Thailand’s general insurance market set to reach THB370.8 billion by 2028

Thailand’s general insurance market set to reach THB370.8 billion by 2028 | Insurance Business Asia

Insurance News

Thailand’s general insurance market set to reach THB370.8 billion by 2028

Data and analytics firm unveils forecast for three key segments

Insurance News

By

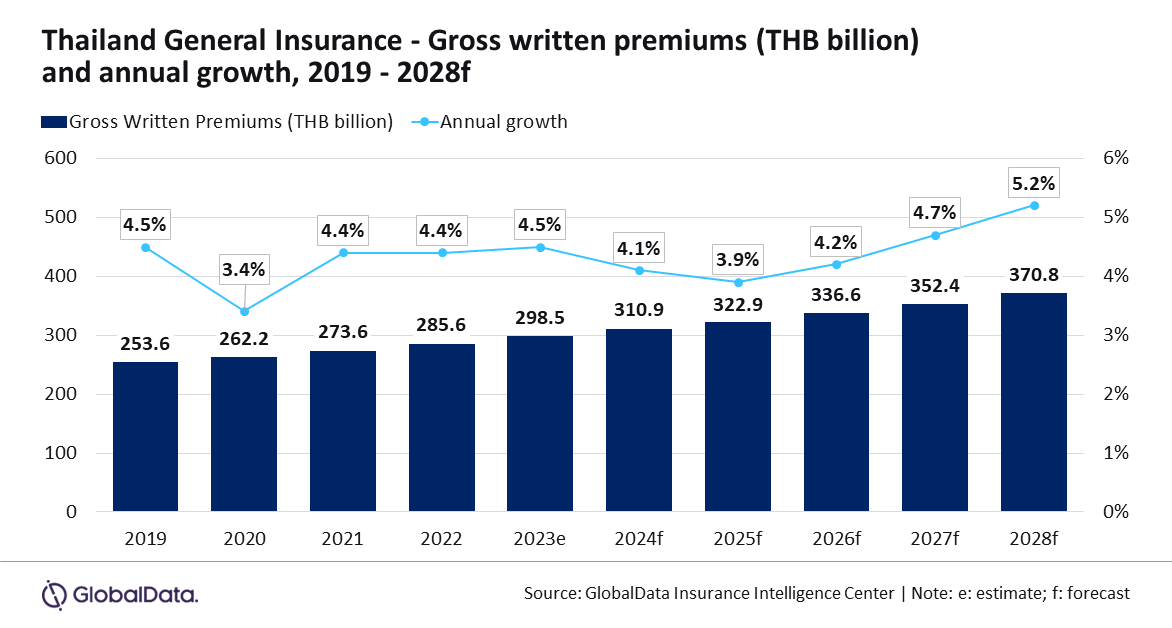

Roxanne Libatique

Thailand’s general insurance market is set to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2028, with gross written premiums (GWP) expected to increase from THB310.9 billion in 2024 to THB370.8 billion by 2028, according to data and analytics firm GlobalData.

GlobalData’s Insurance Database highlighted that the Thai general insurance market will expand by 4.1% in 2024, driven by the property, motor, and personal accident and health (PA&H) insurance sectors. These segments are projected to represent nearly 90% of total general insurance premiums in 2024.

“The general insurance industry in Thailand continued its growth trend and grew by 4.5% in 2023, driven by higher demand for property insurance policies led by growth in construction activity, increased health awareness, and robust regulatory reforms. The trend is expected to continue in 2024,” said GlobalData insurance analyst Manogna Vangari.

Motor insurance expected to dominate

GlobalData expects motor insurance to dominate Thailand’s general insurance market, with a 53.8% share of the GWP in 2024.

However, its growth rate is expected to decelerate to 3% in 2024 from 3.9% in 2023, attributed to a drop in domestic car sales amid slower economic growth. The Federation of Thai Industries (FTI) reported a 23.9% decline in car sales from January to April 2024 compared to the same period in the previous year.

Despite this, motor insurance growth in 2024 will be bolstered by a rise in electric vehicle (EV) sales. According to FTI, newly registered hybrid electric vehicles saw a 35.7% increase in March 2024 compared to March 2023.

Regulatory changes related to EV insurance are also expected to support growth. The Office of the Insurance Commission (OIC) introduced new vehicle codes and insurance premium rates for EVs, effective June 1, 2024, under the Motor Vehicle Accident Victims Protection Act.

The increase in road accidents in 2023 is likely to prompt insurers to reassess risk exposure and raise premium rates in 2024, supporting motor insurance growth. The Road Accident Information Center (ThaiRSC) reported a 2.6% rise in traffic accidents from January to April 2024 compared to the same period in 2023. Motor insurance is projected to grow at a CAGR of 3.7% from 2024 to 2028.

Thai property insurance forecast

Property insurance, the second-largest segment, is expected to hold an 18.8% share of the GWP in 2024. It is forecasted to grow by 9.4% in 2024, driven by government projects in tourism infrastructure, energy, and housing.

Vangari added that the construction industry in Thailand is expected to grow by 3.5% in 2024, with an average annual growth rate of 4.2% from 2025 to 2028. However, geopolitical tensions and high costs of materials and energy present risks to property insurance claims.

“The construction industry in Thailand is expected to expand by 3.5% in 2024 and record an average annual growth rate of 4.2% from 2025 to 2028. Its growth in 2024 will be supported by an improvement in residential demand, highlighted by the increase in the value of outstanding mortgage loans and the number of residential land development licenses issued, which will support property insurance growth. However, in the short term, geopolitical tensions and elevated costs for materials and energy will pose a downside risk to property insurance claims,” she said.

In March 2024, the OIC updated fire insurance premium rates and discounts for fire extinguishing equipment to align with modern risk assessments. Property insurance is expected to grow at a CAGR of 7.5% over the period from 2024 to 2028.

Personal accident and health insurance forecast

PA&H insurance, the third-largest segment, is projected to account for 17.3% of the GWP in 2024. This segment is forecasted to grow by 3% in 2024, driven by increased health awareness and rising medical costs. PA&H insurance is expected to grow at a CAGR of 4.2% from 2024 to 2028.

Liability, financial lines, miscellaneous, and marine, aviation, and transit (MAT) insurance are anticipated to make up the remaining 10.1% of the GWP in 2024.

“Initiatives from the government and favourable regulatory reforms will help in increasing the general insurance penetration rate in Thailand (1.59%), which was lower as compared to other regional markets such as Australia (3.52%), New Zealand (2.23%), Japan (1.75%), and Hong Kong (1.65%) in 2023. Persistently high claim payouts led by inflation and rising cases of road accidents will prompt insurers to reassess their risk exposure and increase premium rates in the short term,” Vangari said.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!