ABIR members report 18% increase in premiums written for 2023

ABIR members report 18% increase in premiums written for 2023 | Insurance Business Australia

Reinsurance

ABIR members report 18% increase in premiums written for 2023

Net income surge driven by strong claims performance

Reinsurance

By

Kenneth Araullo

Member companies of the Association of Bermuda Insurers and Reinsurers (ABIR) reported an 18% increase in premiums written for 2023, according to the group’s global underwriting report released today.

Data from 25 of the 31 ABIR member re/insurers show that gross written premiums reached over $171 billion, up from $145 billion in 2022. The group’s total equity also increased to $164 billion, compared to $117.6 billion the previous year.

The report highlights net income for ABIR members rising to $32.3 billion in 2023, a significant jump from $5.1 billion in 2022, largely driven by an improved claims environment. Of the total gross written premium, 92% was attributed to publicly traded member companies.

ABIR members operate across multiple regions, including Bermuda, the United Kingdom, Europe, Asia, and the Americas, writing insurance and reinsurance across various markets.

The Bermuda market continues to expand into specialty lines, such as cyber, mortgage, political risk, terrorism, transactional liability, and financial lines, while maintaining its dominant position in global property coverage.

The 2023 report was affected by the acquisition of Validus by RenaissanceRe and the inclusion of Sompo International as a new ABIR member. Additionally, a shift to the IFRS 17 reporting standard by several ABIR members required the report to be split into two tables: one for members reporting under US GAAP, IFRS, or Bermuda SAP, and another for those using IFRS 17.

This change has made direct comparisons to previous years difficult due to differences in accounting standards.

The release of the underwriting data follows a report by credit rating agency AM Best, which highlighted the strength of Bermuda’s reinsurance market. AM Best pointed to Bermuda’s role in driving a 14% growth in global reinsurance capital during 2023, attributing much of this to the strong operating performance of Bermuda-based reinsurers.

The AM Best Bermuda Reinsurers Composite reported a 33.7% growth in shareholders’ equity and an average return on equity of 23%.

A significant contingent from Bermuda’s reinsurance sector is preparing to attend the annual Rendez-Vous de Septembre in Monte Carlo from Sept. 7-11, where discussions will begin in advance of January reinsurance contract renewals.

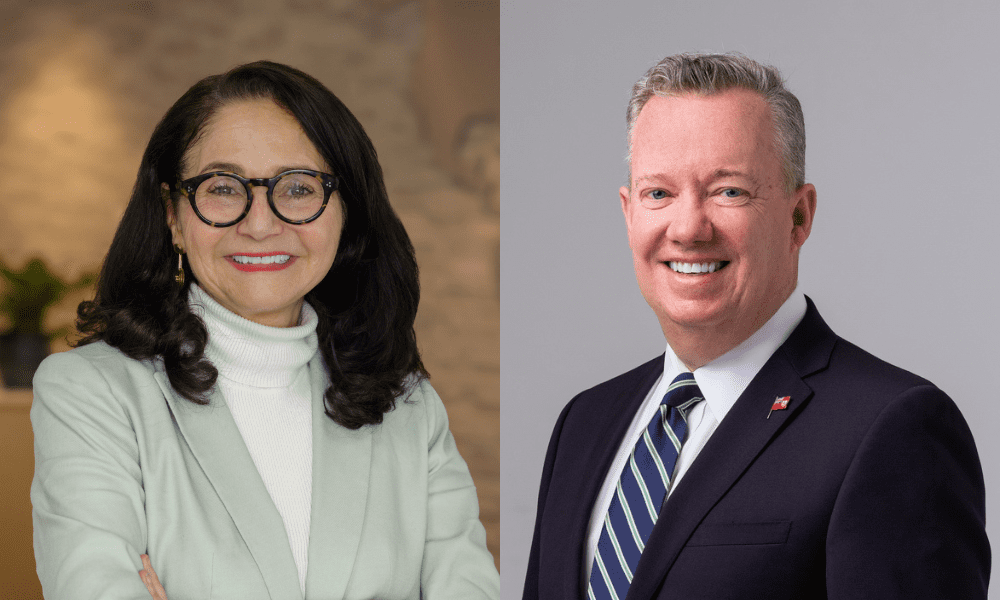

Pina Albo (pictured above, left), chair of ABIR and CEO of Hamilton, said the global underwriting report reflects the growing demand for ABIR member companies’ risk-transfer capabilities and strong capital base.

She emphasized Bermuda’s continued importance as a global re/insurance hub, citing the island’s industry talent, innovative culture, and regulatory framework.

John M Huff (pictured above, right), CEO of ABIR, welcomed Sompo International’s inclusion in the report and noted that the results demonstrate Bermuda’s insurers and reinsurers continue to play a critical role in providing capital, innovative solutions, and peace of mind to customers around the world.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!