S&P 500 Falls 1% at End of Worst Month This Year

To Krishna Guha at Evercore, the disappointment on wages will make the Fed less confident in the outlook for inflation.

“This will manifest itself in a harder tone,” he said “with policymakers clearly open to a more extended hold beyond the initial delay for the first cut from June to July/ September — if there is not a clear stepdown in inflation in the coming months.”

Sticky U.S. inflation this year isn’t necessarily bad news for the stock rally as higher yields are a reflection of strong economic growth, according to HSBC strategists led by Max Kettner.

“If the Fed’s cuts turn out to be more like the recalibration in the mid-1990s and 2019, it may not necessarily be bad news for risk assets,” they wrote.

Bank of America Corp. clients posted their largest inflows to U.S. equities in eight weeks during the five-day period ended Friday.

All major client groups — institutions, hedge funds, and retail investors — were net buyers last week, quantitative strategists led by Jill Carey Hall said in a note to clients Tuesday. Net inflow totaled $3 billion, largest in two months, per BofA.

The recent rebound in equity markets was not driven by a change in investor flows, but rather by the unwind of profitable bearish positions, Citigroup Inc. strategists led by Chris Montagu wrote.

They also noted that the bounce couldn’t continue on de-risking flows alone — and should be supported by new bullish inflows.

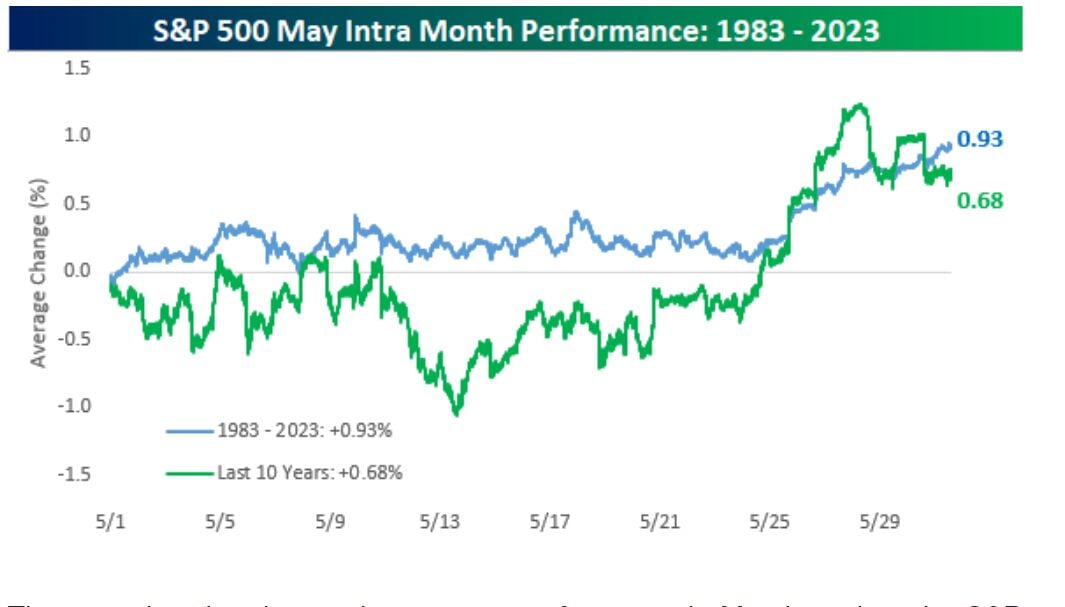

Source: Bespoke Investment Group

Source: Bespoke Investment Group

Despite its reputation, May has historically been a positive month for the equity market, although gains have been backend-loaded towards the last week of the month, according to Bespoke Investment Group.

May tends to be a positive month with an average gain of 0.93% dating back to 1983 and 0.68% over the last 10 years, the firm said.

“The six months from May through October haven’t necessarily been a negative period for equities, but historically, it is the weakest six-month stretch on the calendar,” Bespoke noted.

(Credit: Adobe Stock)