Cat bond market index bounces back, now only -0.30% since hurricane Milton

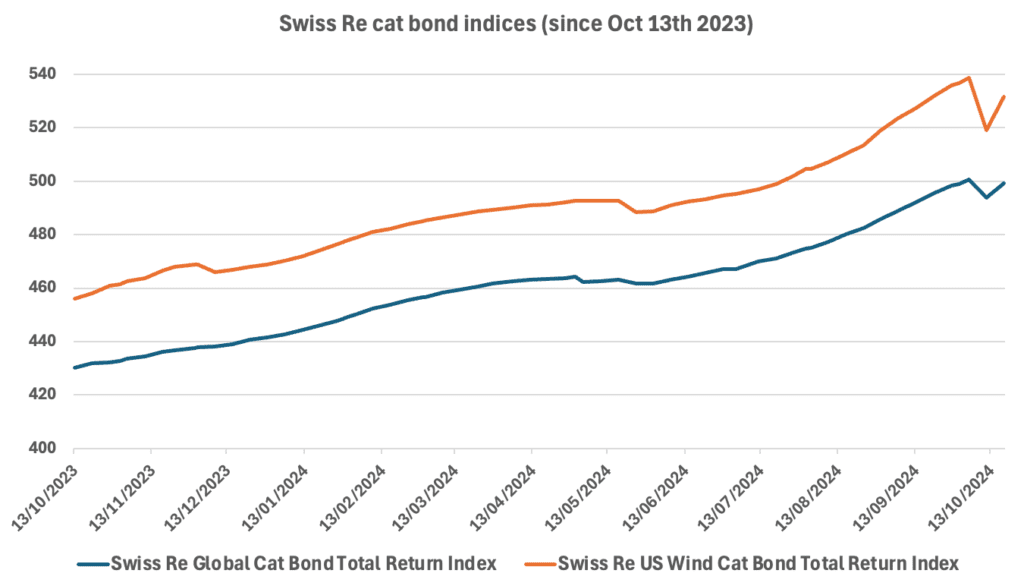

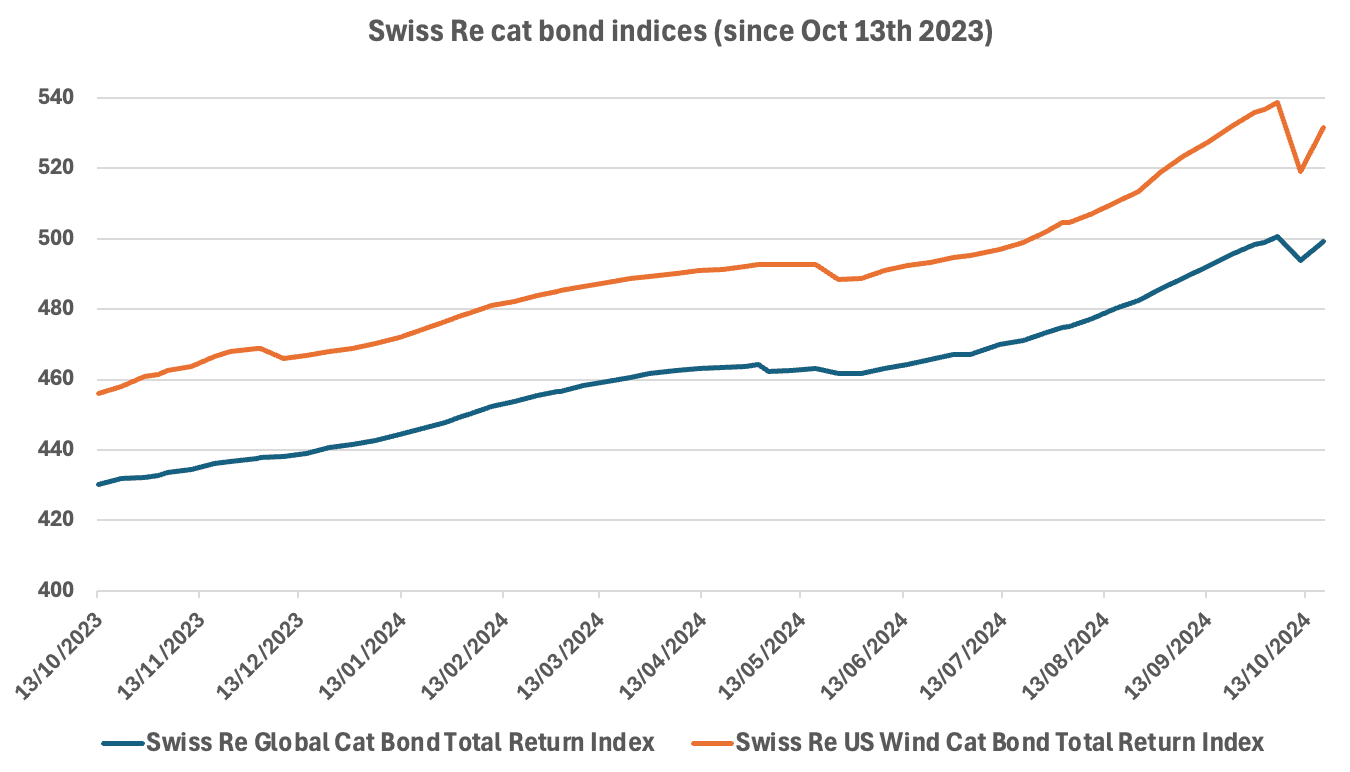

At Friday’s pricing, the catastrophe bond market index calculated by Swiss Re Capital Markets bounced back by more than one percent, leaving the benchmark for the entire cat bond market now only -0.30% down since hurricane Milton, while the US wind specific version of the cat bond index also recovered and is now -1.31% since the hurricane made landfall.

As we reported a week ago, when catastrophe bonds were priced for the first time after hurricane Milton’s landfall in Florida, the Swiss Re Global Cat Bond Total Return Index, that tracks the entire outstanding catastrophe bond market, fell 1.34%.

The Swiss Re US Wind Cat Bond Total Return Index, that is focused solely on US hurricane risks, fell by 3.64% at pricing on Friday October 11th.

Those declines were much less significant than the ones seen after hurricane Ian in 2022, when the Swiss Re Global Cat Bond Index dropped by a considerable 10%, while the Swiss Re US Wind Cat Bond Index plummeted by roughly 32%.

But, reflecting the fact market sentiment is that hurricane Milton will only drive relatively minor catastrophe bond market losses, both indices bounced back at their latest pricing on Friday October 18th, Artemis can report.

It’s important to note here that accumulated coupon over the last week is part of the increase seen in the Swiss Re cat bond indices in the last week.

But, the gains reported as of Friday 18th are more significant than coupons earned alone, so there has been some recovery of a proportion of the initial hurricane Milton decline as well.

On Friday 18th, the Swiss Re Global Cat Bond Total Return Index, that tracks the entire outstanding catastrophe bond market, rose 1.05%, while the Swiss Re US Wind Cat Bond Total Return Index, that is focused solely on US hurricane risks, rose by 2.42%.

Leaving the Global cat bond market index now down only 0.30% since Milton struck and the US Wind cat bond market index down 1.31%.

If we look at the performance of these cat bond market indices over the nearest month of pricing, the Swiss Re Global Cat Bond Total Return Index is now in positive territory again, up 0.73% since September 20th.

That shows the level of coupons being earned at this peak wind seasonality time of the year, with one month of cat bond market returns more than able to absorb the hurricane Milton decline.

The Swiss Re US Wind Cat Bond Total Return Index now sits just 0.07% down since September 20th, so again coupon returns have almost absorbed the entire hurricane Milton mark-to-market loss over the last month.

Looking at the Global index, it appears the latest pricing may have reduced the initial hurricane Milton mark-to-market hit of 1.34% by approximately 0.60% to 0.70%, based on an estimate that the last week would have seen another 0.30% to 0.40% of positive performance from seasonal returns as well and the fact this index is now left at just -0.30% since Milton.

Which (with some rough arithmetic) suggests that catastrophe bond market pricing impies a roughly 0.6% to 0.7% loss from hurricane Milton now, on a mark-t0-market basis. Which based on a market of roughly $46 billion in size, implies a market-wide cat bond loss below $320 million from the storm. This aligns with what we discussed on Friday, based on some early pricing we saw for some of the UCITS cat bond funds.

Finally, the Swiss Re Global Cat Bond Total Return Index is now up 15.61% year-to-date (since October 20th 2023), while the Swiss Re US Wind Cat Bond Total Return Index is up by 16.09%, continuing the market’s impressive performance even including the expected hit from Milton.

At the level of loss that market pricing is implying, hurricane Milton will not derail the catastrophe bond market trajectory and barely dents returns for cat bond investors.

Most catastrophe bond funds will absorb hurricane Milton losses within just a few weeks of performance at most, given the seasonality flowing to returns at this time of the year, it appears.

If there are no reversals to any of the adjustments made to valuations of catastrophe bonds exposed to hurricane Milton at next Friday’s pricing, the Global index will likely stand higher than it did pre-Milton, with the entire mark-to-market hit recovered in just a fortnight.

Which is impressive. But, as we discussed in an article on Friday, there remains uncertainty in the risk modeller estimates and time will tell where any additional degradation of prices for certain hurricane Milton exposed catastrophe bonds is required.

Read all of our hurricane Milton coverage.