Hurricane Debby strengthens and heads for landfall in Florida

Tropical storm Debby, the fourth named storm of the 2024 Atlantic hurricane season, has now become a hurricane over the Gulf of Mexico, with the NHC warning that additional strengthening is expected as hurricane Debby heads for landfall in the Big Bend area of the Florida Panhandle.

Meteorologists had been watching Invest 97L for a number of days now and forecast model runs showed a strong chance for it to achieve tropical storm status and be named as Debby. However there was initially some uncertainty over its track, but that has now become clearer since its upgrade to tropical storm status.

The storm was then officially named Debby and forecasters were expecting it to make low category hurricane status by landfall in Florida’s Big Bend region.

Which has now occurred, as tropical storm Debby had intensified into hurricane Debby on Sunday night and currently has 80 mph sustained winds and stronger gusts, but continues to move over very warm water in the Gulf of Mexico so some additional intensification is anticipated before landfall.

Limiting that potential now is the limited time Debby has to spend over the Gulf before more serious land interaction begins that stops this becoming a more significant wind threat.

The National Hurricane Center (NHC) has now said it expects tropical storm Debby to rapidly intensify up to landfall, with a strong Category 1 storm expected at that time.

Some meteorologists are once again highlighting that models have largely underplayed Debby’s intensity so far and that as a result a Category 2 hurricane at landfall should not be discounted as a possibility.

The NHC said in its latest update as of 18:00 UTC on Sunday, “Debby is moving toward the north near 12 mph (19 km/h). A gradual decrease in forward speed with a turn toward the northeast and east is expected later today and Tuesday. On the forecast track, the center will reach the Florida Big Bend coast later this morning. Debby is then expected to move slowly across northern Florida and southern Georgia late today and Tuesday, and be near the Georgia coast by

Tuesday night.

“Data from Air Force reconnaissance aircraft indicate that maximum sustained winds are near 80 mph (130 km/h) with higher gusts. Additional strengthening is likely before Debby reaches the Florida Big Bend coast later this morning. Weakening is expected after Debby moves inland.”

Forecasters say conditions will remain conducive for intensification as tropical storm Debby moves north, then curves in towards the Florida Big Bend area of the Panhandle.

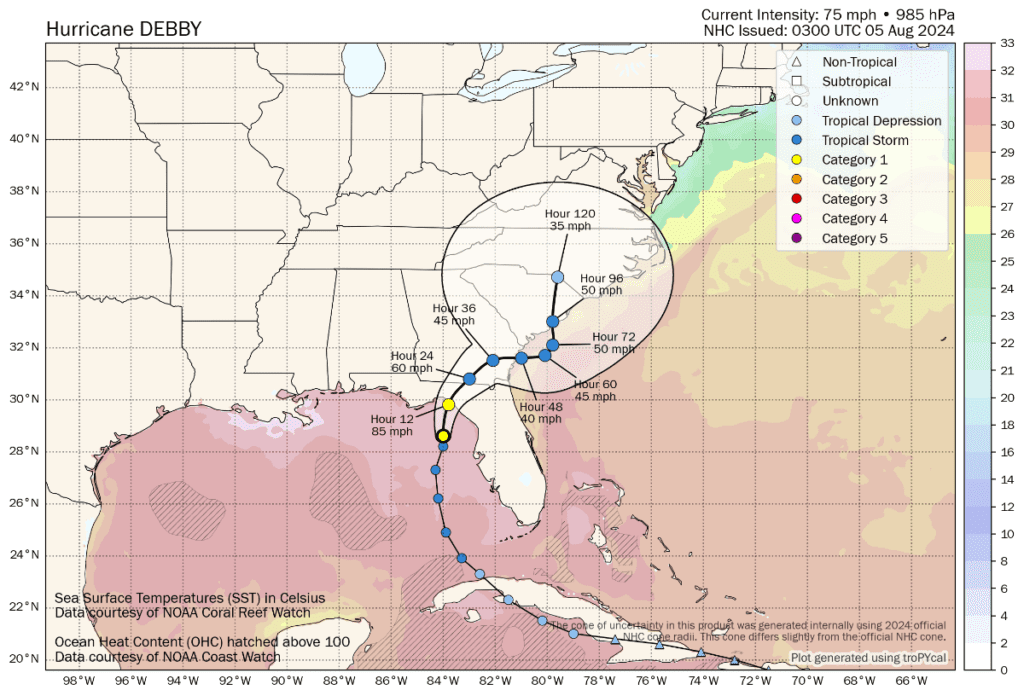

The image below from Tomer Burg’s excellent weather resources shows the forecast path and cone of uncertainty, as well as wind intensity forecasts:

The forecast now predicts hurricane Debby could reach sustained winds of almost 90 mph before landfall, just below Category 2, as it passes over very warm Gulf waters.

Forecasters continue to warn that Debby will pick up a lot of moisture as it moves towards Florida and the south eastern United States, with many cautioning that flooding will be a significant concern no matter how strong the winds from tropical storm or hurricane Debby become.

The NHC said, “Hurricane Debby is expected to produce rainfall totals of 6 to 12 inches, with maximum amounts of 18 inches, across portions of central and northern Florida and southeastern North Carolina through Friday morning. This rainfall will likely result in areas of considerable flash and urban flooding, with significant river flooding expected.

“Across portions of southeast Georgia and South Carolina, 10 to 20 inches of rainfall, with local amounts to 30 inches, are expected through Friday morning. This potentially historic rainfall will likely result in areas of catastrophic flooding.”

As ever with a hurricane heading for the Florida Panhandle, storm surge is also a concern as water can build-up more significantly due to the curvature of the coastline there.

The NHC currently forecasts storm surge heights of as much as 6 to 10 feet for Suwannee River to Aucilla River in Florida, with a much wider area seeing surge of 4 to 6 feet and even Tampa Bay expected to see 3 to 5 feet of storm surge.

At the moment, the forecast area of landfall is relatively sparsely populated, but any shift to the west in the track could bring Debby’s eyewall winds closer to Tallahassee, which is the largest population centre in that region of Florida.

Some models continue to show Debby crossing land and emerging into the Atlantic, after which a second landfall is seen as possible around the Carolinas, where tropical storm Debby could again be strengthening and the rainfall threat is expected to be even more significant, with more time off the East coast to pick up additional moisture.

There remains some uncertainty over the landfall strength, the track and further out how Debby could behave if it makes it back into the Atlantic, so this storm is still something for the insurance, reinsurance, catastrophe bond and insurance-linked securities (ILS) markets to track this weekend.

Steve Bowen of Gallagher Re has said hurricane Debby is most likely to result in a single digit billion insurance and reinsurance market loss, for private and public insurance sources, but how high is hard to say and depends on whether Debby stalls over-land, or can regain intensity over the Atlantic.

The economic loss could be much higher though, with significant uninsured flood losses deemed possible.

Bowen explained, “Historical loss data notes that a landfalling Category 1 or Category 2 hurricane in Florida’s northern Gulf Coast region has led to wind-related insured losses near or above USD1 billion. The wild card is the flood potential. Should rain forecasts verify, plus up to 3 to 10 feet of coastal storm surge inundation, this could result in catastrophic flood impacts. Similar rain totals were associated with 2018’s Hurricane Florence in the Carolinas that led to an economic loss of USD30 billion (2024 USD). Just USD7 billion of that total was covered by insurance. That storm was “only” a Category 1 with 90 mph at landfall.

“If Debby’s forecast does verify, combined wind and water-related insured losses are likely to end as a single-digit billion (USD) total for the private and public insurance market. The overall economic loss would be far higher.

“Coastal counties in Florida have among the highest number of active National Flood Insurance Program (NFIP) policies in the US with take-up rates ranging from 10-50%. Similarly to Florida, despite higher coastal NFIP take-up in the Carolinas and Georgia, the percentage of active policies drops considerably once inland. This means a sizeable portion of flood damage is likely to be uninsured.”

Catastrophe bond fund manager Icosa Investments AG commented on the potential for storm Debby development on Friday, saying it is tracking the system closely, as other cat bond and ILS fund managers will be.

Icosa Investments said, “While forecasts vary regarding its path, the general consensus is that the system will approach Florida from the western coast (possibly near Tampa), cross the Floridian peninsula, and then move back into the Atlantic before moving Northeast.

“Most intensity forecasts do not anticipate for the system to reach hurricane strength. However, given the warm sea surface temperatures and low wind shear, there’s still a small possibility that models underestimate the potential for intensification, similar to what occurred with Hurricane Beryl recently. Fortunately, the system’s current lack of organisation limits the time available for significant strengthening before it makes landfall.

“At this point, we do not expect any impact on cat bond investors, even though a Category 1 hurricane could still cause billions of insured losses if it directly hits the densely populated Tampa area. Such an event might result in some attachment erosion, but is unlikely to result in significant outright losses in the cat bond market. There is also some uncertainty regarding the storm’s path after it reemerges into the Atlantic, with potential impacts in North Carolina — a region well-represented in the cat bond market — still possible.”

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.