Baltimore bridge collapse – a "sizeable loss" for insurers

Baltimore bridge collapse – a “sizeable loss” for insurers | Insurance Business America

Marine

Baltimore bridge collapse – a “sizeable loss” for insurers

Container ship collision with bridge leaves six presumed dead

Insurers could be facing huge claims payouts in the wake of the Francis Scott Key Bridge collapse.

The bridge collapsed early Tuesday when a container ship, the Dali, struck a support column. Several cars went into the water, and six people are missing and presumed dead, although search efforts are ongoing, according to a CBS News report.

Claims arising from the incident could approach those from the 2012 Costa Concordia disaster, according to John Miklus, president of the American Institute of Marine Underwriters.

In that incident, the luxury cruise ship Costa Concordia capsized off the coast of Italy, killing 32 people and leading to $1.5 billion in claims payouts.

Miklus said the collapse could drive “one of the largest claims ever to hit the marine (re)insurance market.”

Ship collisions common

While ship collisions with bridges are rare, vessel collisions with port infrastructure such as harbor walls, piers and locks were the fourth most frequent cause of shipping accidents over the past decade, with nearly 2,000 reports of such collisions within that time, according to data from the Allianz Commercial Safety and Shipping Review.

Total losses of vessels following collisions are rare, Allianz reported. Over the past decade, there have been only 30 total losses from incidents in which vessels collided with each other, and only four from incidents in which a vessel collided with port infrastructure. Altogether, these account for only 4% of the 807 vessels lost between 2013 and the end of 2022.

An academic paper cited by Allianz showed that between 1960 and 2015, there were only 30 bridge collapses due to ship or barge collision worldwide. Eighteen of those incidents occurred in the US.

Insurance implications

Coverage for the Francis Scott Key Bridge incident is likely to fall at the feet of the P&I space, which provides third-party liability for vessels, Allianz said.

“Outside of the implications from any tragic loss of life, the nature of the incident points to a sizeable loss, given the extent of the damage to the bridge and the surrounding area,” Allianz said. “Other potential losses could result from blocked port access, cargo loss, any environmental implications etc.”

Larger vessels, larger risks

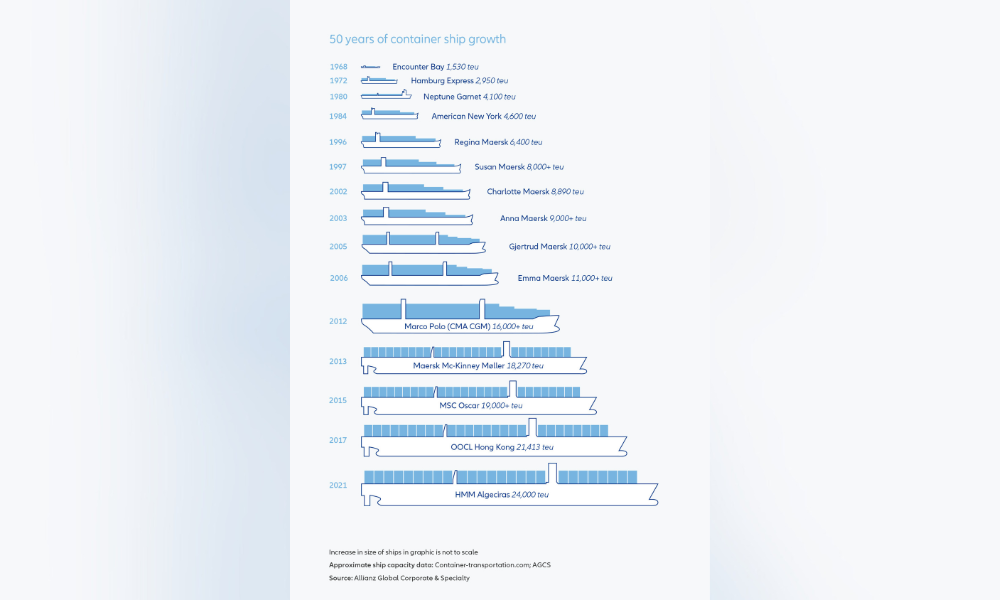

Shipping vessels have become much larger over the past 50 years, with carrying capacity increasing by nearly 1,500%, Allianz reported.

That growth has led to higher exposures including fires, container and carrier losses, and more expensive salvage operations.

“As vessels have grown larger, values at risk have increased, while the environmental bar has been raised,” Allianz said. “However, regulation, safety management system and salvage capabilities appear to have not always kept pace.”

Allianz found that while the number of serious shipping accidents globally has declined over the long term, incidents involving large vessels – specifically container ships and roll-on roll-off car carriers – have resulted in “disproportionately high losses.”

Have something to say about this story? Let us know in the comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!