Texas Windstorm (TWIA) ready to sign reinsurance renewal lines this week

Having already secured its largest ever catastrophe bond issue this year, the Texas Windstorm Insurance Association (TWIA) is now ready to sign lines for its reinsurance renewal, with support secured for the rest of its capacity needs, according to staff and broker Gallagher Re’s executives.

At a Board meeting of the Texas Windstorm Insurance Association (TWIA) today, an update on the reinsurance and funding for 2024 was provided.

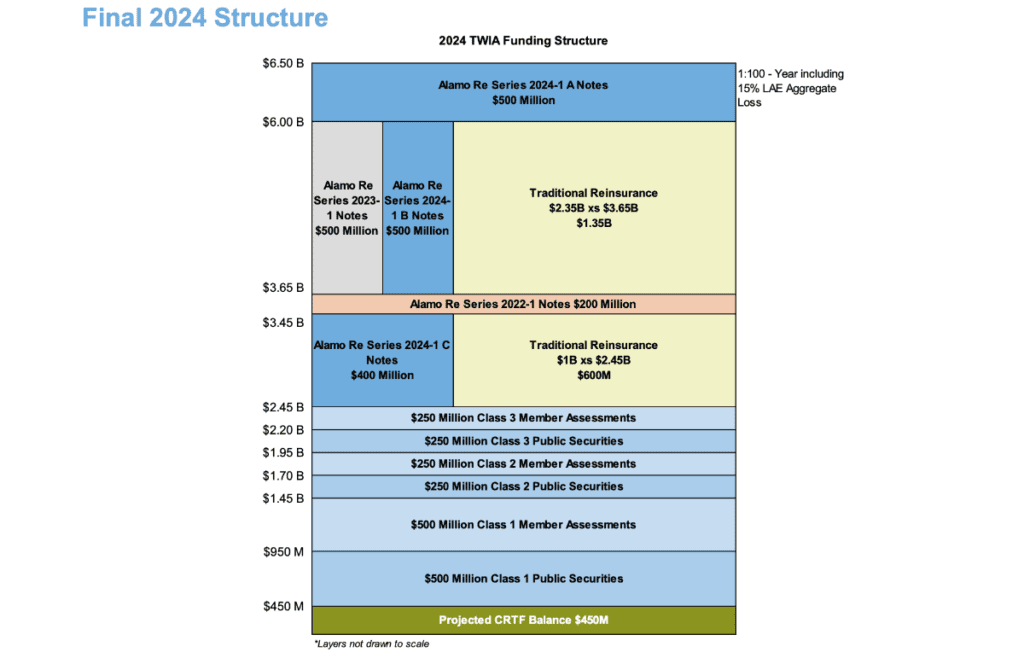

Recall that we reported last week that for 2024, TWIA’s funding tower will see catastrophe bonds as the largest component, providing 32% of the funding limit needed to meet the statutory 1-in-100 year probable maximum loss for the coming hurricane season.

TWIA had already sponsored its largest cat bond yet, with the $1.4 billion Alamo Re Ltd. (Series 2024-1) catastrophe bond issued in recent weeks.

In addition, as we reported in our article last week, TWIA had already placed $750 million of the traditional reinsurance limit it requires for 2024 before the end of April.

In total, TWIA needs just over $4 billion of reinsurance and cat bonds in-force for 2024, to meet its statutory funding limit.

The residual market insurer will have $2.1 billion in cat bonds, having $700 million from previous years that are still in-force.

Then, with that $750 million of traditional reinsurance secured, it left around $1.2 billion left to secure.

Progress seems to have been quickly made, as Gallagher Re executives said that support is already secured for that and it’s expected to be finalised imminently.

Alan Cashin, of Gallagher Re told the TWIA Board, “At this point, it’s a June 1st renewal. A large majority of it has been placed, I think we were left with about $1.2 billion in limit that needed to be placed and as of now we have enough support to execute and sign the programme over the next couple of days.”

Cashin added that, “I will work with staff Wednesday and Thursday of this week to finalise the entire programme… We are just over $1.2bn and then we’ll work with staff to sign lines over the next couple of days.”

Bill Dubinsky, of Gallagher Securities, provided some colour on the largest cat bond issuance TWIA has ever sponsored.

Dubinsky explained that, “To get to the $4 billion figure we increased the total amount of cat bonds by $900 million, so there were $1.4 billion placed this year.”

Dubsinsky went on to discuss the overall reinsurance tower that TWIA will have in-force for the 2024 Atlantic hurricane season.

He explained that, “The whole structure that you see here is designed to both access reinsurance capacity and cat bond capacity on a differentiated basis, to get to reinsurers as well as investors who have different risk-return appetites.

“That really was something that hadn’t been done as much in the past on the cat bond side, but was really key in getting to that $1.4 billion structure.”

TWIA has been directly sponsoring catastrophe bonds since 2014 and now sits as one of the largest sponsors in our cat bond market sponsors leaderboard.

You can read about all of TWIA’s Alamo Re catastrophe bonds it has ever sponsored in the Artemis Deal Directory.