Integrated Shield Plans undergo yet another round of “Adjustment” [What’s your best move as a consumer?]

![Integrated Shield Plans undergo yet another round of “Adjustment” [What’s your best move as a consumer?]](https://www.insurancenewsmag.com/wp-content/uploads/2022/01/1641739725_Integrated-Shield-Plans-undergo-yet-another-round-of-Adjustment-Whats.jpg)

Once again, there are rumblings of changes made to our MediShield Integrated Plan riders (IP riders).

And once again, the consumer might have very little say in the matter, due to a sneak announcement by our venerable friends at the Ministry of Health.

Here’s a 30-second summary:

Long long ago, Insurers used to sell Integrated Shield Plan (IP) riders that covered 100% of all hospital bills. Yes, that means that policyholders of those olden-day IP riders did not have to fork out a single cent for a legit hospital stay (non-cosmetic reasons!).

Then medical claims shot up, and most Insurers lost money on those plans. The Ministry of Health stepped in and gave “guidelines” to Insurers to only offer IP plan riders that had a small co-payment component (at least 5%), starting from 1st April 2019.

The old plans that encouraged reckless claims could no longer be sold, but existing policyholders could keep them.

The era of wanton medical consumption was over, in theory.

One pandemic later, MOH is now “welcoming the latest measures by private insurers to adjust the terms for those on existing Integrated Shield Plans (IP) with riders that cover hospital bills in full.”

In plain speak: Grand Daddy is letting the insurers change the older “full-payment” riders to the new ones that have a mandatory co-payment component.

Holy shit, what now

Well, this depends on what camp you belong to.

If you don’t have an IP plan upgrade as of yet:

You aren’t really affected. You can only buy the new age ones though, the ones with at least a 5% co-payment component

If you have an IP plan upgrade already, bought circa 1st April 2019:

You aren’t really affected since your IP Plan upgrade is already the one with 5% co-payment

If you have an IP Plan upgrade from long ago (the full payment rider ones), bought before 1st April 2019:

Things are about to get interesting for you.

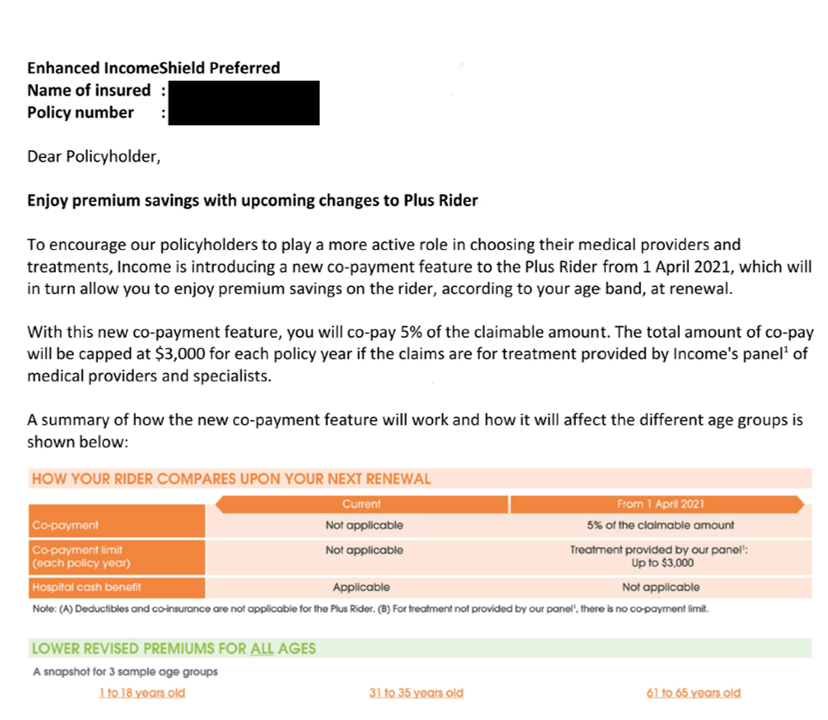

Some insurers like NTUC Income, have already announced conversions from the old IP riders to the new riders, and policyholders do NOT have a say in this. (the premiums are generally lowered though)

The other insurers have not played their hand yet, but it can be generally assumed some will follow in NTUC Income’s footsteps (Singaporean Insurers aren’t really ALL THAT Innovative), while some will maintain the old IP plans.

Alright, I belong to the 3rd Camp (With an ancient IP plan). What can I do?

Well you kinda have a choice. Kinda.

If your insurer does not force you to convert your existing plan into one with the co-pay feature, you can opt to keep your existing plan.

Or you can choose to convert it to the co-pay one that will cost less in premiums.

If your insurer forces you to convert your existing plan, then you got no choice but to go along with it, because there are no more full-pay riders left in the market. Of course, you can also opt to change your insurer out of pure anger, but that is another thing in itself.

Example of letter sent to NTUC Income Full Pay rider policyholders

That’s it?

Yes.

Unless thousands upon thousands of us descend upon Hong Lim Park to declare our utmost desire to insist that insurers uphold their full pay plans. Even so, there are surely clauses in the policy documents that allow the prices to be jacked up so high your eyes might water from reading the bill.

The joys of a law-abiding republic!

That being said, this isn’t really as bad as we’ve made it sound. After all, the cover story they are using this time is the sustainability of health care costs for all, and if you disagree, you might just be painted as that selfish bastard.

If you really want to seek some measure of justice for yourself, why not check our platform out?

We are replacing the role of the middleman (ie the insurance agent) and thus lowering insurance costs for everyone (you). Sign up for your free account today and check out how you can stand to gain $50 cash at the same time!

www.ClearlySurely.com is a refreshing new way to approach Life Insurance – with humour and fun, bound together by imagination.

Our Financial Discovery Platform provides hours of entertainment while providing an overall view of your insurance adequacy.

If you’re curious about how we can make a dry subject nearly as wholesome as Keanu Reeves, join our community today.

We have been eradicating the knowledge gap between consumers and Life Insurance since 2015, and have a vision that one day, every Man, Woman, and Child will be properly insured.