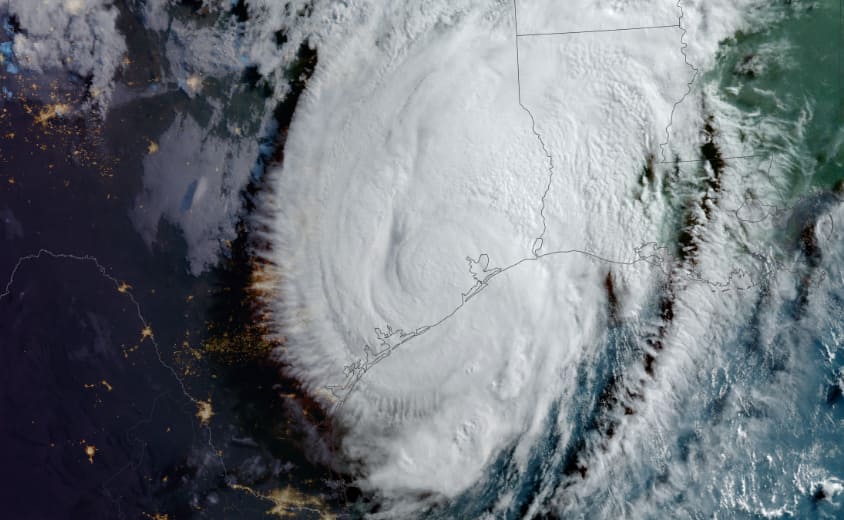

Hurricane Beryl industry insured US wind losses $2bn to $3bn: Verisk

The latest estimate of insurance market losses in the United States after hurricane Beryl comes from the Extreme Event Solutions group at Verisk, who put US onshore wind-only losses from the hurricane at between $2 billion and $3 billion.

We can compare the estimate from Verisk with the one from Moody’s RMS, who put US private market insurance industry losses at $2.3 billion to $4.2 billion from wind including coverage leakage.

Other estimates to compare with include CoreLogic that pegged hurricane Beryl wind losses in the US at between $2.5 billion and $3.5 billion and one from Karen Clark & Company that said hurricane Beryl is estimated to have caused insurance industry losses of $2.7 billion in the United States.

These aren’t the straightest of comparisons though given Verisk’s estimate excludes a lot of potential inputs.

Verisk said its hurricane Beryl insurance industry loss estimate does not include:

Excess impacts due to power failures which may not be implicitly modeled

Losses from storm surge

Losses paid out by the National Flood Insurance Program

Losses exacerbated by litigation, fraudulent assignment of benefits, or social inflation

Storm surge leakage losses paid on wind only policies due to government intervention

Losses from precipitation-induced flooding

Losses to inland marine, ocean-going marine cargo and hull, and pleasure boats

Losses to uninsured properties

Losses to infrastructure

Losses from extra-contractual obligations

Losses from hazardous waste cleanup, vandalism, or civil commotion, whether directly or indirectly caused by the event

Losses resulting from the compromise of existing defenses (e.g., natural and man-made levees)

Loss adjustment expenses

Other non-modeled losses, including those resulting from tornadoes spawned by the storm

Losses for U.S. offshore assets and non-U.S. property