Best Hospital Indemnity Insurance in 2025

Best Hospital Indemnity Insurance in 2025

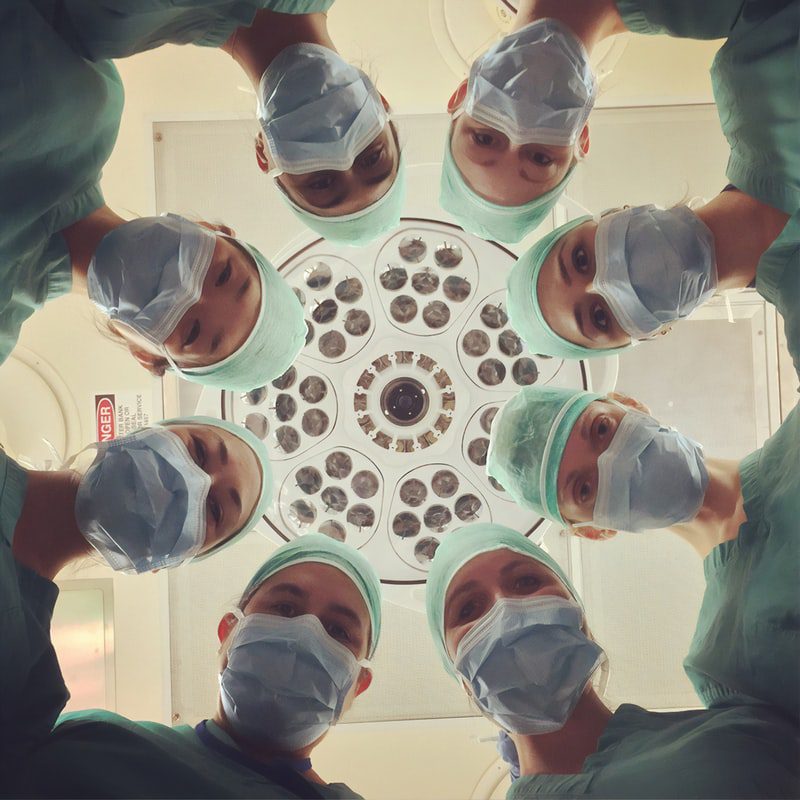

Hospital indemnity insurance is a type of health coverage plan designed to cover hospital stays.

Hospitalization is expensive on its own, but it’s easy to overlook the additional costs you can incur while you’re hospitalized.

Deductibles and co-pays will start piling up, and you may require follow-up outpatient care or a stay in a nursing facility.

That’s where Hospital Indemnity insurance fills in the gaps in a way other insurance plans don’t.

You receive your benefit directly, and you may use the payment however you want — from deductibles to travel and lodging expenses.

What Hospital Indemnity Insurance covers?

Many plans extend coverage to spouses, children, and other dependents, and hospital indemnity policies are often used along with other insurance coverage plans to pay for the entire hospital bill owed.

The plan also acts as a financial backup for some of the out-of-pocket expenses that most health care coverage plans will not cover.

Patients can use the money how they see fit and are not limited by the restrictions that come with other health plans.

Coverage is often provided for intensive care unit stays, general hospitalization, and emergency treatment. Some plans will also cover stays that result from outpatient surgery.

While every hospital indemnity plan is different, you’ll probably see three core types of benefits especially in group plans offered at work.

Hospital admission An initial, usually larger fixed benefit is paid if you are admitted to the hospital due to illness or accident.Overnight stay For each night in the hospital, a smaller daily fixed benefit is paid for each overnight stay in the hospital.Intensive care If you stay overnight in the hospital but are in intensive care, an additional fixed daily benefit is paid for each overnight stay in the intensive care unit.

In addition, to these core types of payments, you might see some other types of benefits offered in these as well. You are more likely to see these benefits in individually purchased plans but you could see them offered in group plans too.

Hospital Indemnity Insurance worth it?

If you are presented an opportunity to buy a hospital indemnity plan, here are some reasons why you might want to take a look at it.

High deductible health insurance plan – The number one reason to consider a hospital indemnity plan is if you have a high deductible plan. This is for two reasons. Most people don’t have that kind of money set aside and if you even if you have that much money set aside in a health savings account, you can maybe protect it assuming it’s an HSA compliant plan.Planning on getting pregnant – If you are planning on getting pregnant, a normal childbirth is two days in the hospital while a C-section is likely four. Unlike short term disability plans, group hospital indemnity plans don’t usually have a pre-ex that would exclude pregnancy.Over 50 years old – Once you start getting older, the more likely it is you’ll get admitted to the hospital. Statistics show that once you reach the age of 50, there’s a greater than 10 percent chance you’ll be admitted to the hospital. And that percentage goes up each year you get older.Upcoming surgery – If you know you are going to have a knee replacement or some other surgery you have control of when it happens, you might want to consider it.You have a chronic condition – If you have heart issues, diabetes are on medications for other types of conditions, you are more likely to be admitted to the hospital. Here’s another study done by the AARP that shows the most common reasons older adults are admitted to the hospital.You missed open enrollment – Sometimes, people miss open enrollment. If a hospital indemnity plan is offered to you during an off cycle enrollment, you might consider it. While not a replacement for health insurance, at least it’s something.It’s guaranteed issue – If it’s guaranteed issue and you have some major medical problems you might want to consider it. It could help you get through pre-ex period on a critical illness policy for example.If it’s inexpensive – If the cost is reasonable, then consider purchasing a policy. You are more likely to find that the basic core plans aren’t that expensive. Some of seen are under $200 per person per year which isn’t too expensive.No cash saved or to replace lost income – If you don’t have much sick time or don’t have short-term disability, you might consider it. While it’s not disability insurance, it would still provide some cash you might need.Unexpected out of network expenses – Even with a good medical plan, medical providers will still try and stick you with some unexpected expenses like my wife discovered when she got a bill from an out of network provider when she went to an in-network facility for treatment.

How Much Does Hospital Indemnity Insurance Cost?

Indemnity medical insurance costs depend on your age, the amount of coverage you want and the indemnity insurance company.

You can buy coverage per individual or per family. For the benefit that a hospital indemnity insurance plan provides, the cost is relatively inexpensive.

What to look for in a Hospital Indemnity insurance plan

First, understand which hospital expenses your health insurance, Medicare, Medicare Advantage, or Medicare Supplement benefits cover. Talk to a licensed insurance agent who is familiar with your individual policy.

Secondly, establish what you can afford for an additional policy and determine the value it provides within the base cost.

Most plans pay you a cash benefit for days on which you’re confined to a hospital.

Upon enrollment, you choose the number of days the cash benefit should pay and the daily benefit amount.

Then, you’ll need to examine what optional benefits are available at an additional cost.

For example, some Hospital Indemnity insurance plans offer optional coverage for outpatient surgery, physical therapy, and chiropractic care. Base benefits and optional coverage vary by state, so you should speak with an agent who can explain what is available in your area.

Finally, understand what is not included under the plan.

Non-medically necessary hospital stays, such as cosmetic procedures, or injuries from engaging in high-risk behaviors, like skydiving, are usually not covered.

Best Hospital Indemnity Insurance in 2025 Where can I buy Hospital Indemnity Insurance?

The best way to compare quotes on hospital indemnity coverage and get the right amount of insurance for your needs is to work with an independent agent.

While shopping for a hospital indemnity insurance plan, review your options and make sure you don’t overpay for the same amount of coverage that you could get somewhere else for a better price.

Mintco Financial can compare quotes and coverage options from multiple insurers and help you find the right coverage for your needs.

We will get to know you and will be able to help you navigate your options for indemnity health insurance.

Get a quote TODAY!

Drop Us a Line

Call us at 813-964-7100 or 716-565-1300

www.MintcoFinancial.com

info@mintcofinancial.com