Hurricanes Helene and Milton indicate better risk assessment needed

Enjoy complimentary access to top ideas and insights — selected by our editors.

The nation has witnessed the devastation caused by Hurricanes Helene and Milton, which brought widespread destruction to Florida and across the Southeastern U.S., affecting areas from Georgia to North Carolina.

The Washington Post, covered Helene and Milton and their aftermath in great detail. Many of these media reports included statements from community leaders and homeowners surprised by the impacts, particularly inland, in places like the Macon, Georgia region, and Asheville and Buncombe County, North Carolina.

Yet, the hurricane and flooding risks in these areas should not have been a surprise.

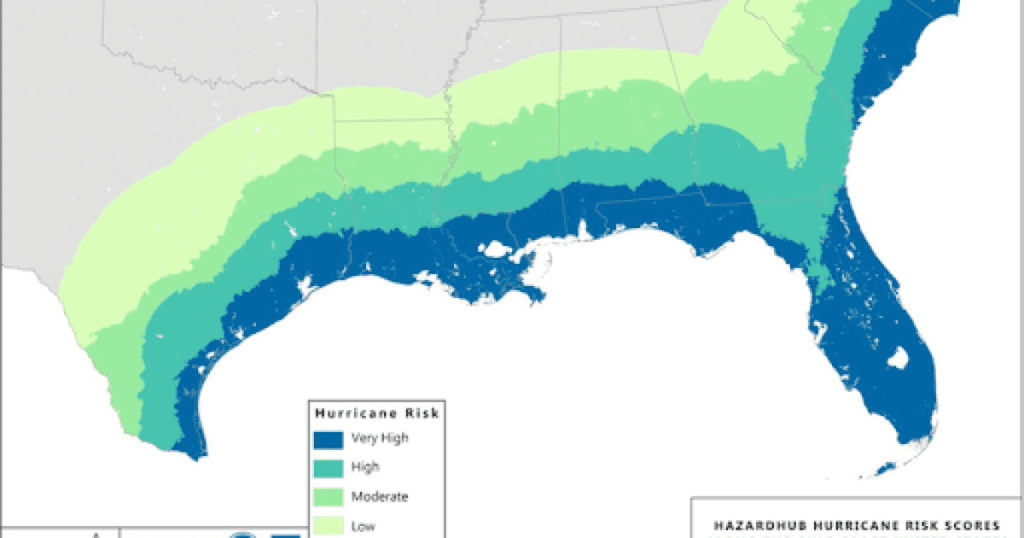

Next-generation data and risk models available today provide much more accurate and detailed assessments of risk than were historically available from FEMA flood maps and other sources. Just two weeks before Hurricane Helene formed, HazardHub had issued its latest risk scores and maps for the U.S., explicitly highlighting Florida’s Big Bend, Georgia, and the Carolinas—including inland areas in Southeastern states—as high risk for hurricane damage and catastrophic flooding.

HazardHub Hurricane Risk Map for the U.S. Gulf Coast.

The hurricane map shown above and storm surge maps accurately detailed the areas of high risk affected by Hurricane Helene, particularly the extended area along Florida’s Big Bend coast, where the storm made landfall.

What is less frequently discussed, however, is the impact of Probable Maximum Precipitation (PMP) in an area. Catastrophic rainfall risk models and maps were highly predictive of the risk of inland flooding from Helene’s heavy rainfall, highlighting regions like North Georgia, Asheville, North Carolina, and Tennessee. The PMP data showed how these areas, despite not being in traditional flood zones, were at significant risk from catastrophic rainfall and subsequent flooding. FEMA Flood zones do not consider PMP.

HazardHub Catastrophic Precipitation and Storm Surge Map for the Gulf Coast and Southeast U.S.

As this hurricane swept through these populated regions, it left behind a trail of devastation that should serve as a catalyst for the insurance industry and community leaders to raise greater awareness about the risks posed by extreme weather and natural catastrophes—particularly hurricanes, storm surges, and flooding.

This includes educating the public about their insurance coverage and options. A survey by the Insurance Information Institute found that only about 27% of U.S. homeowners had flood insurance. A significant portion of those without it mistakenly believed their standard homeowner’s insurance covered flooding or thought they didn’t need it because their area hadn’t flooded recently.

Many homeowners don’t realize they are uninsured or under-insured for storm surge and flooding, especially those outside FEMA-designated flood zones. They also may not be aware coverage is available to them. Improved risk maps can help property owners better understand their exposure and determine if a private flood policy would be beneficial.

Challenges with the NFIP and the need for better risk data

While the National Flood Insurance Program (NFIP) plays a crucial role in flood insurance, it has faced criticism for its shortcomings. These criticisms underscore the need for more accurate, data-driven risk assessments to supplement the information FEMA provides. For example, a property may be outside of NFIP coverage but within a high probable maximum precipitation region, and this information could alert a property owner to secure additional flood coverage.

A recent article by The Washington Post emphasized how underinsurance in flood-prone regions exacerbates financial losses for individuals and communities. The article highlights the policy gaps in current flood insurance offerings and underscores the need for improved disaster preparedness and more effective flood insurance strategies.

How better data, analytics, and risk models can help address flood risk

A more comprehensive, accurate, and up-to-date assessment of flood risks beyond the 100-year floodplain is critically needed. Here’s how next-generation data, analytics and risk models improve risk assessment and mitigation:

Accurate and updated risk mapping: Advanced data analytics and risk modeling techniques can create detailed and more frequently updated risk maps. Unlike the NFIP’s information, they offer a current assessment of flood risks within and outside traditional floodplain boundaries.

Expanded risk assessments: Advanced data analytics and risk modeling includes a broader range of water bodies, including smaller tributaries and streams often overlooked by the NFIP. Such granular analysis provides a more thorough risk evaluation, identifying properties at risk that might not be classified as flood-prone by traditional methods.

Enhanced risk scoring: By providing FEMA flood scores alongside storm surge potential, flooding, catastrophic flooding, and historical flood events, such risk models enable both the public and insurance industry to consider a broader range of risk data. This allows insurers to better understand and underwrite flood risks.

Proactive risk management: More detailed risk data allows property owners, insurers, and communities to understand risk levels and take proactive measures to mitigate flood risks. A data-driven approach aids in identifying areas needing better floodplain management, targeted mitigation efforts, or stricter building codes. Reducing the protection gap will help communities recover more quickly after an event.

Support for the private insurance market: More accurate and comprehensive risk data enables private insurers to assess and underwrite flood risks confidently. This supports the growth of the private flood insurance market, offering alternatives to NFIP policies and improving market competition. Private insurance can provide more tailored coverage options, higher coverage limits, and risk-based pricing, which can better meet the needs of homeowners and businesses.

As we witness the increasing severity of storms like Hurricanes Helene and Milton, it’s evident that greater awareness and proactive risk management are essential to safeguarding our communities and homes. Accurate, up-to-date data and risk assessments are no longer optional—they are critical tools for insurers and homeowners to prepare for inevitable disasters.

Advanced risk models and scores provide the insights needed to better understand these risks and guide meaningful steps toward protection and resilience. Now is the time to prioritize improved risk assessments and explore expanded coverage options.

This blog was originally posted on Guidewire. It is being republished with permission.