144A catastrophe bond issuance will set new H1 record, already tracking to $11.4bn+

The market for 144A catastrophe bonds is on-track to set a stunning new issuance record for the first-half of the year, with more than $11.4 billion of new cat bonds already lined up to be issued during H1 2024, data from Artemis’ Deal Directory shows.

As of today, there are almost $9.3 billion of Rule 144A catastrophe bonds that have been issued and settled in 2024 so far, with a further $145 million set to join that total later today with the settlement of the NCJUA’s new Longleaf Pine Re cat bond.

That’s already getting very close to the prior year, when first-half 2023 set new records for cat bond market issuance.

But, with still billions more in new cat bonds being marketed or waiting to settle, this figure is set to rise much further.

As it currently stands, more than $11.4 billion of new 144A cat bond issuance is now slated for this first-half of 2024.

We had already reported a record start to 2024 in our most recent quarterly cat bond market report.

Then, as we reported a few weeks ago, the outstanding catastrophe bond market reached a new record high of more than $47 billion in risk capital late in April, having already risen by 5% since the end of last year.

So we’re already in record-breaking territory again in the catastrophe bond market in 2024.

But, the Artemis Deal Directory has a further over $2.1 billion in new cat bond issuance listed that has yet to settle, so the total will rise to a new level that could be above $11.4 billion once the quarter is done.

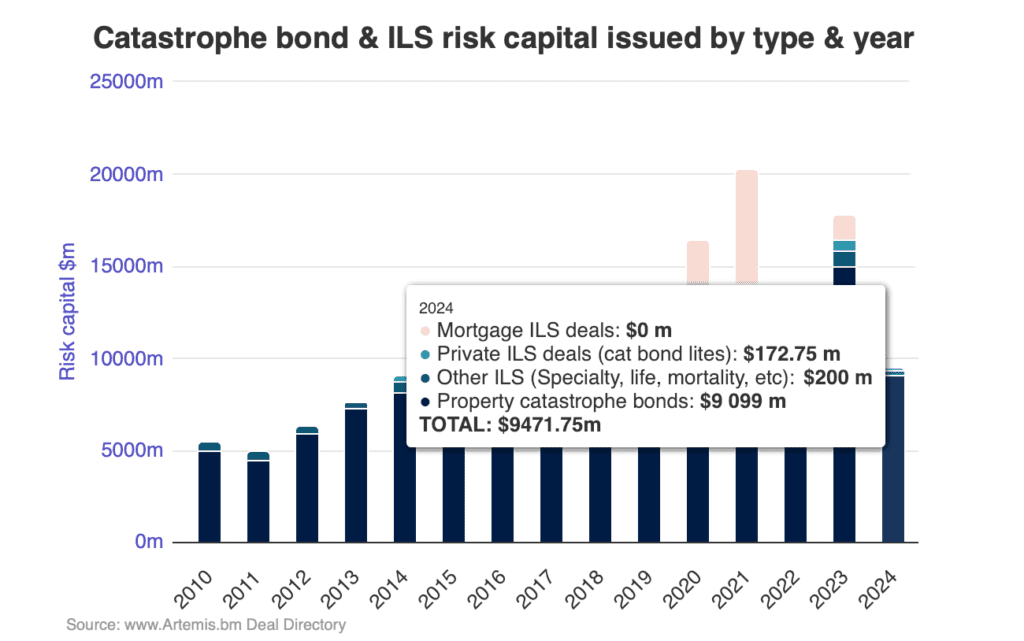

Click on the chart below to analyse cat bond issuance by year and type of transaction, which shows the figures as they stand for all new cat bond and related ILS issued and settled as of this day (remember, our other category are 144A cat bonds covering other perils than nat cat risk):

If we take out the private cat bonds, or cat bond lites, we’ve tracked so far this year, we are currently at just under $9.3 billion of settled 144A cat bond issuance in 2024 to-date.

We have $2.11 billion of new 144A catastrophe bond deals listed in our extensive Deal Directory and yet to settle but expected to do so this H1, out of which four transactions currently contributing $450 million of the total could still get upsized.

In addition, we’ve just seen the first new cat bond begin marketing with a schedule to settle within the month of June and there could be others that launch with the intention to do the same.

So, there is every chance the total rises further, but as it all stands today, if no additional cat bonds upsize, or emerge, and everything settled as it currently appears, we’d see a first-half 2024 total for 144A catastrophe bond issuance of just under $11.41 billion.

The record set in H1 2023 for 144A cat bonds issued was just under $10.12 billion.

So already the market is setting the pace to break the prior year record by roughly $1.3 billion, which is very impressive and puts the catastrophe bond market well on-pace to achieve, or at least get very close to, that $20 billion milestone this year.

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.