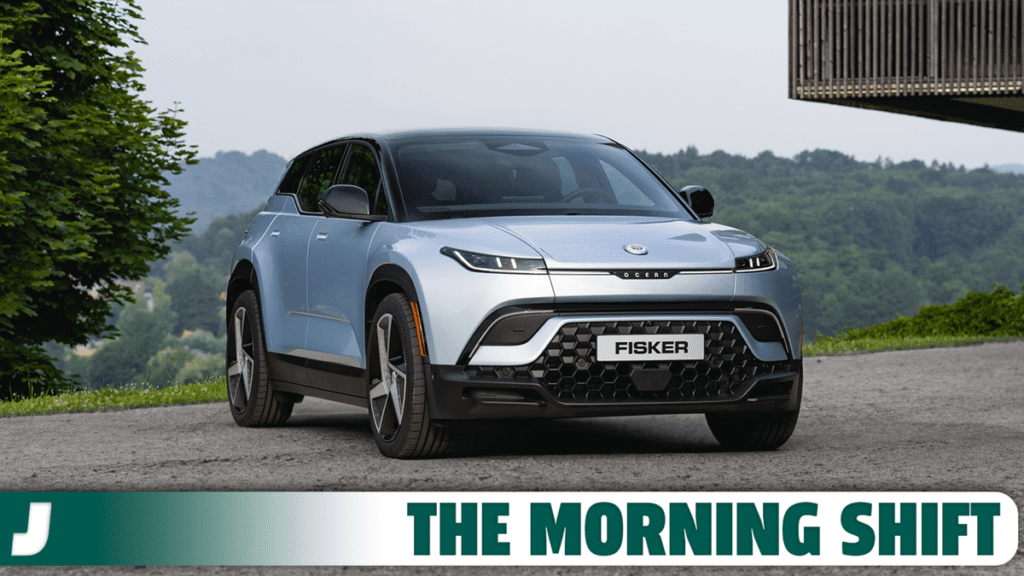

Comedy Of Errors Led To Fisker’s Bankruptcy

Good morning! It’s Thursday, June 20, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

Jalopinions | The Best Type is Jaguar’s E-Type

1st Gear: Fisker Messed Up At Every Turn

When Fisker filed for bankruptcy earlier this week the now-dead automaker did everything but admit to its own mistakes. It patted itself on the back by claiming it achieved “incredible progress” and was “making good” on promises before blaming its demise on “various market and macroeconomic headwinds” that impacted the electric vehicle industry as a whole.

While the EV slowdown didn’t help its case, that is far from the only reason Fisker went the way of the dodo bird. In fact, it’s probably not even in the top 50 reasons Fisker failed even though it had a better chance than most to succeed. From Bloomberg:

Henrik Fisker and his wife, Geeta Gupta-Fisker, benefitted from incredible strokes of luck four years ago, when one of the weirder byproducts of the Covid-19 pandemic was stock market amnesia. Specifically, investors forgot how difficult it is to start a car company and keep it alive.

Henrik’s second plug-in car venture — the first went bankrupt in 2013 — epitomized this phenomenon. Fisker, the company, was so low on funds in early 2020 that its husband-and-wife co-founders stopped taking pay and furloughed other employees for months. Their fortunes changed when a bevy of special-purpose acquisition companies sprung up and started offering huge sums to aspiring EV manufacturers.

No revenue was no problem. What mattered was whether these companies and the SPACs that gobbled them up could craft slide decks snazzy enough to pique the interest of overnight day traders cooped up in their homes.

A month after electric-truck startup Nikola made its market debut and briefly exceeded Ford’s valuation, Fisker agreed to combine with a SPAC sponsored by the private equity giant Apollo, in a deal that would leave the car company flush with roughly $1 billion in cash. The Fiskers parlayed this into a partnership with the Canadian auto-parts manufacturer Magna.

On paper, at least, Fisker had secured a huge leg up over other new automotive entrants. The company wouldn’t have to worry about standing up a car factory and staffing it with productive workers. A massive Magna facility in Austria packed with experienced factory hands who put together hundreds of thousands of Toyota sports cars, BMW sedans and Mercedes-Benz SUVs annually would handle that work for Fisker.

Here’s where things started to go wrong. In practice, Fisker’s asset-light business philosophy was actually too light on assets. Sure, Magna got Ocean production going in late 2022, but those early cars were especially half-baked, missing things as simple as cruise control. For months, Fisker worked to deliver over-the-air updates that would bring more features.

But wait, it gets worse.

Automotive sales revenue didn’t start trickling in until the second quarter of last year, and Fisker apparently wasn’t even ready to handle this milestone. My former colleague Sean O’Kane reported for TechCrunch that the company lost track of millions of dollars in customer payments as it was ramping up deliveries. One person he spoke with said that checks weren’t cashed in a timely manner or were outright lost, and that staff often were scrambling to find credit card receipts or wired funds.

Fisker also floundered in its attempt to replicate Tesla’s direct-sales model. Last year, 10,193 Oceans were produced, but the company delivered only 4,929 to customers. Efforts to partner with dealerships at the beginning of the year proved too little, too late.

In January, February, April and May, the US National Highway Traffic Safety Administration opened investigations into possible defects, after drivers complained about multiple braking issues and being unable to shift into park or open doors. In the only month during this span that the regulator didn’t launch a probe, Fisker slashed Ocean prices by as much as $24,000 — a 39% discount.

Sure, EVs have hit a bit of a rough patch, but the automaker has acted like a spoiled kid who is blaming everyone but himself for its self-inflicted misfortune. This probably will not be a good look when Henrik attempts to make his third car company.

2nd Gear: Toyota Shareholders Weary Of Akio Toyoda

More than one-in-four Toyota shareholders opposed reappointing Chairman Akio Toyoda to the board. The move suggests that there is rising dissatisfaction with Toyota’s corporate governance just a year after Toyoda gave up his role as CEO.

Toyoda ended up being reelected to the board with just 72 percent of the vote. Sure, that’s a strong number, but it’s down from nearly 85 percent in 2023 and over 95 percent in 2022. Yikes. From the Wall Street Journal:

Proxy advisers Institutional Shareholder Services and Glass Lewis had called on investors to reject Toyoda. They cited recent cases in which Toyota and group companies acknowledged they didn’t follow correct procedures in obtaining Japanese government certification for some vehicle models.

Glass Lewis said Toyoda was responsible “for failing to ensure that the group maintained appropriate internal controls.” It also faulted the chairman for not putting enough independent directors on Toyota’s board. ISS said the company should “establish appropriate compliance mechanisms under the board’s leadership.”

Although the certification issue has weighed on Toyota shares, the stock price remains up more than 50% since early last year on the back of strong sales of Toyota’s gas-electric hybrid vehicles and record profit. Toyoda, the grandson of the automaker’s founder, correctly anticipated that hybrids would capture market share among consumers who felt they weren’t ready to buy a fully electric vehicle.

Some shareholders have expressed concern that Toyoda, 68 years old, retains too tight a grip over the company even after handing the CEO job last year to Koji Sato, 54. Sato won 95% support from shareholders.

Asked about corporate governance at the automaker’s annual shareholder meeting Tuesday, Toyoda rebuffed suggestions that he was still in charge of day-to-day decision-making, but both he and Sato affirmed that the buck ultimately stops with Toyoda.

“I believe that the person responsible for Toyota and the Toyota group is still myself,” Toyoda said. Sato said, “The chairman is taking the lead to reform the deep-rooted culture” of the company and fix the regulatory problems.

Here’s what a spokesperson for Toyota said about Toyoda’s relatively low support:

“We perceive the approval rate at this year’s shareholders’ meeting as candid feedback from institutional investors.”

That’s a short, simple statement if I’ve ever seen one.

3rd Gear: The EU Wants Tons Of Chinese EV Data

China’s commerce ministry is saying the European Commission sought an “unprecedented” amount of detailed information on its automakers’ supply chains. The request came during an investigation into China’s subsidized electric vehicle imports. From Reuters:

The Commission, which oversees trade policy for the 27-nation strong European Union, last week slapped extra duties on imported Chinese EVs following the probe, prompting rebuke from Beijing and spying allegations from Chinese state media. China has also launched a dumping investigation into EU pork imports.

“The type, scope and quantity of information collected by the European side was unprecedented and far more than what is required for a countervailing duties investigation,” He Yadong, a commerce ministry spokesperson told a news conference. He was responding to a question from Chinese state radio over whether Brussels had been seeking to spy on China’s EV industry.

The Commission “mandatorily required” Chinese automakers hand over information concerning sourcing raw materials for batteries, manufacturing components, and pricing and developing sales channels, the spokesperson said.

Governments typically impose anti-subsidy duties on imported goods to protect domestic firms when they suspect the item in question can only have been produced for less than the market rate because it benefited from unfair incentives or handouts.

Right now, European automakers are being heavily challenged by an influx of lower-cost EVs from rivals in China. Typically, those vehicles cost 20 percent less than comparative EU-made vehicles, according to the Commission.

4th Gear: Toyota Halts Production On Six Lines

Toyota announced it was halting production on six lines at five different plants in Japan starting on June 20 because of a parts shortage, according to Reuters. Right now, not too much information is known about the move.

The automaker will apparently decide whether or not to resume production on the lines on Friday, June 21, according to a spokesperson for the Japanese automaker. It’s not immediately clear what part Toyota is facing a shortage of or what vehicles are impacted by the shutdown.

It’s been a bit of a rough go of it for Toyota and its production lines. Here’s more from Yahoo Finance:

In January the automaker shut down two of its Japan production lines over its Daihatsu emissions test scandal.

Last year it was also hit by a system failure caused by a parts ordering system update that forced the shut down of 14 of its plants in Japan.

I know you’re all deeply concerned about this issue for Toyota, so we’ll be sure to bring you an update once the issue is remedied.

Reverse: Solidarity Forever, Baby

Neutral: PHEV Is The Way To Be

2024 BMW X5 50e PHEV Shows Why Plug-In Hybrids Are The Way To Go

On The Radio: Robyn – “Dancing On My Own”

Robyn – Dancing On My Own (Official Video)