Life Insurance and Obesity

Life Insurance and Obesity: Background:

Obesity is on the rise. Between 1978 and 2017, the number of obese Canadians went from 49% to 64%.

This trend has slowed in the most recent years where between 2015 and 2020, the share of overweight people has held steady (35.8% in 2015) and 35.6% in 2020). However, for obese people the growth continued, from 26.1% in 2015 to 28.2% in 2020. Although many complained of stress eating during the pandemic, in reality, the pandemic has not necessarily contributed overly to these numbers.

Today, 1 in 4 adults and 1 in 10 children are obese. This puts them at risk for serious health issues such as diabetes, hypertension and high cholesterol. Even more worrying is the fact the Canadian Cancer Society feels obesity will soon become the leading cause of cancer after smoking.

Obesity affects every aspect of one’s life – including the ability to qualify for good life insurance rates.

Overweight vs obesity: life insurance view

There are some differences between overweight and obesity from an insurance perspective. The main one is that overweighted people can qualify for better rates and higher coverages as opposed to those who suffer from obesity. It is also common to see some other health issues that obese people are facing, making it more difficult for them to qualify for good rates.

Here is a summary of key points for each category of people.

OverweightObesityGeneralBMIFrom 25 to 30Moderately obese: from 30 to 35

Severely obese: from 35 to 40

Very severely obese/morbid obese:

over 40Impact on life insurance

products you can getA broad choice of products

starting from rated

traditional life insuranceA narrower selection of products,

mostly no medical life insurance

optionsImpact on life insurance ratesSlightly increasedHighly increased

Can an obese person get life insurance?

Yes, obesity does not mean an automatic denial. However, finding the best plan at a good rate is more difficult. A medically underwritten plan may result in a rated policy (more expensive) to compensate for any noted health conditions. It may be easier for the individual to apply for a simplified issue plan where no medical test is required. The plan is more expensive than traditional but could be the same or less than a rated policy, and much less risky in terms of an outright denial (which is possible as obesity is considered a medical condition, and therefore a high risk). The last resort would be guaranteed issue coverage. Everyone can quality for it, but it is a restrictive policy with high rates and lower insurance coverage.

How does obesity affect life insurance?

As mentioned earlier, obese people can get various types of life insurance but, in most cases, obesity will impact several aspects of this insurance such as: insurance type, insurance rates and insurance coverage. Let’s look at them in more detail.

Insurance type: Some insurance types, such as standard insurance without a medical exam or standard insurance with preferred rates, would not be available to obese people. In some cases, people with an obesity pre-condition will be able to get standard life insurance with a medical exam. No medical life insurance products will be available to obese people as well (e.g. simplified and guaranteed life insurance).

Insurance rates: Insurance rates for people with obesity as a pre-condition will be higher than for people without weight issues. Depending on an insurance product, rates can be either somewhat higher (e.g. rated traditional life insurance or simplified issue life insurance) or significantly higher (e.g. guaranteed life insurance).

Insurance coverage: An obese applicant can get the same level of coverage as a non-obese applicant, if he/she is able to qualify for traditional life insurance. In case of simplified life insurance coverage, limits typically do not exceed $300,000 and in case of guaranteed life insurance they do not exceed $25,000 – $30,000.

How much does BMI affect life insurance?

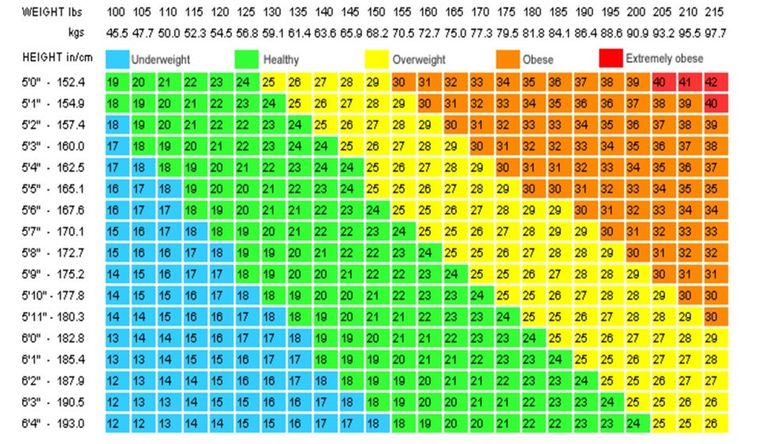

Insurance companies use the BMI to assess an individual’s health and fitness based on their weight and height. An overview of how the BMI categories work is listed in the chart below.

CategoryBMI rangeVery severely underweightless than 15Severely underweightfrom 15.0 to 16.0Underweightfrom 16.0 to 18.5Healthy, normal weightfrom 18.5 to 25Overweightfrom 25 to 30Moderately obesefrom 30 to 35Severely obesefrom 35 to 40Very severely obeseover 40

Here is full BMI view for life insurance purposes with colours showing the different weight categories.

BMI view for life insurance?

Yes, even in case of morbidly obese cases, there are life insurance solutions available to Canadians.

For example, a guaranteed life insurance policy is available to anybody since there are no questions asked or medical exams to be completed. It is important to note that guaranteed life insurance solutions come with two-year claim hold period, meaning that if a policy holder passes away during those first two years, no claim will be paid (but the premiums will be returned). Also, coverage limits for no medical policies like guaranteed issue are on the lower side.

Simplified life insurance comes with a short questionnaire, but there is good news for applicants with obesity pre-conditions. Some insurance companies do not have weight-related questions in their questionnaire, meaning that morbidly obese people can easily qualify for these plans. Simplified life insurance rates are better than guaranteed life insurance rates and if there is an opportunity to qualify for this insurance type rather than for a guaranteed policy, it is highly recommended.

What is the best life insurance if you are overweight/obese?

There are a number of various life insurance plans out there and not all of them are a good fit for obese people. Please see our summary to find the best option and discuss the options with a life insurance broker.

Insurance typeMedical

ExamDetailed

Medical

QuestionnaireShort

QuestionnaireCoverage

LimitsImportant to

Know1. Traditional, Medically Underwritten Life Insurance with PREFERRED RATESYesYesNo$5,000,000+No, overweight and obese people will not be able to qualify for this type of insurance.2. Traditional, Medically Underwritten Life Insurance with STANDARD RATES Yes Yes No$5,000,000+ Some overweight but not obese people may be able to qualify for these rates depending on insurance company and application replies.3. Traditional, Medically Underwritten Life Insurance WITHOUT A MEDICAL EXAMNoYesNo$5,000,000+Yes, overweight and obese people can typically qualify for this insurance (with the exception of multiple serious additional health pre-conditions).4. Traditional, Medically Underwritten RATED Life Insurance Yes Yes No$5,000,000+Yes, overweight and obese people can typically qualify for this insurance (with the exception of multiple serious additional health pre-conditions).5. Simplified Issue Life InsuranceNoNoYes$1,000,000Yes, both overweight and obese people can apply for this insurance type. Even morbidly obese applicants can qualify for a simplified life insurance policy if it does not have weight-related questions.6. Guaranteed Issue Life Insurance No No No Yes, anybody can apply for this insurance as it comes without medical exams and w/o medical questionnaire.

It is important to know that it comes with a two-year waiting period clause.

Always work with a broker to find the best plan. A broker can help with a preliminary insurance inquiry. This is where the broker emails the insurance company to find out the likelihood of a rating or decline before you start the application process.

While a simplified issue plan has no medical exam to worry about, different insurance companies have different questionnaires. A broker can identify which one has a questionnaire best suited for you (one that excludes weight related questions, for example).

Brokers aim to match individuals with the policy that they will most likely quality for, and that will provide the best value overall.

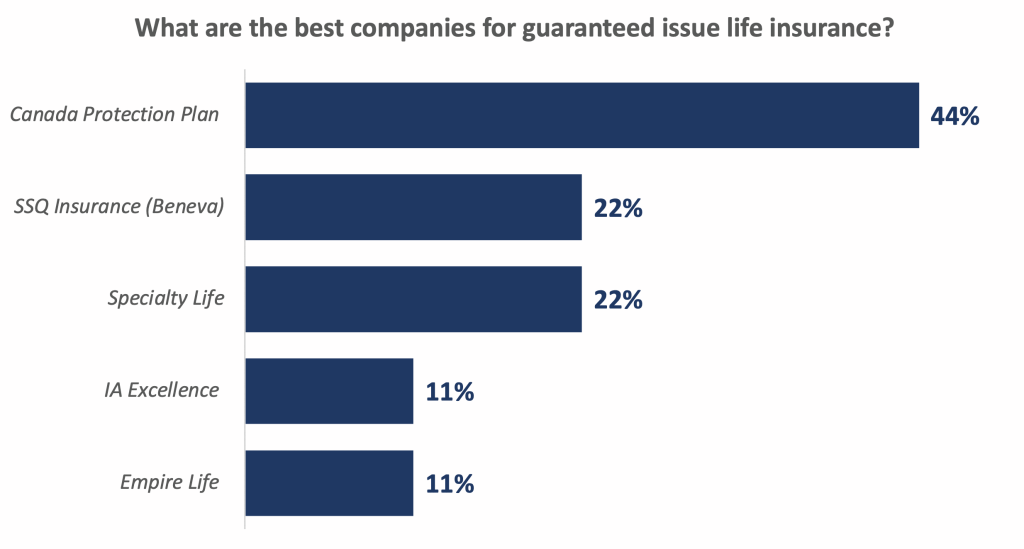

What are the best companies for overweight people?

In general, nearly every life insurance provider will have products that are available for overweight and obese people.

In the past we had an opportunity to interview a number of insurance experts and learn their views with respect to life insurance companies for no medical life insurance for those with weight issues.

The top three answers were:

Canada Protection PlanSSQ InsuranceSpecialty Life Insurance

Please note that most life insurance companies offer guaranteed life insurance products, but only a few ones truly specialize in it. An insurance broker can guide you to these companies.

You can read more about it here.

Do insurers consider heart disease or history of heart attacks when issuing a policy?

Some insurers may ask if you have had a heart condition or heart attack in the past, how far back it was, how stable your current health situation is, if you have a family history of heart disease, etc. Yes, your answers will affect your ability to qualify for a fully underwritten, traditional policy. A different policy, such as simplified or guaranteed issue, may be offered. However, always answer the questions truthfully. If you don’t disclose the health issue and are issued a claim, your claim could be denied, your contract cancelled, and it will be difficult to get insurance elsewhere.

If you have a health condition, work with a broker who can help steer you to the best company and policy for your needs.