Inflation surging. Catastrophe loss quantum to rise. Pricing for it is key

A new report from Moody’s paints a gloomy picture of rising combined ratios and elevated loss costs, because of the influence of rising inflation, soaring construction costs and more expensive labour rates, all of which reinforce the need for reinsurance and ILS pricing to cover these factors.

These inflationary factors are inevitably going to result in higher catastrophe losses for the insurance and reinsurance industry, with the inevitable share in losses passed onto insurance-linked securities (ILS) markets as well.

Inflationary factors are rife right now and you cannot read the mainstream press without hearing about rising prices, from fuel to food staples.

The fact construction costs have been rising has been well-known in the insurance and reinsurance industry for a few years now, we’ve even interviewed experts on precisely this topic (how inflationary pressures will elevate catastrophe claims) about a year ago.

Global reinsurance firm Swiss Re had warned in 2021 that the industry would face raised loss costs after land-falling hurricanes in the United States last year, as inflationary factors would drive claims amounts higher.

However, later last summer things looked like they would begin to improve and Swiss Re forecast last July that claims inflation may have subsided in 2022, as the inflationary effect of higher materials and construction prices may only last through 2021.

Fast-forward roughly 10 months and, of course, things look very different now, with rampant inflation, escalating prices, ongoing supply-chain challenges affecting the supply-side, while stock markets plummet and other economic markers move in directions that were entirely unexpected last year.

The economic shocks the world is going through right now are once again stoking inflationary factors that will ultimately drive catastrophe claims and property loss costs far higher and a new report from Moody’s provides some excellent insight into just how fast things are moving, really underscoring the need for these factors to be priced into new insurance and reinsurance contracts.

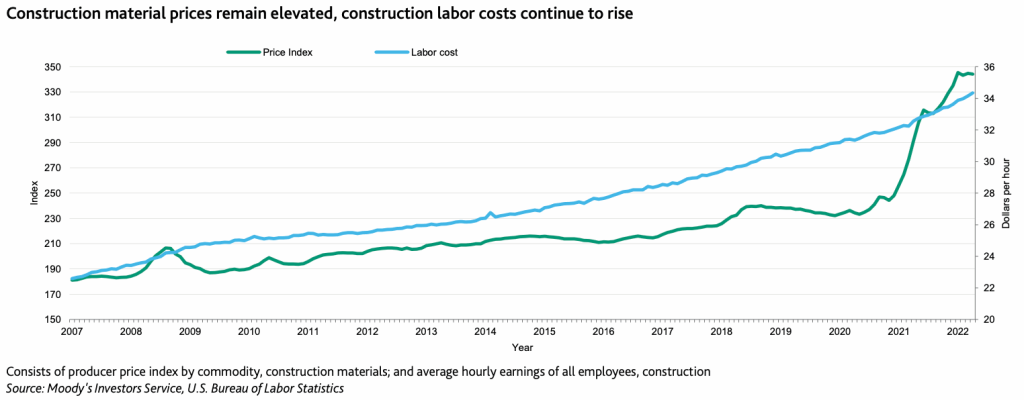

Since 2021, so in just the last few months, Moody’s notes that construction material costs have increased 26.7% and construction labour rates are up 5.5% compared to the prior year period, based on government data in the United States.

That’s a really significant increase, against the backdrop of which Moody’s warns, “Rising construction costs are credit negative for homeowners and commercial property insurers because they drive up repair and rebuilding costs.”

It’s far broader than just lumber costs now, which is the main topic of inflationary discussion back in 2021.

How things change in just one year, as now oil prices will affect the costs of paint, roof shingles, and some flooring, but also transportation of other goods, while specific materials are in short-supply and parts, such as garage doors, seen as challenging to source, or just much more expensive than a year ago.

In addition, Moody’s cautions that COVID pandemic related shutdowns in China are set to drive shortages and price inflation for many additional products that could be required in repairs to catastrophe-impacted properties, from fixtures to fittings.

You can see the escalating construction costs in this chart from Moody’s report:

These higher costs are going to drive elevated loss severity for homeowners and commercial property insurers, Moody’s says.

Of course, that will translate into higher industry losses as well.

The ramifications of which are more readily attaching reinsurance layers, with more loss cost flowing through proportional arrangements such as quota shares, while excess-of-loss reinsurance layers attach more quickly than a reinsurer or ILS fund may anticipate.

This, “will lead to higher ex-catastrophe combined ratios over the course of 2022,” Moody’s explains.

Of course, insurers are raising their pricing and rates to counter the effects of inflation and can move much more quickly given they sell new policies on a daily basis.

However, the reinsurance market, which signed a significant percentage of its capacity away as of January 1st, before this latest bout of inflation hit the globe, is going to need to watch out for potential shocks to its systems, when catastrophe claims come in higher than expected and perhaps not fully-priced for.

Right now the mid-year reinsurance renewals are ongoing, as readers will be all too aware and the escalating rates being seen are partly being driven by the increasing fear of how inflation is going to affect claims and ultimately loss quantum for the reinsurance and ILS industry.

Inflation is becoming a really significant contributor to pricing decisions and markets are assessing the macro economic environment on a daily basis to try and identify how prolonged the upswing in prices will be, to enable them to price their capacity commensurate with the potential risk and loss cost levels they will be facing throughout that annual, or even multi-year contract.

We understand that this is making the pricing of multi-year reinsurance covers challenging in 2022, as there is no clear sight of how long the inflationary effects may last.

Also, these days markets, commodities and products have a habit of rising with inflationary effects, but never quite falling back to the previous price levels, meaning there has to also be some forward-pricing embedded into any longer tenure reinsurance and ILS deals at this time.

Moody’s continues to explain in its new report that, “Combined ratios for homeowners and commercial property insurance are largely determined by the extent of catastrophe and other storm losses in a given year.”

Which is where Moody’s lays out its base case for inflationary effects to combined ratios, “In our base case for homeowners for 2022, which assumes a 7% average rate increase on written premiums during the first half of the year and a 10% loss cost trend applied to current business and prior period reserves, we expect combined ratios to rise (deteriorate) by about 2.5 points.”

But it could be worse, as, “The combined ratio impact could increase to 5 and 7.5 points in our downside and stress cases, respectively,” Moody’s explains.

Insurers are well-capitalised, in the main, to deal with inflation and have the ability to price it into their policies as they go.

But catastrophes remain a key risk to them and with this inflation large property catastrophe industry events promise to bring inflated losses to the industry, meaning if it hasn’t been priced for there could be some nasty surprises, something to watch through the US hurricane season.

It’s important to also remember that the current inflationary cycle is a global one, with prices escalating all over the world, meaning the same potential effects, of elevated or higher than modelled for property loss quantum could emerge anywhere a major disaster strikes.

In addition, there is the social inflationary effects of fraud and litigation on insurance claims to also consider in pricing, something particularly critical for the June reinsurance renewals for Florida business.

As we discussed yesterday, property and casualty (P&C) insurers in the United States are estimated to have paid between $4.6 billion and $9.2 billion extra in disaster claims because of insurance fraud in 2021.

Add on the inflated prices of reconstruction and repair and it’s clear reinsurance recoveries after disasters are going to inflate, making pricing upfront for these inflationary effects absolutely critical.