Platform allows bundled home and auto coverage from different insurers

Insurtech and digital brokerage YouSet has launched what it calls a first-of-its-kind offering — the ability to bundle home and auto policies from different insurers.

Most insurance providers focus on offering bundled home and auto policies with the same insurer, and offer multiple-lines discounts to customers.

But sometimes, issuing two different policies from two different insurers is the best choice, Xavier Freeman, co-founder and CEO of YouSet, tells Canadian Underwriter.

“Our platform compares all possibilities for our users, whether it’s both policies with the same insurer or policies [from] two different insurers,” he tells CU in advance of the Tuesday product announcement. “The user can buy both policies online. We take care of all the back-office work to set up the policies with the respective insurer afterwards.”

Coverage mechanics

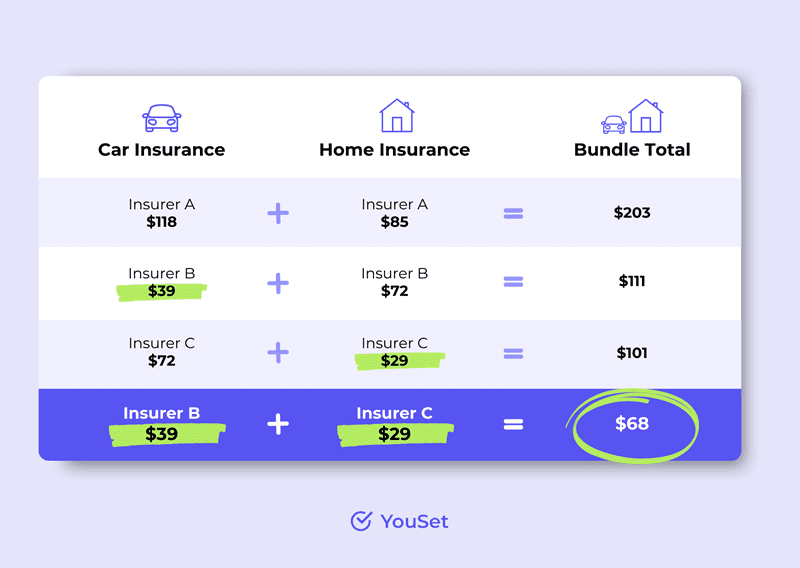

Here’s how it works: Users looking for home and auto insurance come to YouSet’s website and complete a quote for home and auto insurance together. YouSet’s system analyzes the best option(s) available among the 16 insurers and providers it has access to, all of whom are eligible to bundle the insurance policies, Freeman explains.

YouSet is currently licensed in Quebec and Ontario. Acting as a broker, YouSet respects guidelines from the Registered Insurance Brokers of Ontario and Quebec’s financial services regulator, the Autorité des marchés financiers (AMF).

The company’s current growth strategy is focused on growing through distribution partners, of which it has more than 50.

“For example, we work with multiple partners who aren’t licensed in Quebec to service their customers for home and auto insurance in the province,” he says. “Our next growth strategy will be focused on continuing our expansion across Canada.”

In particular, YouSet is looking at Alberta and British Columbia, Freeman tells CU when asked about which provinces it’s looking at as part of its expansion plan.

Related: Insurtech launches exclusive line of insurance

New investment round

YouSet also announced Tuesday a $3.5 million investment from a group of Canadian investors and entrepreneurs. The funding comes from investors who’d participated in YouSet’s $2.1 million pre-seed round announced in 2022, as well as new strategic angel investors, YouSet says in a press release.

Investors doubling down on the insurtech include Don Fox (former executive VP at Intact), Neil Mitchell (former managing director at Marsh), Joe Canavan (principal of Canavan Capital) and Nicholas Bouchard (founder of DuProprio). New investors include Jim Texier (former head of big data at AXA), Phil Gibson (former senior VP at Aviva) and Dan Robichaud (a serial entrepreneur and investor).

Founded in 2017, YouSet has more than 250,000 users and allows Canadians to find home, condo, tenant and auto insurance policies for “29% less on average” in four minutes or less, the company says in the release. “For the first time, users can bundle home and auto insurance from different providers, and unlock up to an additional 15% in savings when purchasing the bundle.

“The funding announced today allows YouSet to accelerate its aggressive growth strategy, designed to further increase sales through the company’s growing network of more than 50 distribution partners.”

Part of the investment will be used to expand the company’s team, and YouSet is looking to fill multiple roles to further grow its team of 20 employees.

Canavan, one of the early investors in YouSet, said insurtech is changing the way people shop for insurance around the world and he’s excited to see how such companies can revolutionize the industry in Canada.

“The company’s growth has been impressive and we believe that the value it delivers for Canadians will only increase,” Canavan says. “There is a large appetite for this all across Canada.”

Feature image provided by YouSet.