TWIA wants to reduce reinsurance as proportion of funding going forwards

The staff of the Texas Windstorm Insurance Association (TWIA) is set to recommend lawmakers consider a variety of ways to reduce its reinsurance purchases going forwards, primarily by amending the rules to allow other areas of statutory funding to be increased.

This comes on the heels of the Texas Windstorm Insurance Association (TWIA) securing its largest reinsurance purchase ever, within which was its largest catastrophe bond ever, the recent $1.4 billion Alamo Re Ltd. (Series 2024-1) deal.

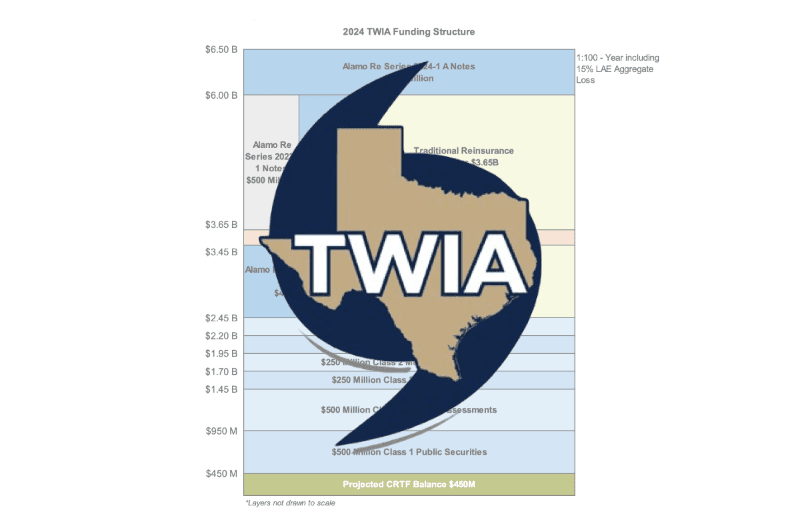

TWIA needed to secure funding of $6.5 billion for the 2024 hurricane season to meet its statutory 1-in-100 year storm coverage level, which was up from a $4.5 billion funding level agreed in the prior year.

To achieve that, reinsurance is the area of funding growth, with just over $4 billion of reinsurance and cat bonds required to be in-force for 2024, to meet its statutory funding limit.

TWIA’s 2023 reinsurance program consisted of $2.24 billion of reinsurance limit, with TWIA’s catastrophe bonds making up the biggest share at $1.2 billion, the rest being traditional reinsurance.

In the end, for the 2024 reinsurance program, TWIA secured the just over $4 billion of reinsurance protection, with catastrophe bonds contributing $2.1 billion of that total.

The need for more funding is derived solely from TWIA’s exposure growth and the staff and Board of the Association want to find ways to stop the reinsurance purchase running exponentially higher as exposure is expected to keep growing, at least for a time.

As a result, the only way to protect TWIA from its reinsurance costs running ever-higher, is to raise some of the other statutory funding contributions for the insurer of last resort.

A range of items for consideration will be presented to the Texas legislature in the next edition of TWIA’s biennial report, due later this year, we understand.

While not making firm recommendations at this stage, the staff and Board of TWIA want to get the legislature focused on helping to contain its reinsurance costs and making better use of other funding sources.

Starting lower down in the TWIA funding tower, the use of public securities has been questioned and a range of items for consideration will be presented, from using less of this type of instrument and taking out a loan of sorts instead, to getting the state to back them to reduce their cost, to re-ordering the layers of the tower to make public securities a higher-attaching funding source.

Any moves taken on the public securities layers of funding would have ramifications for reinsurance too and TWIA staff have highlighted that, for the reinsurance market, these public securities are a bit of an unknown and as they sit beneath the reinsurance layers it does raise questions from reinsurers.

Ideas on reducing reinsurance purchasing specifically are focused on the other types of statutory funding and overall funding mix, it seems.

One item to be sent to the Texas legislature for consideration, is making statutory funding change in line with TWIA exposures, which means all funding sources would adjust proportionately.

As exposure grows, because funding is largely statutorily prescribed, it requires TWIA to buy significantly more reinsurance, such as almost twice as much reinsurance being bought in 2024 as in the prior year.

If all funding sources moved proportionately to the exposure growth, you wouldn’t see such a massive increase in reinsurance buying needs again, as we’ve seen for 2024.

The goal would be to ry and keep funding in-line with exposure, adjusting the statutory funding sources so they increase as the exposure increases.

This could be achieved either directly, by growing other contributing segments of the statutory funding, such as the member assessments or even the public securities. Or to authorise a specific mechanism to keep the catastrophe reserve trust fund (CRTF) at a minimum level, so that proportionately the CRTF has to make up a certain fixed percentage of the total funding required.

Another proposal being sent for consideration, is a possible requirement for TWIA’s premium and maintenance taxes to be deposited directly into the CRTF, to boost it and keep it as a larger component of overall funding.

All of which would have a direct effect on reducing TWIA’s reinsurance needs and perhaps bring it back to a more balanced funding structure.

For TWIA, of its $6.5 billion funding tower for 2024, reinsurance overall makes up roughly 62% at $4.05 billion, while catastrophe bonds are set to make up 32% of the total and, at $2.1 billion, cat bonds are the biggest single funding source for 2024.

Compare that to Florida’s Citizens Property Insurance Corporation, which has a funding tower that extends to almost $17.3 billion, but of which only $5.5 billion will be made up of reinsurance and catastrophe bonds for 2024.

Out of Florida Citizens funding, catastrophe bonds for 2024 will be only $1.6 billion, so less than 10%.

Which makes TWIA’s reliance on reinsurance very clear and it’s no surprise the residual market insurer for Texas would like to balance its funding sources, by reducing the reinsurance spend in future years. It remains to be seen whether the legislature responds positively to the ideas for consideration that are being outlined.