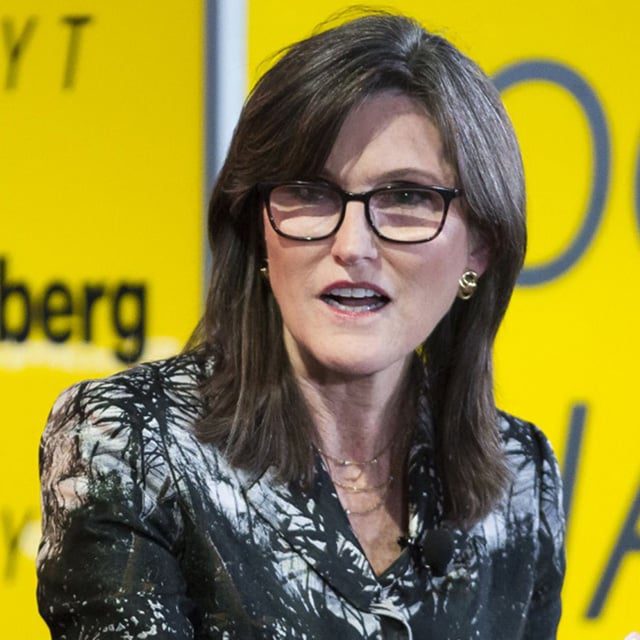

Cathie Wood's ARKK Hits Five-Month Low

A representative from Ark did not immediately respond to a request for comment.

“Cathie is an incredible marketer. She put out some very lofty return goals and attracted a ton on inflows,” said George Cipolloni, portfolio manager at Penn Mutual Asset Management. “But ARKK really has not lived up to the hype.”

ARKK charges a 75 basis-point fee. That’s not particularly high for an active fund but steeper compared with passive ones like Invesco QQQ Trust Series (QQQ), which tracks the Nasdaq 100 and charges just 20.

Wood’s ARKK and its entire suite of ETFs from her firm, Ark Investment Management LLC, rose to fame during the pandemic after making big bets on companies working in artificial intelligence, genomics, and gaming, among others.

Most of her Ark funds lean into industries where investors have been willing shell out higher valuations on the hope of explosive future growth.

That tactic is coming under pressure as high-priced firms that have yet to post profits lose their allure in a climate of elevated interest rates. The latter is seen as a drag on valuations for growth stocks, since they rely on future profits.

“One of the symptoms of excess liquidity and irrational exuberance is speculative stocks making new highs, but the reverse is also true,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. “As liquidity rushes out of the market and people become fearful, speculative stocks go down the most.”

(Image: Bloomberg)