Cat bond risk spreads now up by 23% since March

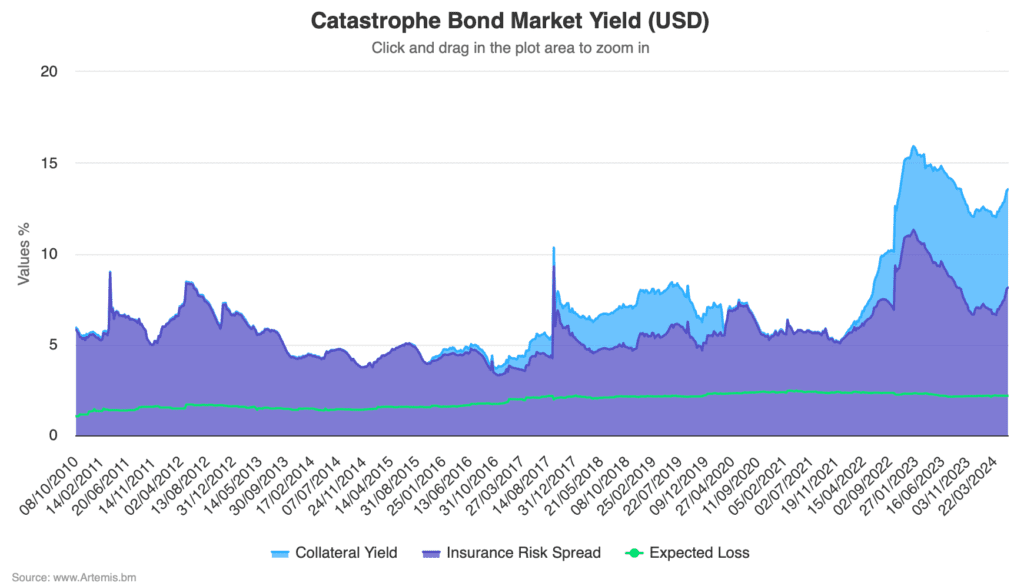

At the end of May, the overall yield of the catastrophe bond market had reached 13.54%, its highest level since September, with the driver of this being the spread widening seen in the market, as cat bond risk spreads rose by 13% in the last month alone.

The insurance risk spread component of the cat bond market yield reached 8.13% at the end of May 2024, having risen from 7.18% at the end of April.

But, reflecting the magnitude of the spread widening seen, insurance risk spreads in the cat bond market are now up by 23% since bottoming-out in March after the tightening earlier in the year, at 6.62%.

Over that same period, the expected loss of the market and the return on collateral have remained relatively static, meaning it is the movement in risk spreads alone that have driven the higher performance potential of the catastrophe bond market.

Analyse the yield of the catastrophe bond market and its constituent parts in Artemis’ chart (click the image below to access an interactive version):

The yield of the catastrophe bond market had fallen to as low as 11.99% around the middle of March.

So this rebound in risk spreads and the widening that occurred has now driven a more than one and a half percentage point increase in cat bond investment yields, across the market.

The movement in cat bond market yields has clearly been influenced by the factors that have driven the spread widening of recent weeks, so a more balanced supply and demand in the market, as well as the effects that a recent hurricane risk model update has had on investor and manager perception of risk, while some also cite the forecasts for an active hurricane season as a further driver, all resulting in a commensurate adjustment to investor’s demand for returns.

Index-trigger cat bonds have led the way through the recent spread widening, as we’ve documented, but more widely risk spreads are now up across much of the marketplace, compared to where they fell to in March.

Which has led some to suggest this current elevated spread situation makes for a particularly compelling entry point to cat bonds for investors.

Analyse catastrophe bond market yields over time using this chart.