How Does Demolition Insurance Protect Your Projects?

You might not realise that demolition insurance goes beyond just covering physical damage; it also addresses legal and regulatory compliance. This type of insurance safeguards your projects from unexpected liabilities, such as third-party injuries and hazardous material handling. With extensive coverage, you can manage unforeseen disruptions without compromising financial stability. Wondering how this insurance guarantees smooth project continuity and boosts stakeholder confidence? Let’s explore its key components and benefits.

Key Takeaways

– Provides liability coverage for third-party injuries and property damage during demolition activities.

– Covers costs for accidental damage to nearby properties, ensuring financial stability.

– Includes environmental liability coverage for hazardous material cleanup, reducing legal risks.

– Offers worker’s compensation for on-site injuries, protecting against employee-related financial liabilities.

– Ensures compliance with local regulations, preventing legal penalties and project delays.

Understanding Demolition Insurance

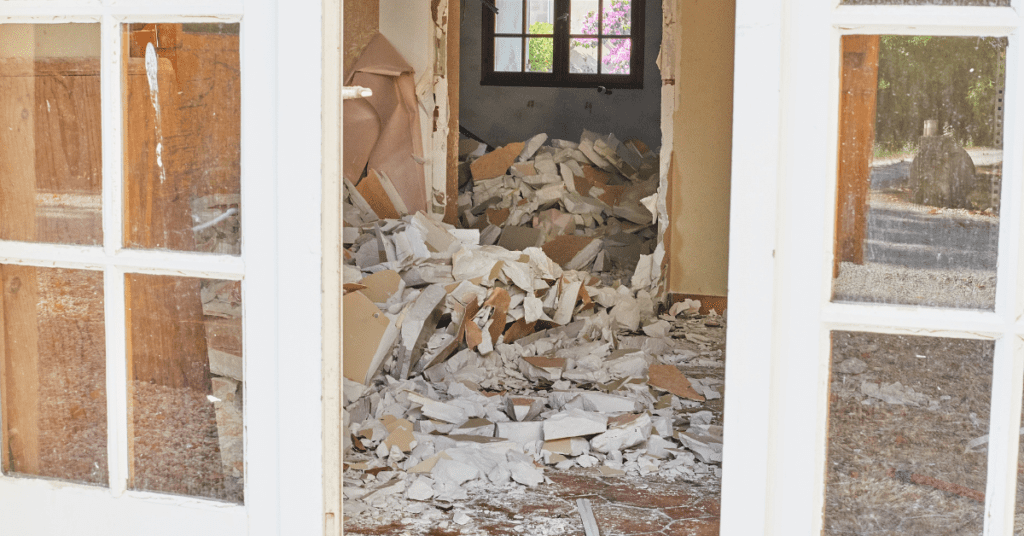

Understanding demolition insurance is essential for anyone involved in the construction or real estate industries. You need to recognize its critical role in safeguarding your financial interests during the demolition process. As you know, demolishing a structure involves many risks, from unintended structural damage to environmental hazards. Proper project planning includes having the right insurance coverage to mitigate these risks.

When you initiate a demolition project, unforeseen complications can arise, such as accidental damage to adjacent properties or injuries to workers. Without demolition insurance, these incidents could lead to substantial financial losses. By incorporating this insurance into your project planning, you guarantee that you’re protected against potential liabilities.

Additionally, demolition insurance supports your compliance with local regulations and contractual obligations. Many jurisdictions and contracts mandate specific insurance requirements for demolition projects. Failing to adhere to these can result in legal penalties and delays.

Incorporating demolition insurance into your project planning isn’t just a precaution—it’s a strategic move. It demonstrates your commitment to managing risks effectively, guaranteeing smooth project execution, and protecting your financial interests.

This foresight can help you avoid costly setbacks and maintain a strong reputation in your industry.

Key Coverage Components

Key coverage components of demolition insurance are vital for guaranteeing thorough protection throughout your demolition project.

First, you should focus on liability coverage. It’s essential to conduct a detailed risk assessment to identify potential hazards and liabilities. This includes third-party injuries, damages to nearby properties, and public liability. Having robust liability coverage mitigates financial losses and legal issues.

Next, consider coverage for equipment and machinery. Demolition projects rely heavily on specialised tools, and any loss or damage could halt progress. Confirm your policy includes protection for these assets.

Additionally, worker’s compensation is a must. Demolition is inherently risky, and accidents can occur despite stringent safety protocols. A good policy should cover medical expenses and lost wages for injured workers.

Be mindful of policy exclusions. These are specific scenarios or conditions not covered by your insurance. Common exclusions might include pre-existing structural issues or damages resulting from unapproved methods. Always review these exclusions carefully to avoid unexpected costs.

Lastly, an environmental liability component can’t be overlooked. Demolition can release hazardous materials, such as asbestos. Confirming your policy covers environmental cleanup and related liabilities is vital for thorough protection.

Protection Against Property Damage

Protection against property damage is a critical element of any demolition insurance policy. When you initiate a demolition project, the potential for property damage is significant. This insurance coverage guarantees that you’re not financially burdened if something goes wrong.

It’s important to conduct a thorough risk assessment before beginning any demolition work. Identifying potential hazards and weaknesses will help you implement effective site safety measures.

You’ll want to evaluate the proximity of neighbouring structures, underground utilities, and environmental factors that could affect the project. Mitigating these risks is essential, but even with the best precautions, accidents can occur. That’s where your demolition insurance steps in. It covers the costs associated with accidental damage to nearby properties, assuring that you can rectify any issues without severe financial repercussions.

Additionally, maintaining a high standard of site safety throughout the project can reduce the likelihood of property damage. This includes regular inspections, proper training for all personnel, and adherence to safety regulations.

Handling Hazardous Materials

Handling hazardous materials during a demolition project demands meticulous planning and strict adherence to safety protocols. You can’t afford to overlook any steps when dealing with hazardous waste, as the risks to health and the environment are significant.

Start by conducting a thorough assessment to identify all potential hazardous materials on site, such as asbestos, lead, and chemical residues.

Implementing rigorous safety protocols is essential:

– Personal Protective Equipment (PPE): Guarantee all workers wear appropriate PPE to safeguard against exposure.

– Containment Measures: Use barriers and containment systems to prevent the spread of hazardous waste.

– Proper Disposal: Follow legal guidelines for the disposal of hazardous materials to avoid fines and environmental damage.

– Training and Certification: Make certain your team is trained and certified in handling hazardous waste safely.

Managing Unexpected Events

When dealing with hazardous materials, you’ve already put in place stringent safety measures. However, managing unexpected events requires a meticulous approach to risk assessment and contingency planning. You’ve got to anticipate potential disruptions, from sudden structural failure to accidental discoveries of asbestos.

First, conduct a thorough risk assessment. Identify all possible scenarios that could derail your project. This involves evaluating the site’s history, environmental factors, and the condition of surrounding structures. Use this information to develop a detailed risk matrix, categorising each potential event by its likelihood and impact.

Next, focus on contingency planning. Have pre-established protocols for each identified risk. For instance, if unexpected asbestos is found, make sure you’ve got rapid response teams ready to handle it safely. Your plan should also include clear communication channels to inform all stakeholders promptly and effectively.

Lastly, regular drills and reviews are essential. Test your plans under simulated conditions to identify weaknesses and areas for improvement. This proactive stance minimises downtime and confirms your team is prepared for whatever comes their way.

Financial Safeguards

No one can predict every financial pitfall a demolition project might face, but robust financial safeguards are crucial to mitigating risk.

By conducting a thorough risk assessment, you can identify potential financial threats and take proactive measures to guarantee financial stability throughout the project. Demolition insurance acts as a fundamental component of these safeguards, providing a financial safety net that can cover unexpected costs and losses.

Consider the following financial safeguards to protect your demolition project:

– Comprehensive Risk Assessment: Analyse every aspect of the project to identify potential risks and quantify their financial impact. This helps in creating a tailored insurance policy.

– Adequate Coverage Levels: Confirm your insurance covers various scenarios, including accidental damages, site contamination, and unforeseen delays, to maintain financial stability.

– Contingency Funds: Allocate specific funds within your budget to handle unexpected expenses without disrupting the project’s financial flow.

– Regular Financial Audits: Conduct periodic audits to monitor financial health and adjust your insurance and financial strategies accordingly.

Implementing these financial safeguards not only helps in managing risks but also guarantees that your demolition project remains on solid financial ground.

Legal and Regulatory Compliance

Charting the intricate landscape of legal and regulatory compliance is essential for any demolition project. You need to be aware of the regulatory requirements that govern demolition activities. Failing to meet these can lead to significant legal ramifications and increased liability exposure.

Conduct a thorough risk assessment to identify potential compliance challenges early on. Stay updated on policy changes and industry standards. Regulatory requirements often evolve, and enforcement agencies are vigilant about ensuring adherence. Non-compliance could result in hefty fines, project delays, or even shutdowns.

To mitigate these risks, establish a robust compliance plan that includes regular training for your team and periodic audits of your processes. Understanding the interplay between local, state, and federal regulations will help you navigate the complexities more efficiently.

Each layer of regulation can impact your project differently, so it’s vital to align your practices with the most stringent standards applicable.

Cost Considerations

Considering the financial implications of demolition insurance protection is essential for managing your project’s budget effectively. By conducting a thorough cost estimation, you can anticipate potential expenses and avoid unexpected financial strain.

Start by evaluating the overall risks associated with the demolition project. This risk evaluation will help you understand the potential costs you might incur from accidents, damages, or delays.

To guarantee you’re fully prepared, consider the following factors:

– Premium Rates: Compare different insurance providers to find competitive rates that match your project’s specific needs.

– Coverage Limits: Evaluate the coverage limits to ensure they align with your project’s scope and potential risks.

– Deductibles: Higher deductibles can lower your premium costs but may increase out-of-pocket expenses in the event of a claim.

– Policy Exclusions: Identify any exclusions within the policy to avoid unexpected costs if an incident occurs outside the coverage parameters.

Paying close attention to these details won’t only help you develop a precise cost estimation but also allow you to allocate funds more effectively.

This analytical approach minimises financial risks and guarantees your project remains on track, even in the face of unforeseen challenges.

Choosing the Right Policy

When selecting the right demolition insurance policy, it’s vital to meticulously analyse various factors to confirm thorough coverage for your project.

Start by conducting a detailed policy comparison. Look at what each policy covers and identify any gaps. Verify the policy includes protection against common risks like third-party damages, environmental liabilities, and site accidents.

Next, perform a detailed risk assessment of your project. Consider the unique challenges and hazards specific to your demolition work. High-risk areas might require additional coverage, so tailor the policy to your project’s needs. Evaluate the potential financial impact of each risk and confirm the policy provides adequate limits.

It’s also important to scrutinise the exclusions and limitations of each policy. Some policies mightn’t cover certain types of demolition work or specific materials. Clarify these points with your insurance provider to avoid surprises later.

Lastly, review the claims process. A policy with a streamlined, efficient claims procedure can save you time and stress in case of an incident.

Benefits for Stakeholders

Understanding the benefits of demolition insurance protection is essential for all stakeholders involved in a demolition project. It guarantees that everyone, from project managers to investors, can proceed with confidence.

Here are specific ways demolition insurance benefits stakeholders:

– Enhanced Stakeholder Confidence: Knowing that potential risks are covered boosts trust among all parties involved.

– Financial Security: Coverage of unexpected incidents prevents budget overruns and financial loss, guaranteeing stability.

– Project Continuity: Insurance facilitates quick recovery from setbacks, maintaining the project’s timeline without major disruptions.

– Legal Protection: It safeguards against liabilities and potential legal issues, providing peace of mind.

Frequently Asked Questions

What Types of Projects Typically Require Demolition Insurance?

You’ll typically need demolition insurance for renovation projects, commercial buildings, or any site requiring environmental assessments. It’s essential for mitigating risks like accidental damage, hazardous material exposure, and ensuring regulatory compliance during your project’s demolition phase.

How Does Demolition Insurance Interact With Other Types of Project Insurance?

Demolition insurance interacts with other project insurances by ensuring coverage coordination and policy integration. You minimise gaps in protection and streamline claims processes, reducing risks and ensuring thorough coverage across all aspects of your project.

Are There Common Exclusions in Demolition Insurance Policies?

Did you know 60% of claims face policy limitations? You’ll often find exclusions in demolition insurance policies, such as pre-existing damage. Always scrutinise coverage details to avoid surprises and guarantee thorough protection for your project.

Can Demolition Insurance Be Customised for Unique Project Needs?

Yes, you can customise demolition insurance to address project specific risks. By exploring custom coverage options, you guarantee your policy is tailored to unique challenges, minimising vulnerabilities and safeguarding against unforeseen issues specific to your project.

What Happens if a Claim Is Denied Under a Demolition Insurance Policy?

Coincidentally, if a claim is denied, you’re thrust into the claim process maze. You’ll face policy disputes, requiring detailed documentation and potentially legal advice. Always review your policy meticulously to minimise risk and avoid surprises.

Conclusion

In summary, demolition insurance is essential for protecting your projects. Did you know that 30% of demolition projects face unexpected delays due to unforeseen complications? This insurance not only safeguards against property damage and worker incidents but also guarantees legal compliance and financial stability. By choosing the right policy, you’ll maintain project continuity and stakeholder confidence, effectively managing risks and avoiding costly disruptions. Don’t leave your project’s success to chance—secure the right demolition insurance today.