NW Pacific typhoon season forecast 20% below-norm on La Niña

The Northwest Pacific typhoon season, which is one of the peak zone perils for reinsurance, catastrophe bond and other insurance-linked securities (ILS), is forecast to see activity levels roughly 20% below-normal, as the effects of La Niña are increasingly expected to last through summer and into Autumn.

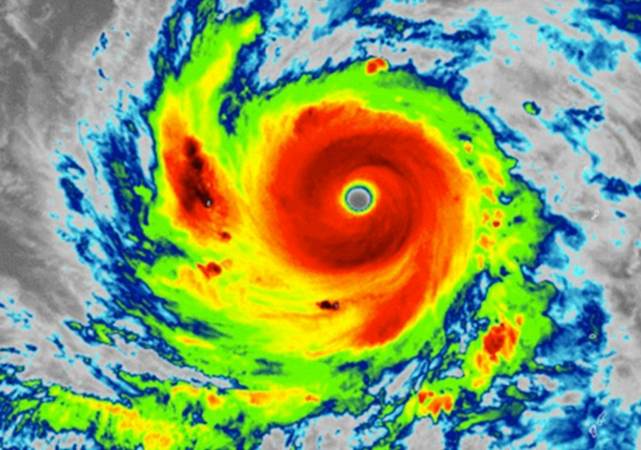

Tropical Storm Risks (TSR), an insurance and reinsurance industry supported team of forecasters, believe the Northwest Pacific typhoon season will see 23 tropical storms, 13 typhoons and 7 intense typhoons during 2022.

This sounds like a high number, especially if you’re more used to tracking the Atlantic hurricane season where such a year may be considered hyperactive, like a few recent seasons, but it’s actually below the norm by as much as 20%.

TSR said for 2022 it predicts that Northwest Pacific typhoon activity will be 20% below the 1991-2020 30-year norm, also saying that this forecast has more confidence than is usual at this range.

“The TSR early May forecast for Northwest Pacific typhoon activity in 2022 anticipates another season with below-norm activity albeit at levels slightly higher than in 2020 and 2021,” the forecasters explained.

Going on to highlight the link to the El Nino Southern Oscillation, saying, “TSR uses the strong link between the annual Northwest Pacific ACE index and August-September-October (ASO) ENSO combined with the increasing expectation that the current La Niña state will persist through ASO 2022”

The continuation of La Niña conditions in the Pacific is also a factor cited in recent Atlantic hurricane season forecasts, which are all calling for an above average year in that basin.

The Northwest Pacific typhoon season is notable for insurance, reinsurance and ILS interests, given it encompasses potential storms affecting Japan, mainland China, Hong Kong, Taiwan, South Korea, and the Philippines.

Japan typhoon is a peak zone peril of note, given it features relatively heavily in ILS and catastrophe bond circles, while outside of that there is still some risk in the ILS market from China, Taiwan, the Philippines and South Korea.

Of course, when it comes to typhoons in the Northwest Pacific and their potential to impact reinsurance layers, be they traditionally or alternatively backed, it really comes down to steering and where precisely storms and typhoons track towards and make landfall.

La Niña conditions are now seen as increasingly likely to persist through to the August – September – October time frame, implying they will be in effect through the peaks of the Northwest Pacific typhoon season and the Atlantic hurricane season.

So this could imply below average typhoon activity, but elevated hurricane activity, clearly the latter of which is generally considered to have higher loss potential for the cat bond and ILS market.

But still, the direction of travel of any intensifying storms remains the crucial factor, as well as where they make landfalls.

With 13 typhoons and 7 intense typhoons forecast for this season, that’s still plenty of activity to concern the insurance, reinsurance and ILS market, should steering currents direct more storms towards regions with elevated insured values, such as Japan.