Tesla's Q1 Earnings Call Is Tonight, Tune In Here For Live Updates

Tesla’s first-quarter earnings call for 2024 is tonight, and it’s shaping up to be a rough one. The stock is nosediving, and investors desperately want Elon Musk to right the ship — and, in doing so, reinspire their confidence in the company’s continued ability to generate returns.

Why Tesla stock might not be a buy

Investors are concerned with profit margins, delivery figures, and the ever-present rumor of the entry-level model’s cancellation. Tesla has already put out the major announcement of the Model 3 Performance today, which doesn’t bode well for the earnings call itself — what’s the company hiding behind all that media flash?

While the Model 3 announcement appears to have righted Tesla’s stock price for the time being — though it may simply be trading flat on market uncertainty leading into the upcoming call — analysts appear torn on the company’s trajectory. Nasdaq quotes 12-month price targets from analysts as ranging from $310/share all the way down to just $22.86. Functionally, based on a current price of $144.92, that’s a double or nothing bet. Overall, estimates point to a slight rise over the next year.

As more competitors enter the EV space — and do so with better and better cars — Tesla is hitting a watershed moment. Demand for EVs may increase, particularly as ICE engines are phased out and regulatory structures encourage the shift to electrification, but demand for Teslas may not. Will the company maintain its dominance over EVs, or will more traditional automakers win out?

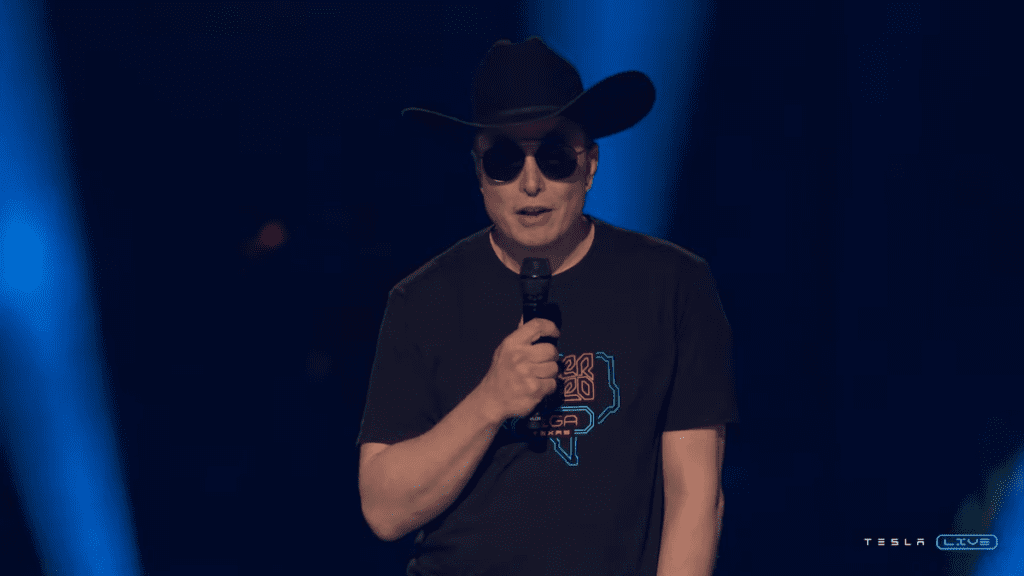

We’ll be tuning in to Tesla’s investor call at 5:30 PM Eastern, and live reacting here to all the statements, questions, and investor concerns. Will Musk explain away the company’s issues sufficiently, or will shares continue to tumble when the market bell rings tomorrow morning? Let’s find out together.