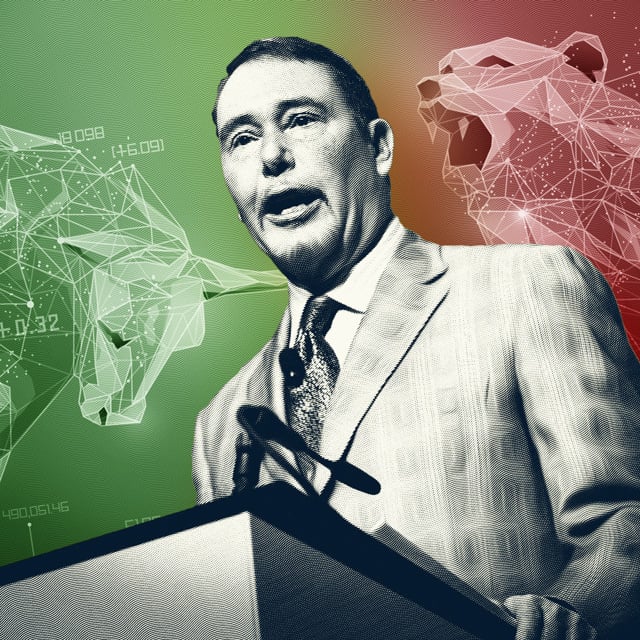

Gundlach: 8 Signs of an Economy on the Brink

Start Slideshow

DoubleLine Capital CEO Jeffrey Gundlach sees a lot of mixed data. To the famed fixed income investor, the economic picture looks far better for some than for others. But all in all, it doesn’t look good.

After the Federal Reserve’s Open Market Committee on Wednesday dialed back its forecast for interest rate cuts, Gundlach said he was less confident the central bank would cut interest rates at all this year and even saw the potential for a rate hike.

Fed Chairman Jerome Powell “tipped his hat to the fact that we have highly contradictory data,” Gundlach said.

“That’s because we have a highly inconsistent economy. And I think that’s a theme that’s been developing in commentary across the board, that some levels of the economy — those that are needs-based — consumers are getting crushed because the things that you need are still very high in price and they’re not going down.”

For example, auto insurance, up 22% year over year, is a major force driving inflation, Gundlach said.

The billionaire investor continues to expect a recession, saying it’s a question of when the downturn will arrive. “It’s been a long time coming,” with many flags appearing two years ago, he said, adding “this was a crazy cycle” due to economic policies during the pandemic.

Gundlach spoke on CNBC’s Closing Bell after the Fed kept its benchmark interest rate at 5.25% to 5.5% and signaled it would cut rates only once this year rather than the previously projected three times.

“I’m less confident there’ll be one cut this year,” he said. “I almost feel like the Fed is going into a reactionary mode. They’re going to react much more volatilely and quickly, I think, if the data starts to get bumpier.”

Gundlach expressed concern that when an economic downturn arrives, the government will react again with inflationary policies, as it did during the coronavirus pandemic.

Gundlach suggested there’s a growing acceptance of a higher baseline inflation rate. He discussed similar themes Tuesday in his own firm’s webcast.

Gundlach on Wednesday also predicted rhetoric from the Fed “is going to change fairly dramatically between now and year end, because I don’t think this data is going to be sideways to the extent that it has been.”

Here are eight trends that Gundlach cited in both appearances in analyzing the economy and the financial markets.

Start Slideshow