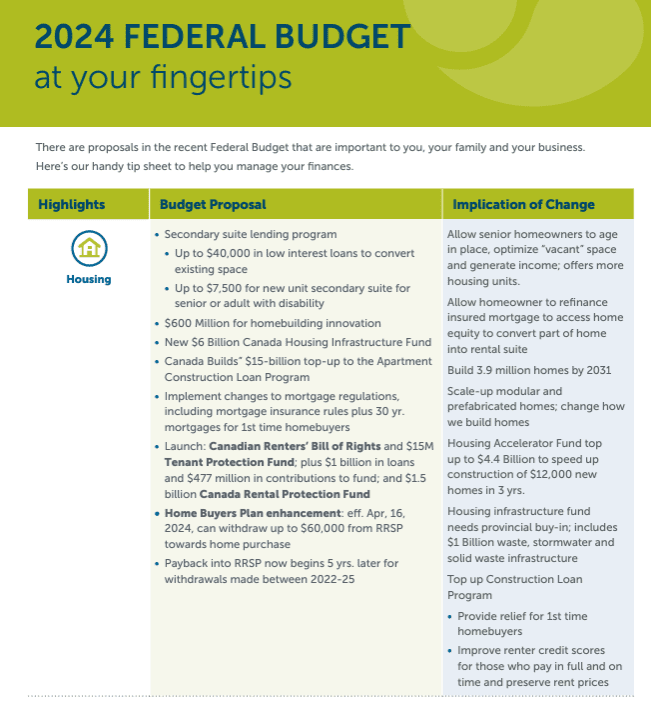

2024 Federal Budget @ your fingertips

Highlights

Budget Proposal

Implication of Change

Housing

Secondary suite lending program

Up to $40,000 in low interest loans to convert existing space

Up to $7,500 for new unit secondary suite for senior or adult with disability

$600 Million for homebuilding innovation

New $6 Billion Canada Housing Infrastructure Fund

Canada Builds” $15-billion top-up to the Apartment Construction Loan Program

Implement changes to mortgage regulations, including mortgage insurance rules plus 30 yr. mortgages for 1st time homebuyers

Launch: Canadian Renters’ Bill of Rights and $15M Tenant Protection Fund; plus $1 billion in loans and $477 million in contributions to fund; and $1.5 billion Canada Rental Protection Fund

Home Buyers Plan enhancement: eff. Apr, 16, 2024, can withdraw up to $60,000 from RRSP towards home purchase

Payback into RRSP now begins 5 yrs. later for withdrawals made between 2022-25

Allow senior homeowners to age in place, optimize “vacant” space and generate income; offers more housing units

Allow homeowner to refinance insured mortgage to access home equity to convert part of home into rental suite

Build 3.9 million homes by 2031 Scale-up modular and prefabricated homes; change how we build homes

Housing Accelerator Fund top

up to $4.4 Billion to speed up

construction of $12,000 new

homes in 3 yrs

Housing infrastructure fund

needs provincial buy-in; includes

$1 Billion waste, stormwater and

solid waste infrastructure

Top up Construction Loan Program

Provide relief for 1st time

homebuyers

improve renter credit scores for those who pay in full and on time and preserve rent prices

![]()

Capital gains

Capital gains inclusion of 2/3 effective June 25, 2024, not prorated, so only on sales after this date

For individuals on capital gains >$250,000

Corporations and trusts subject to 2/3 inclusion rate on all capital gains, up from ½

Lifetime capital gains exemption increasing to $1.25 Million for qualifying businesses, July 1, 2024, indexing in 2026

Support massive pre-promised initiatives for housing, health, childcare of which >$17 billion are loan based

Capital gains inclusion rate for individuals stays at ½ for sales up to $250,000; two different rates apply for 2024

Need for more individual and corporate tax planning; will impact sales of investment properties, vacation homes, corporately held investments

Canadian Entrepreneurs’ Incentive reduces inclusion rate to 1/3 on lifetime maximum of $2 Million in eligible capital gains

Remember 10 yr. capital gains reserve vs. normal 5 yrs. for Employee Ownership Trusts

More incentive for entrepreneurs to develop business and benefit from success, phased in at $200K on Jan. 1, 2025, increasing to $2 Million by Jan. 1, 2034; not available for professional corp., financial services, real estate food, accommodation, arts, recreation and entertainment, consulting or personal care

![]()

Alternative Minimum Tax (AMT) amendments

Revised tax treatment of charitable donations allowing individuals to claim 80% (vs. previous 50% of the Charitable Donation Tax Credit) when calculating AMT

Fully exempt Employee Ownership Trusts from AMT

Reduce punitive measure affecting charitable sector

More amendments to permit more deductions (Guaranteed Income Supplement, social assistance, Workers Comp.); allow more credits eligible for AMT carry‑forward

AMT exemption for trusts benefiting Indigenous people

![]()

Healthcare

National Pharmacare Act phase one rollout

$500 Million for Youth Mental Health fund

Canadian Dental Plan information sharing

$77.1 million over four years in 2025-26, to more effectively integrate internationally educated health care professionals into Canada’s health workforce

Consultation launch on development of National Caregiving Strategy

Upgrade Health Canada’s supply management capacity for drugs and medical supplies

Universal single payor health coverage for most prescription diabetes meds and contraceptives; enhanced healthcare spending across Canada to cover full costs

Help community organizations provide more care

Updated process so CRA can share taxpayer information to help administer and enforce Canadian Dental Plan

![]()

National defence and Intelligence

$8.1 billion over next five years; and

$2.4 billion to build capacity in artificial intelligence (AI), mainly for computing capabilities and technical infrastructure

Including $200M to boost adoption of AI in health care, agriculture and clean technology

Part of long-term defence policy update to increase military spending to 1.76% of GDP by 2030

Boost adoption of artificial intelligence in specific sectors to improve effectiveness and efficiency

![]()

Childcare Centres

$1 billion in loans and $60 million in grants to build or renovate childcare centres

$48 million to extend student loan forgiveness for early childhood educators

Improve child care support

Energy transition

Introduce or expand a variety of measures to help with the Government’s energy transition strategies

Provide $607.9 million over two years, starting in 2024-25, to Transport Canada to top-up the Incentives for Zero Emission Vehicles program

Encourage more people to buy zero emission vehicles

![]()

Employee Ownership Trusts (EOT)

Temporary tax exemption for qualifying transfers to employee ownership trusts on first $10 Million of capital gains realized on sale to EOT, subject to certain conditions; plus more details on other exemptions and conditions

For three years (2024-26)

Provides exit option for business owners and opportunity for employees to maintain business with no upfront funding

Fully exempt Employee Ownership Trusts from AMT

10 yr. capital gains reserve vs. normal 5 yrs.

![]()

Disability Supports

New Canada Disability Benefit up to $200/mo. for those with valid Disability Tax Credit certificate and be exempt as income from provincial/territorial supports

Expanding the Disability Supports Deduction

Income for low income persons with disabilities ages of 18-64

Additional expenses eligible for the deduction, subject to certain conditions; including trained service animals, alternative computer input devices, ergonomic work chairs and bed positioning devices

![]()

Cracking down on auto theft

Amend Criminal Code introducing new offences and aggravating factor if offender involved young person

Regulate the sale, possession, distribution, and import of devices used to steal cars

Addressing harms to Canadians, rising insurance rates, replacing vehicles and out of pocket costs

![]()

Supporting the Trades

$10 million over two years, starting in 2024-25, for the Skilled Trades Awareness and Readiness Program to encourage Canadians to explore and prepare for careers in the skilled trades

$90 million over two years, starting in 2024-25, for the Apprenticeship Service to help create placements with small and medium-sized enterprises for apprentices

To encourage more people to pursue a career in the skilled trades