How much do narrow networks impact premiums?

Patients hate narrow networks. Anything that limits their choice of physicians or hospitals is disliked. Americans love more choice.

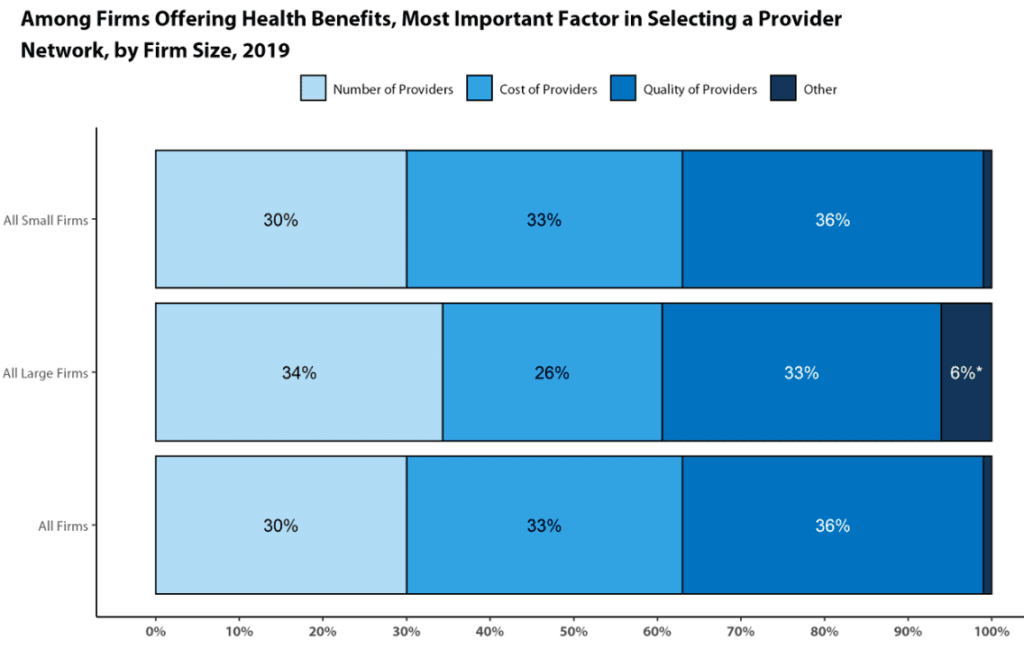

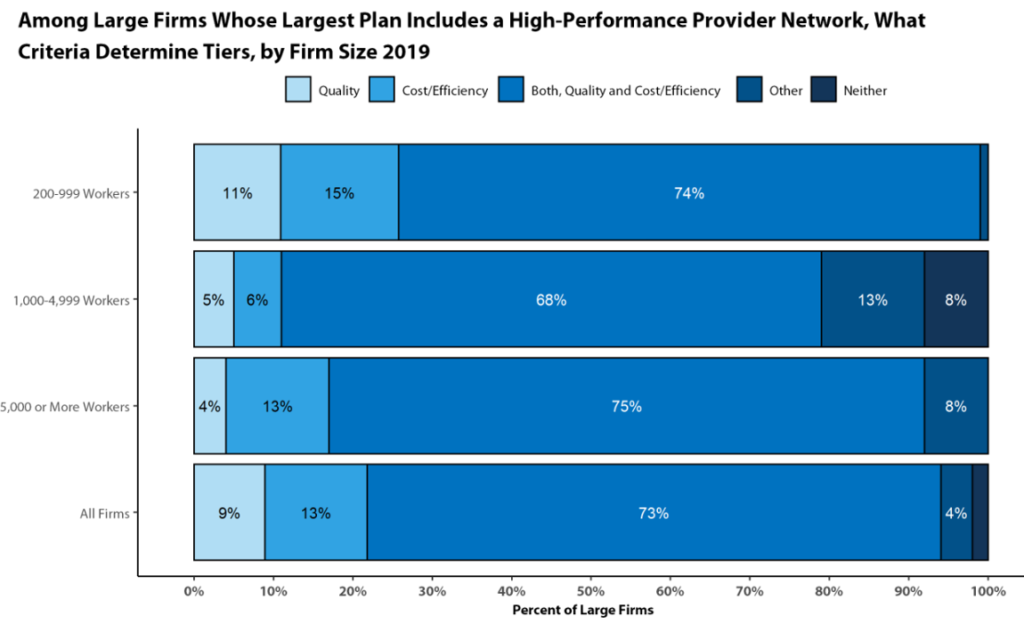

Payers, on the other hand, like narrow networks because they save cost–through the ability to negotiate lower rates–and potentially increase quality–if the contracted network has higher quality physicians. In fact, according to the KFF Employer Health Benefits Survey, both cost and quality are important factors in selecting a provider network.

2019 Employer Health Benefits Survey – Section 14: Employer Practices and Health Plan Networks

https://www.kff.org/report-section/ehbs-2019-section-14-employer-practices-and-health-plan-networks/

https://www.kff.org/report-section/ehbs-2019-section-14-employer-practices-and-health-plan-networks/

A key question is then, is how much money do narrow networks save health plans? That is the question that a paper by Dafny et al. (2017) aims to answer. The authors use data from the Robert Wood Johnson Foundation HIX Compare on silver-tier health insurance plans offered on the 2014-2015 ACA Marketplaces in 8 states (CA, CO, FL, MI, NJ, NY, TX, WA). After using these data and conducting a multivariate regression, the authors find that:

…an increase in hospital network breadth…was linked to a premium increase of 5.7 percent, or $191 per year—given the national average premium of $3,359 for a twenty-seven-year-old in 2014. An increase in physician network breadth from small (corresponding to 10 percent of physicians) to large (corresponding to 40 percent) was linked to a premium increase of 9.4 percent, or $316 per year. An increase in both hospital and physician network breadth was linked to a premium increase of 15.7 percent, or $527 per year.

https://www.healthaffairs.org/doi/10.1377/hlthaff.2016.1669

https://www.healthaffairs.org/doi/10.1377/hlthaff.2016.1669

You can read the full paper here.