Kevin O’Leary rolls out watch insurance platform WonderCare

Kevin O’Leary rolls out watch insurance platform WonderCare | Insurance Business America

Insurance News

Kevin O’Leary rolls out watch insurance platform WonderCare

New proposition is “Mr Wonderful’s” response to “broken” insurance market

Insurance News

By

Terry Gangcuangco

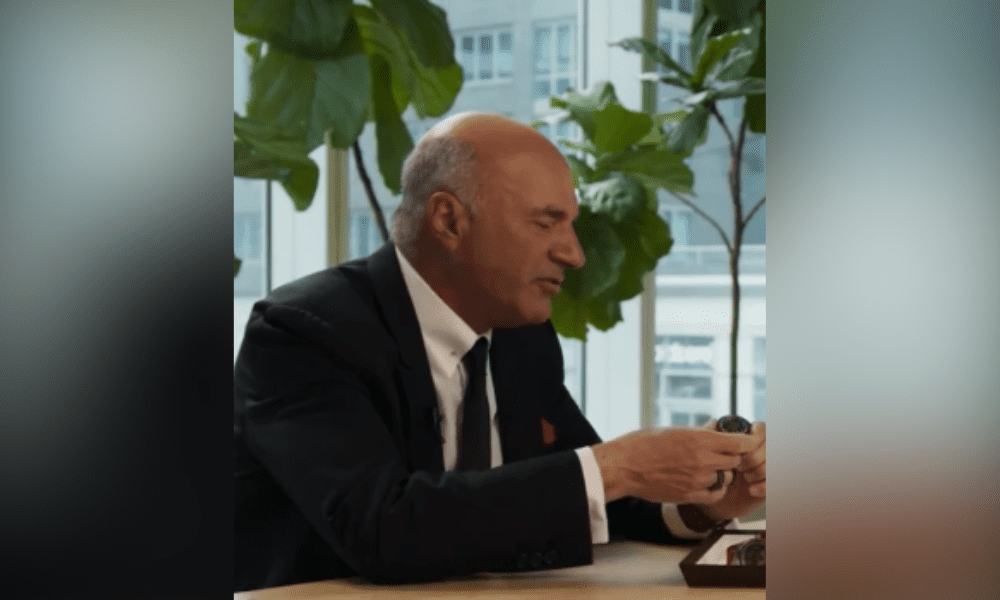

Kevin O’Leary (pictured above in a screengrab from his X post) has launched his watch insurance platform WonderCare in response to a “broken” market.

The Canadian businessman, who is also known as Mr Wonderful, rolled out the platform over the weekend after three years of working on the offering.

I am launching WonderCare in Geneva on April 7th. A new platform for watch insurance. Something I’ve been working on for 3 years. The whole idea of WonderCare is to let you take a portion of your collection and insure it between perhaps 1.7 – 2.1% of its value on an annual basis. pic.twitter.com/XZHOqfsUkF

— Kevin O’Leary aka Mr. Wonderful (@kevinolearytv) April 3, 2024

In his posts on X and Instagram, the famous Shark Tank panelist said: “I have been looking at the watch insurance industry worldwide now for five years – how broken it is – because I look at my own situation.

“I’m launching WonderCare… a new platform for watch insurance. I’m going to start in the United States, then we’re going to go to the UAE (United Arab Emirates), and then we’re going to do Europe.”

O’Leary highlighted how many contents insurance policies “depreciate the value of the underlying insured piece” when that isn’t the case when valuing luxury watches.

“If you buy a Rolex, just a Daytona – this does not depreciate over time; it appreciates in value,” he said. “So, you can’t replace it if you lose it five years later or 10 years later, or it’s stolen the day after you buy it, even at retail.

“The whole idea of WonderCare is to let you take a portion [of your watch collection] – one watch or two or three – and insure it for between 1.7 and 2.1% of its value on an annual basis.”

O’Leary explained that those two or three watches are the ones collectors travel with often or are kept in their homes, unlike watches that are stored in a vault or a bank safe deposit box.

He added that there is a demand for the proposition, having gathered feedback from his nearly nine million social media followers.

What do you think about this story? Share your thoughts in the comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!