How Hurricane Beryl could indirectly affect Canadian insurers

Hurricane Beryl’s early, record-setting pace has the P&C insurance industry bracing for the impact of a difficult hurricane season in 2024.

Canadian P&C insurers are still cleaning up the damage after the losses of Hurricane Fiona in 2022 along the Atlantic Canada coast.

Another hurricane hitting Canada this year might impact local primary insurers more because of higher retentions after a challenging reinsurance renewal last year, as recent A.M. Best commentary suggests.

“While the losses to the reinsurance industry [arising from Hurricane Beryl] are likely to be within risk appetite and contained in their earnings, cost pressures in higher frequency excess reinsurance layers have driven some carriers to increase retentions modestly,” A.M. Best says. “As a result, the earnings impacts may be more severe for Beryl than for storms in prior years.

“A hurricane of this magnitude early in the hurricane season would act as a warning sign for the industry as it braces for the rest of the hurricane season.”

Given the record warmth of water temperatures in the Atlantic Ocean during a La Nina season, the National Oceanic and Atmospheric Administration (NOAA) predicted an above-average season of four to seven major hurricanes (Categories 3, 4 or 5, with winds of 111 mph or higher) in 2024.

Some reinsurance brokers note Beryl may have already tempered what was otherwise a more normal reinsurance renewal season on July 1.

In earlier commentary, A.J. Gallagher observed an above-average hurricane season predicted for 2024 has “not significantly affected pricing and capacity of traditional reinsurers.”

But that may have changed with Hurricane Beryl this week.

“Florida property catastrophe reinsurance treaty renewals [on July 1, 2024] may have taken a last- minute nudge from the rising tide of forecasts showing a very active hurricane season likely on the way,” Intelligent Insurer reports, citing a recent note to markets from Bryan Friendshuh and Adam Schwebach at A.J. Gallagher.

In a recent blog, Moody’s noted Beryl’s strength and timing has already broken eight records, including the earliest rapid intensification (a tropical storm depression to a Category 4 storm in just 48 hours), the earliest Category 5 hurricane, and the strongest hurricane in June.

This portends a strong hurricane season, which should have the attention of Canadian insurers with exposure along the Atlantic Canada coast.

Even if Canada is not hit directly, Canadian reinsurance brokers told CU earlier this year that reinsurance rates rose for Canada last year, even if the United States took the brunt of the storms.

In a CU reinsurance outlook issue published in 2005, Canadian reinsurers noted the impact of hurricane losses after Katrina, Wilma and Rita caused global reinsurers to bump up reinsurance property and casualty rates in Canada by as much as 20% to 25%.

And so, Canadian insurers are braced for exactly the kind of conditions predicted by Moody’s Insurance Services this week.

“Since 2000, only two years have had early-July major hurricanes, 2005 and 2008,” says Robert Muir-Wood, chief research officer at Moody’s Insurance Solutions.

“Given that 2005 ultimately saw seven major hurricanes, with four of them Category 5s – including the only other one in July (Emily), as well as Katrina, Rita, and Wilma – and that 2008 saw five major hurricanes, there is every indication this is an intense hurricane season likely to break more records.”

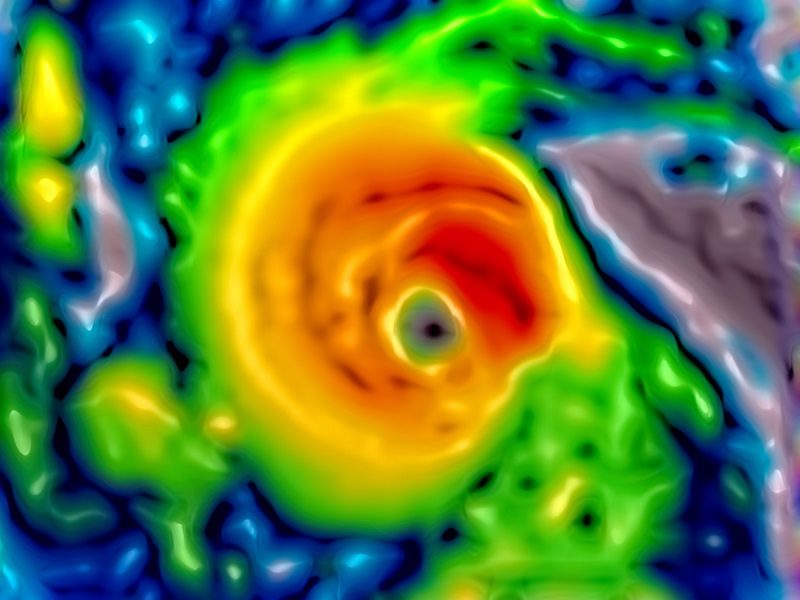

Feature image courtesy of iStock.com/Peter Blottman Photography