Best & Worst Online Direct Banks: J.D. Power, 2024

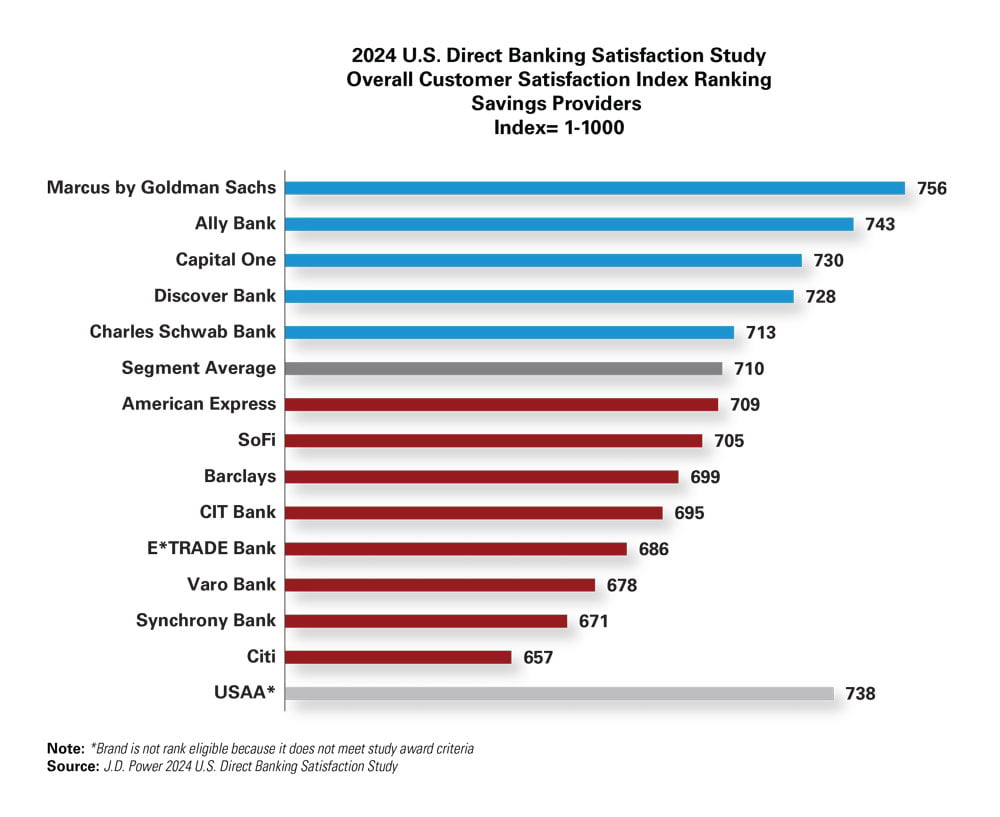

The overall customer satisfaction score for direct bank checking accounts was 688 (on a 1,000-point scale), down 27 points from 2023. Overall satisfaction for direct bank savings accounts was 710, down 8 points from last year.

The 2024 study heard fewer customer complaints, but the problems customers did experience were more complicated and took longer to resolve. As a result, satisfaction with the problem resolution process fell 67 points. The total amount of time required to resolve a problem grew to 2.6 days, up from 1.9 days in 2023.

J.D. Power found that the most significant declines in problem resolution satisfaction were focused on problems with debit cards, fraud and unauthorized account activity and problems with the interest rate paid on a deposit account. The number of customers who said it was convenient to reach and interact with live phone representatives declined 3 percentage points in 2024.

Customers’ use of mobile app and website features also declined this year, even among those who have not experienced a problem with their direct bank. The visual appeal, the range of services that can be performed and clarity of information provided via digital channels suggest that mobile apps and websites need a refresh, according to the study.

See the charts below for the online direct banks that ranked above and below the national average for overall customer satisfaction. Click the images to enlarge.

2024 U.S. Direct Banking Satisfaction Study, Overall Customer Satisfaction Index Ranking, Checking Providers

2024 U.S. Direct Banking Satisfaction Study, Overall Customer Satisfaction Index Ranking, Savings Providers

2024 U.S. Direct Banking Satisfaction Study, Overall Customer Satisfaction Index Ranking, Savings Providers