Will Medicare Advantage Work in 2025? UnitedHealth Hopes So

What You Need to Know

UnitedHealth wants to hold profit margins steady.

Executives are hazy about what competitors will do.

The company posted $4.4 billion in net income in spite of the Change ransomware attack.

UnitedHealth Group executives were vague Tuesday about what the Medicare Advantage program might look like in 2025.

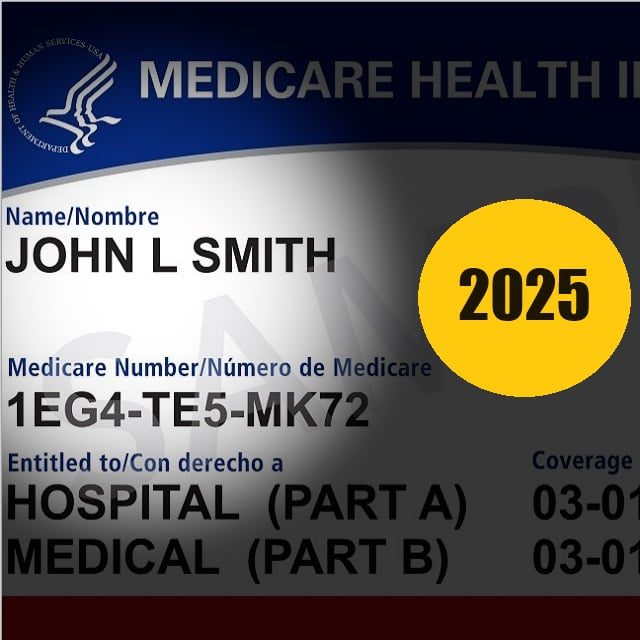

UnitedHealth is the biggest Medicare Advantage player, with plans covering 7.8 million of the 32 million enrollees. The company also covers about 4.3 million of the 14 million people who own another type of supplemental coverage, Medicare supplement insurance.

The Centers for Medicare and Medicaid Services, the agency that oversees Medicare, has announced what issuers see as a funding cut.

What will that mean for UnitedHealth?

UnitedHealth is trying to hold Medicare Advantage plan profit margins steady, Tim Noel, the head of the company’s Medicare and retirement unit, said during a conference call the company held to go over second-quarter earnings with securities analysts.

“We’ve priced the products so that we’ll be comfortable with whatever growth is the outcome of what we bring to the marketplace,” Noel said.

Andrew Witty, UnitedHealth’s CEO, declined to predict how UnitedHealth’s Medicare Advantage plan market share might change.

“Ultimately, the way growth plays out in the marketplace depends on how everybody bids, not just on how you bid,” Witty said. ”It only takes one bid to be kind of out of expectation to completely distort how things could play out.”

What it means: Clients with Medicare coverage might find that it ends up being about the same in 2025, but they could also end up seeing big, confusing changes, given that even top executives at a top issuer aren’t sure what to think.