Allstate’s aggregate cat losses near attachment of franchise deductible cat bond

Artemis can report that the annual aggregate catastrophe losses applicable to US primary insurer Allstate’s outstanding catastrophe bond that features a $1m franchise deductible are now just slightly below the attachment point for the notes, suggesting the maturity will likely extend to allow for any loss development.

The notes in question are the $100 million Sanders Re II Ltd. (Series 2020-1) Class B tranche of notes, which are the only in-force tranche through the last annual aggregate risk period that still utilise a $1m franchise deductible as the qualifier for loss events.

We are told that the applicable qualifying aggregate catastrophe losses are reported to have reached $5.05 billion as of the end of March 2024, which was the final month in the annual risk period.

At this level the attachment deductible for the notes is approximately 99% eroded.

These Sanders 2020-1 Class B notes have an attachment point for their reinsurance coverage at $5.1 billion, meaning just a $51 million increase in qualifying losses would trigger a recovery and any increase of the total above that would result in a larger loss to investors through this $100 million tranche of notes.

These notes have been on-watch for potential losses for some months now, having been steadily marked down in the secondary cat bond market as investors and broker-dealers were anticipating a high and rising probability of principal losses.

As we reported last week, Allstate released figures for its first-quarter 2024 catastrophe losses, in which we suggested the data meant that a triggering of these cat bond notes had not yet occurred, but that the annual aggregate total was likely closing on the attachment point and so any loss creep could threaten them further.

Which turns out to be the case, although we hadn’t really envisaged the total being quite so close to attachment as this.

In March, Allstate suffered a significant hail loss event, which made up roughly 80% of its catastrophe losses for the period and it is this event that has elevated the annual aggregate loss tally applicable to the franchise deductible Sanders Re cat bond notes.

This single event has added $280 million to the annual aggregate tally for the Sanders Re catastrophe bonds, we are told.

As a result, Allstate reported that its annual aggregate catastrophe losses applicable to the Sanders Re cat bond tranche with the franchise deductible reached $5.05 billion, so just slightly below the $5.1 billion attachment point.

Given how close this is, it’s not surprising to note that these Sanders Re II 2020-1 B cat bond notes were marked down a little further in some cat bond pricing sheets this week, with one sheet marking them down a further 20 points.

There is still a wide dispersion in marks for these notes though, with some sheets having them marked down as if facing a total loss, others anything from a 50% to 70% loss of the $100 million of principal.

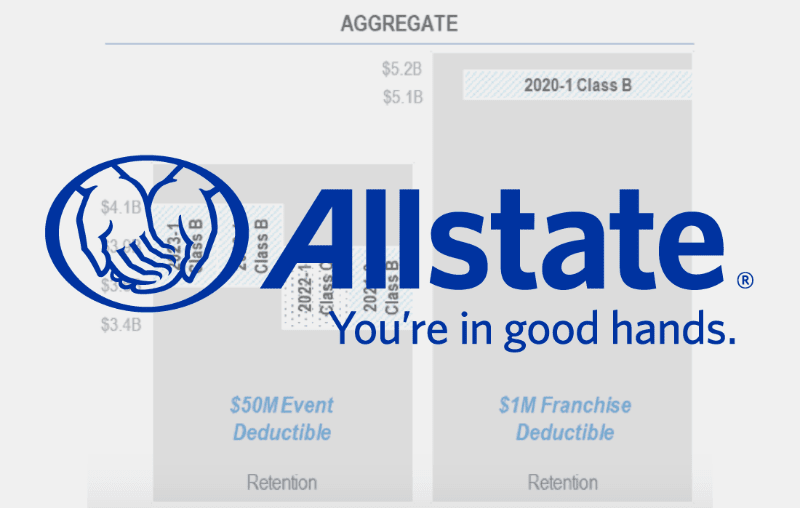

For the other exposed aggregate catastrophe bonds from Allstate, which all feature a $50 million event deductible, while this March hail loss event has qualified and so raised the applicable annual loss total, it still sits well below where those tranches attach.

We’re told the annual aggregate loss tally applicable to the Sanders Re cat bonds with a $50 million event deductible has risen to $2.34 billion, which is still well below the $3.4 billion attachment where the lowest-down of these tranches sit.

As a result, it seems safe to suggest those event deductible Sanders cat bond tranches of notes are likely safe from any loss from the last annual risk period, given how significant any loss creep would need to be in order to breach the attachment point.

It seems holders of the Sanders Re II 2020-1 B cat bond notes may remain on the hook a while longer, while loss quantum develop further to see if there is any creep to trigger a recovery for Allstate.

View details of this and many other exposed deals in our directory of cat bonds facing losses or at-risk of loss.