10 most affordable accident insurance providers in the Philippines

10 most affordable accident insurance providers in the Philippines | Insurance Business Asia

Guides

10 most affordable accident insurance providers in the Philippines

Accident insurance is vital for Filipinos who rely on their physical health to earn an income. Take your pick from our list of affordable accident insurance

Accident insurance is a type of policy designed to provide financial cushion for people who suffer an injury or disability because of an accident. It can be a crucial form of protection for many Filipinos who rely heavily on their physical health to earn an income.

In this client education guide, Insurance Business Asia lists the top affordable accident insurance policies in the Philippines. We will give you a walkthrough of these policies’ different features and benefits and how much premiums cost.

If you’re searching for cheap personal accident coverage, you can use this guide to make a side-by-side comparison of the different policies in the market. If you’re an insurance agent or financial adviser, you can share this article with your clients who may have questions about how accident insurance works.

Accidents strike when you least expect them. When they do, these incidents can have a far-reaching financial impact on you and your loved ones. This is where affordable accident insurance comes in handy.

In this section, we will list the top 10 personal accident insurance policies that provide quality coverage at inexpensive rates. The list includes only products from providers that disclosed how much premiums cost. All premiums listed are one-time payments. Prices are current as of July 31, 2024. The list is arranged alphabetically.

1. BPI-AIA Accident Guard 24/7

BPI-AIA, formerly known as BPI-Philam, offers the Accident Guard 24/7 personal accident insurance for individuals, couples, parents, and whole families. The policy provides coverage for accidental dismemberment, disablement, and death, including incidents of murder.

Policyholders can receive an additional 25% of the principal sum if an injury results in the loss of one or both hands or feet, or both eyes. A special compassionate benefit for those whose deaths are not accidental can also be accessed.

Annual premiums start at around Php1,200 for Php300,000 worth of coverage. The most expensive individual plan costs Php10,032.80 yearly for a coverage limit of Php2 million. Medical reimbursement worth Php100,000 and a Php2,000 weekly accidental benefit (maximum of 26 weeks) can be included at an additional premium.

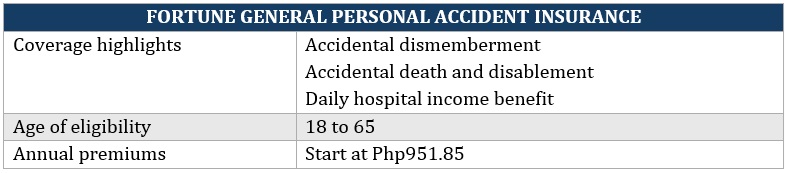

2. Fortune General Personal Accident Insurance

The most affordable personal accident insurance plan from Fortune General starts at Php951.85 per year for coverage worth up to Php250,000. The maximum policy limit is Php1 million, costing Php2,676.87 annually.

Coverage includes motorcycle accidents, and instances of unprovoked assault and murder. The basic plan provides Php25,000 worth of coverage each for burial and medical expenses. It also pays out a Php250 daily hospital income benefit for a maximum of 30 days.

Generali offers affordable accident insurance through its individual and group plans. Policies are available in six- or 12-month terms. Basic individual plan costs Php490 per year. The annual premium for the basic group plan is Php830.

Coverage includes three calls to its 24/7 Call-a-Doc service, Php5,000 emergency care benefit, and Php400 DHIB for a maximum of 14 days. The Php50,000 personal accident coverage includes motorcycling accidents and unprovoked assault and murder.

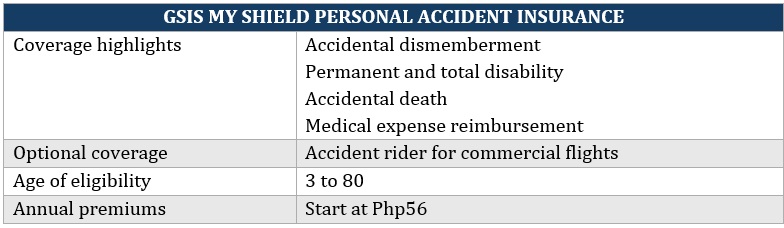

4. GSIS My Shield Personal Accident Insurance

Members of the Government Service Insurance System (GSIS) and their families can access the My Shield Personal Accident Insurance plan. Annual premiums start at Php56 for coverage up to Php50,000. The maximum coverage limit is Php5 million with yearly premiums of Php3,280.

My Shield provides coverage for accidental death, including those resulting from unprovoked murder and assault. The policy also pays disability and medical expense benefit for accidental dismemberment, and loss of sight, hearing, and speech.

5. Manulife Philippines 365 Ready Accident

Manulife Philippines 365 Ready Accident personal accident insurance is available in five tiers. The cheapest plan costs Php199 per year for coverage up to Php25,000. The maximum policy limit is Php1 million with yearly premiums at Php1,299.

365 Ready Accident provides coverage for accidental death, disablement, and dismemberment. Policyholders can receive double the benefit amount if the injury occurs while they are:

riding as a passenger of any motorized or licensed public utility land transport

riding in an elevator car, excluding those from mines and construction sites

inside a burning public establishment, including theaters, malls, hotels, hospitals, and restaurants

If the reason for the death is non-accidental, the insured’s family will also receive a benefit equal to 5% of the face amount capped at Php50,000.

6. Metropolitan Insurance Company Inc. Personal Accident Insurance

Metropolitan Insurance Company Inc. (MICI) offers one of the most affordable accident insurance policies on the list, with yearly premiums starting at Php45. Policies are available for various industries, including:

auto and truck dealers

construction

food services

healthcare

manufacturing

retail

transportation

The plan provides up to Php20,000 coverage of accidental death and disablement and 10% of the sum insured for burial and medical expenses benefit. Coverage for motorcycling accidents, animal bites, and food and gas poisoning can be purchased as an add-on.

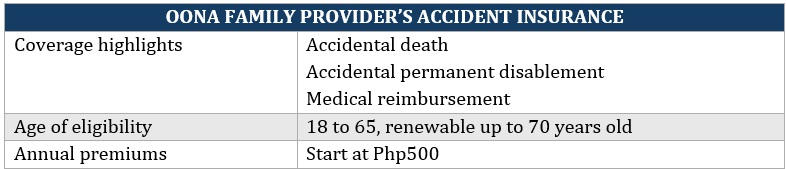

7. Oona Family Provider’s Accident Insurance

Oona Insurance, formerly MAPFRE, provides a personal accident insurance plan designed for breadwinners and heads of families. Its Plan 500 provides accidental death and permanent disablement benefits worth up to Php500,000 each. The plan also offers:

Php5,000 monthly shelter allowance for up to one year

Php30,000 yearly educational assistance per child up to five years, capped at four children

Php10,000 annual coverage for hospitalization of dependents, up to five years

8. Starr Accident Protect

Starr Accident Protect’s basic plan provides up to Php100,000 coverage for accidental death, dismemberment, and disablement. This includes incidents of unprovoked assault and murder. The plan also pays a Php5,000 medical reimbursement benefit, and Php2,500 each for burial assistance, treatment of burn injuries, and accidents involving common carriers. Starr’s top-tier personal accident insurance plan provides up to Php2 million in coverage. The annual premium is Php4,350.

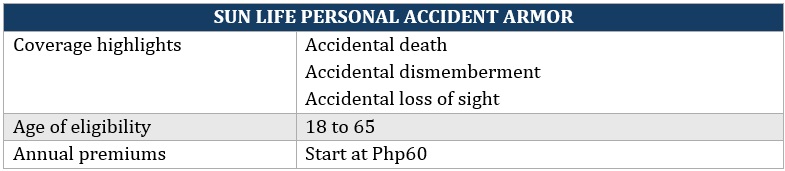

9. Sun Life Personal Accident Armor

Sun Life Personal Accident Armor pays out up to Php50,000 for accidental death, dismemberment, or loss of sight. Annual premiums start at Php60. Policyholders can double the benefit amount by purchasing another plan. The policy is available to registered members of Lazada Philippines, GCash, and Moneygment.

The plan, however, doesn’t cover work-related injuries for certain occupations. These include aviators, construction workers, detectives, fishermen, loggers, miners, security guards, and window cleaners.

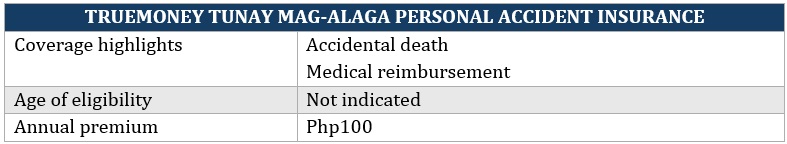

10. TrueMoney Tunay Mag-Alaga Accident Insurance

Regional fintech firm TrueMoney has partnered with local insurer Bankers Assurance to offer affordable accident insurance designed for low-income families. The premiums for the Tunay Mag-Alaga personal accident insurance start at Php25 for a three-month period. This provides up to Php20,000 accidental death and Php5,000 medical reimbursement benefit.

Policyholders can extend the plan to four, six, or 12 months for Php35, Php50, and Php100 to access the same coverage.

Get more news and information about the life, accident, and health insurance line in the region on our Life & Health News Section. Be sure to bookmark this page to access breaking news and the latest industry updates.

As the name suggests, accident insurance is designed to provide individuals and their families financial protection when an accident strikes. It is also called personal accident insurance.

This type of policy provides lump-sum compensation if the policyholder suffers an injury or permanent disability or dies due to an accident. The insureds and their beneficiaries can use the benefit for anything they deem fit. This includes medical or treatment costs, daily living expenses, or their children’s educational expenses. Accident insurance acts as a form of financial cushion if the family’s primary provider loses their ability to earn income.

Filipinos can usually access personal accident insurance in two ways:

1. Through the employers as a group benefit

Employers often include accident insurance as part of an employee’s benefits package. If your company offers this type of benefit, it’s a good idea to reach out to your HR team to find out what’s covered.

2. Through an insurance agent or financial advisor for individual plans

If your employer doesn’t offer this type of coverage, you can purchase an individual personal accident insurance plan through private insurers. You can consult an experienced insurance agent or financial advisor to find a policy that best fits your needs.

Most policies provide coverage for accidental dismemberment, disablement, and death. This includes incidents resulting from unprovoked assault or murder. Varying coverage limits apply to different types of injuries. Insurers indicate in the policy document the portion of the sum insured to be paid out for different injuries.

The higher the premiums, the higher the coverage limit and the wider the scope of coverage.

Both accident insurance and life insurance provide a lump-sum benefit if a policyholder dies. But unlike a personal accident plan, life insurance coverage also kicks in even if death is by natural causes. These include illness and age-related impairments.

Life insurance policies often have longer terms, with some lasting the policyholder’s lifetime. Some policies also have an investment component that can allow you to build equity over time.

Health insurance is designed to cover a portion or the full cost of medical care and treatment. Unlike in personal accident insurance, you don’t have the flexibility to use the benefit for other expenses as the payouts are often sent directly to the medical and healthcare providers.

A health insurance plan, however, offers more comprehensive coverage, which includes a wide range of illnesses and injuries. These include non-accidental causes and work-related incidents.

If you have people depending on you financially, getting personal accident insurance may be a good idea. Accidents happen when you least expect them. Such incidents may adversely affect your ability to earn a living. Having accident coverage can ease some of the financial strain of not being able to get your usual income.

If you’re on the lookout for insurers who can provide affordable accident insurance, our Best in Insurance Special Reports page is the place to go. The companies featured in our special reports have been nominated by their peers and vetted by our panel of experts as trusted and respected market leaders. By partnering with these insurers, you can be sure that your needs are well taken care of when accidents occur.

What’s your pick in our list of affordable accident insurance policies? Let us know in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!