive and consistent communication

personal interaction with current and potential clients, including assessing their current policy, recommending potential exposure areas, and offering professional advice

building long-term relationships based on trust

“It’s gratifying when you can help someone in a predicament. When there is a claim, you want to ensure the client is taken care of and is happy they had the right coverage”

Michael RocchettiSt. Andrews Insurance Brokers

An example of Rocchetti’s proactive and client-focused service philosophy involves a client’s legal dispute over a project-related issue.

Without hesitation, Rocchetti took immediate action to protect the client’s interests. He arranged for legal representation at the brokerage’s expense, giving the client support and peace of mind during a stressful time.

“They weren’t sleeping at night, and I can only imagine what they were going through. I would speak with them daily,” he adds.

As the voice of the brokerage in his director role, Rocchetti regularly communicates with carriers and other partners on the plethora of industry changes, from rates and appetites to claims and technology that helps to recover stolen vehicles.

“When something comes to me, I push it out to my staff and, where relevant, to our clients.”

Going forward, the challenge for IBC’s Top Insurance Brokers is to maintain the high standards they have set.

Fullarton points out that they need to be “flexible” and “adapt” as they enter the next chapters of their careers.

She says, “Leading brokerages will be tasked with identifying internal candidates that will have the ability to step into the roles that our retiring team members will leave. It will be this movement of bodies and resources that will directly impact client loyalty and overall agency retention.

“Experience, communication style, personalized skillset, work ethic, and a strong commitment to maintain a solid reputation in local communities will play an important part in this future movement.”

The leading brokers will carry their firms forward, but the importance of customer service will remain crucial.

“It is solely with the dedication and determination of our teams that we can continue our pattern of providing superior client service with the speed and efficiency clients have come to rely on,” Fullarton says.

Amanda Bourque

JB Elliot Insurance

Ben Beazer

Surex

Bobbee Wood

Atlas York Insurance (Johnston Insurance)

Carrie Bernardo

We Talk Insurance

Chris Sanderson

Maximus Rose Living Benefits

Frank Spidalieri

Insureit Group

John McMahon

Sentinel Risk Insurance Group

Karim Chandani

Wilson M. Beck Insurance Alberta

Kathy Dang

Surex

Lloyd Mitchell

LM Family Wealth

Morgan Roberts

RH Insurance

Nikki Keith

Wilson M. Beck Insurance Services

Olimpia Sklad

Mowen Insurance Brokers

Paige Murphy

Wilson M. Beck Insurance Alberta

Patricia Stevens

Experior Financial Group

Robert Lewis

Jones DesLauriers

Rose Freeman

Willow Insurance

Tiffany Baird

Kilgour Bell

Tony Fasulo

Maximus Rose Living Benefits

Insights

As part of our editorial process, Key Media’s researchers interviewed the subject matter experts below for their independent analysis of this report and its findings.

Insurance Business Canada conducted its second annual search for the Top Insurance Brokers to discover the best brokers who act in their clients’ interests. From a diverse cross-section of insurance professionals, the IBC team had the opportunity to spotlight remarkable examples of passion, dedication, and commitment.

From June 17 to August 2, the IBC team undertook a rigorous marketing and survey process, leveraging its connections to thousands of readers across the country. Readers were asked to nominate their brokers and rate them on six key criteria.

The most voted-for brokers that received an average score of 8 or higher were named Top Insurance Brokers who were recognized based not on revenue but rather the service provided to their clients.