Suze Orman: 'Smart People Don't Pass Up Free Money'

Employer-matching emergency savings accounts with automatic enrollment are emerging as a trend in corporate America. Giants like Amazon, Delta Airlines and Levi Strauss are among those offering them.

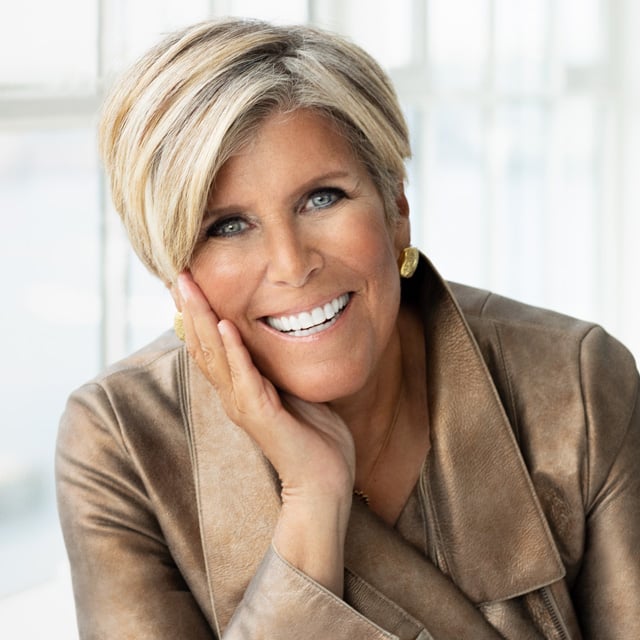

Even wealthy employees should sign up for ESAs — and they do, Suze Orman, the financial advisor-turned founder of Suze Orman Worldwide Enterprises, tells ThinkAdvisor in a recent interview.

The wealthy “should have [employer-matching] emergency savings [accounts] for the same reason they continue to fund their retirement account: Most get a match from their employer,” Orman argues. “Even if they don’t need the money, smart people don’t pass up free money.”

Orman is co-founder of SecureSave, the leading workplace emergency savings account program, according to its CEO, Devin Miller, who joined Orman in the interview.

She is busy encouraging employers to sign up for the service and hosts webinars for those firms’ employees when they do. ESAs reward employers with increased employee retention and productivity increases, according to Miller.

Orman, an advisor with Prudential and Merrill Lynch before starting her own practice and becoming a bestselling author in personal finance, maintains that adopters of the SecureSave program are “getting addicted to saving.” Contributing to an ESA is “changing [their] psychological and financial habits.”

SecureSave’s biggest client is Humana, the health insurance company, which has a 71% employee adoption rate. HSA Bank, a division of Webster Bank, announced recently that it will offer ESA solutions, with SecureSave powering the technology for the program, Miller notes.

In the interview, Orman gives a peek at consultations with her longtime financial advisor and offers advice to investors: “There are big gyrations [in the market]. I wouldn’t be lump-sum investing at this point in time. I’m a tremendous believer in dollar-cost averaging.”

Here are excerpts from our conversation:

THINKADVISOR: You have a financial advisor — the same one for more than 20 years. Does he give you advice?

SUZE ORMAN: We talk every single morning. He would sometimes give me advice like, “I don’t know if you should do that.”

But over the years, I’ve been doing certain things because he says, “OK, you want to do it — done.” He makes the trade, and that’s it.

We’re now figuring out what to do with large amounts of income-generating money from preferred stocks I invested in five years ago that are being called. There are millions of dollars.

What’s your current investing strategy?

ORMAN: I’m still holding 10-, 20- and 30-year Treasury bonds. I like the interest rate. Eventually, if rates do come down, I’ll be fine there.

The majority of my money is in a dividend-and-growth portfolio.

Also, I’m totally into artificial intelligence — stocks of chip manufacturers.

What about crypto?

ORMAN: If you’re going to play bitcoin, Coinbase is one of the ways to do so. As it goes down, I sell puts; as it goes up, I buy them back. [Recently] I made a good $25,000 or $30,000 in a day.

You’re co-founder of SecureSave, an employer-sponsored emergency savings program, automatic and free to employees. What’s the most significant benefit of having an emergency savings fund?

ORMAN: Changing the psychological and financial habits of the employee.

They’re getting addicted to saving, which is why many people voluntarily increase the amount they want taken from their paychecks, which usually is $20.

SecureSave last month found that inflation was the No. 1 reason for withdrawals, even as inflation has started to go down. Please elaborate.

DEVIN MILLER: That’s alarming. But 99% of the time, when people take money out, they keep the connection with payroll going, which is what funds their account automatically.

ORMAN: One would logically think that if they took money out, they would stop putting money in. But that’s not the case. They continue to contribute monthly to their account knowing that it will be there if they need it.

Broadly, should firms make emergency savings accounts available to their employees?

ORMAN: Without a shadow of a doubt. We surveyed people about which employee benefit people need most. They said their retirement account. Next in line was an emergency savings account.